Abby Joseph Cohen, advisory director and senior investment strategist at Goldman Sachs, on Wednesday said that policy decisions are the biggest threat to economy and the market, reflecting on the heightened U.S.-China trade conflict that has roiled equity markets around the globe over the past three sessions.

‘I think what we’ve seen over the last few days is that policy decisions and comments are in fact creating havoc not just in our markets but around the world.’

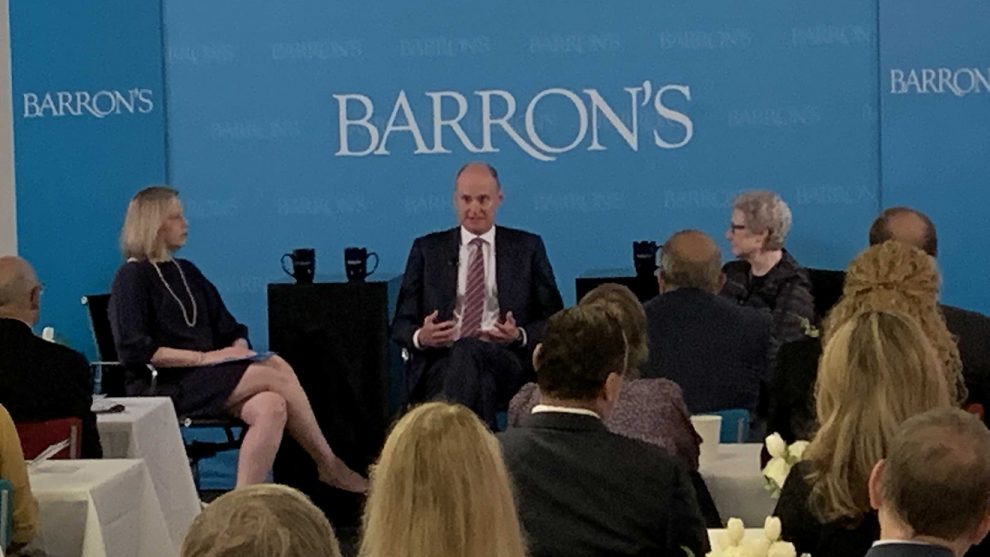

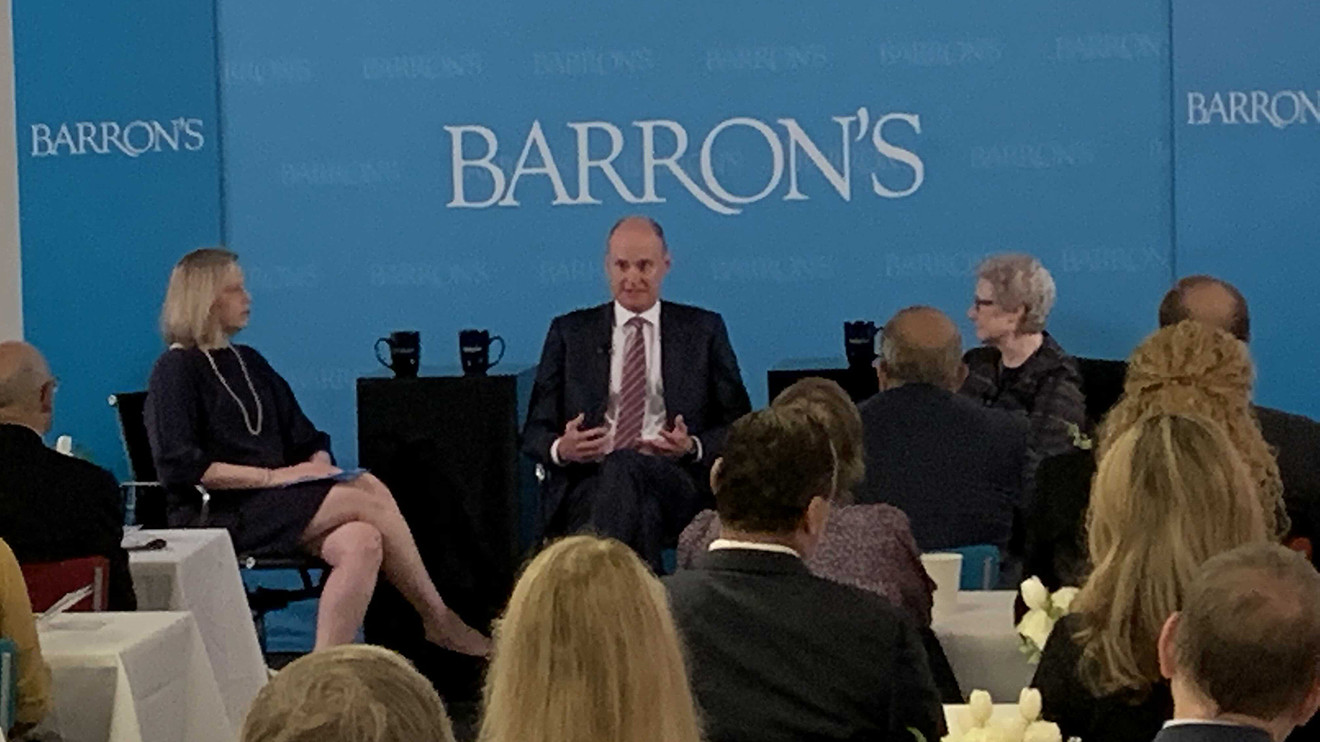

Speaking at a well-attended roundtable in New York at MarketWatch’s sister publication Barron’s — along with Todd Ahlsten, chief investment officer at Parnassus Investments — the pioneering investment strategist said fundamentals of the economy and the financial markets remain solid, noting that S&P 500 index equities weren’t overvalued.

“If one just looks at the fundamentals: ‘How is the economy doing, labor markets, inflation and so on?’ Things look to be in a good way,”

However, she said volatility has resurfaced in otherwise placid markets on the back of political rhetoric that could have a deleterious effect on investors.

Cohen’s comments come as the Dow Jones Industrial Average DJIA, +0.32% on Tuesday tumbled 473.39 points, or 1.8%, to 25,965.09, suffering its largest percentage decline since Jan 3, as President Donald Trump increased pressure on China in a negotiation over trade policy between the world’s largest economies.

Surprising market participants who had expected a resolution between the parties was at hand, the U.S. officials have accused Beijing of reneging on its side of the bargain and have set the stage to raise tariffs on $200 billion of Chinese imports to 25% from 10% at 12:01 a.m. Eastern Time on Friday.

A Chinese trade envoy, featuring Vice Premier Liu He, will head to Washington Thursday to resume negotiations, raising the possibility that a full-blown, stock-market rattling trade war, can be averted.

Stocks were struggling to recover on Wednesday, with the S&P 500 index SPX, +0.21% trading virtually flat, after dropping 48.42 points, or 1.7%, to 2,884.05 on Tuesday, while the Nasdaq Composite Index COMP, +0.15% was also trying to gain traction higher after its 2% skid the previous day, with both benchmarks notching their sharpest daily declines since March 22.

Cohen’s comments at the Barron’s event, comes a week after she warned investors to “get into their heads that the period of low inflation, low interest rates and monetary policy continuing to provide nothing but stimulus is over.”

The prominent strategist started working on Wall Street in the 1970s, and became a partner at Goldman Sachs in 1998. She has been hailed at times as the “prophet of Wall Street,” and is, perhaps, best known for her prescient, bullish calls on the market as the 1990s dot-com boom, though she missed signs of the 2008 financial crisis that would bring global investors to their knees.

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.