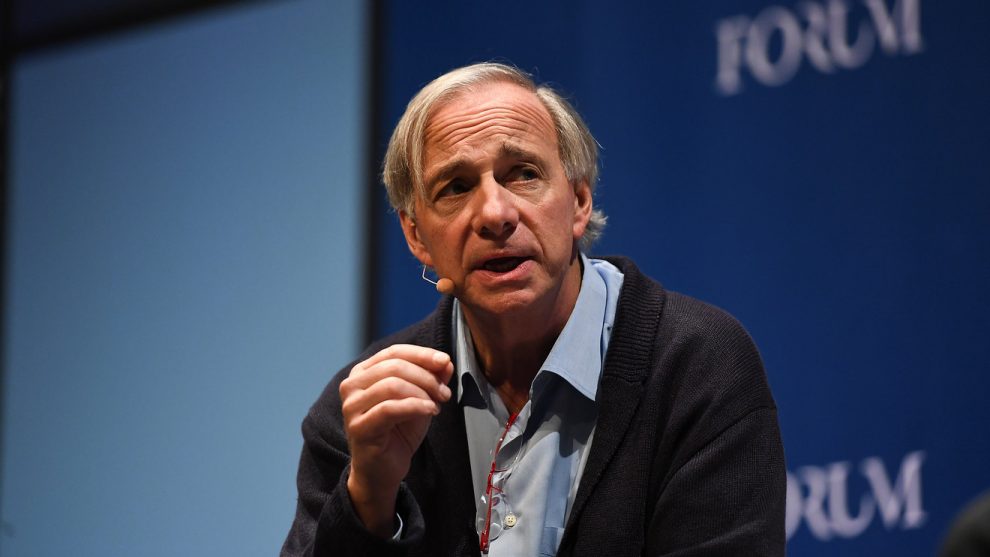

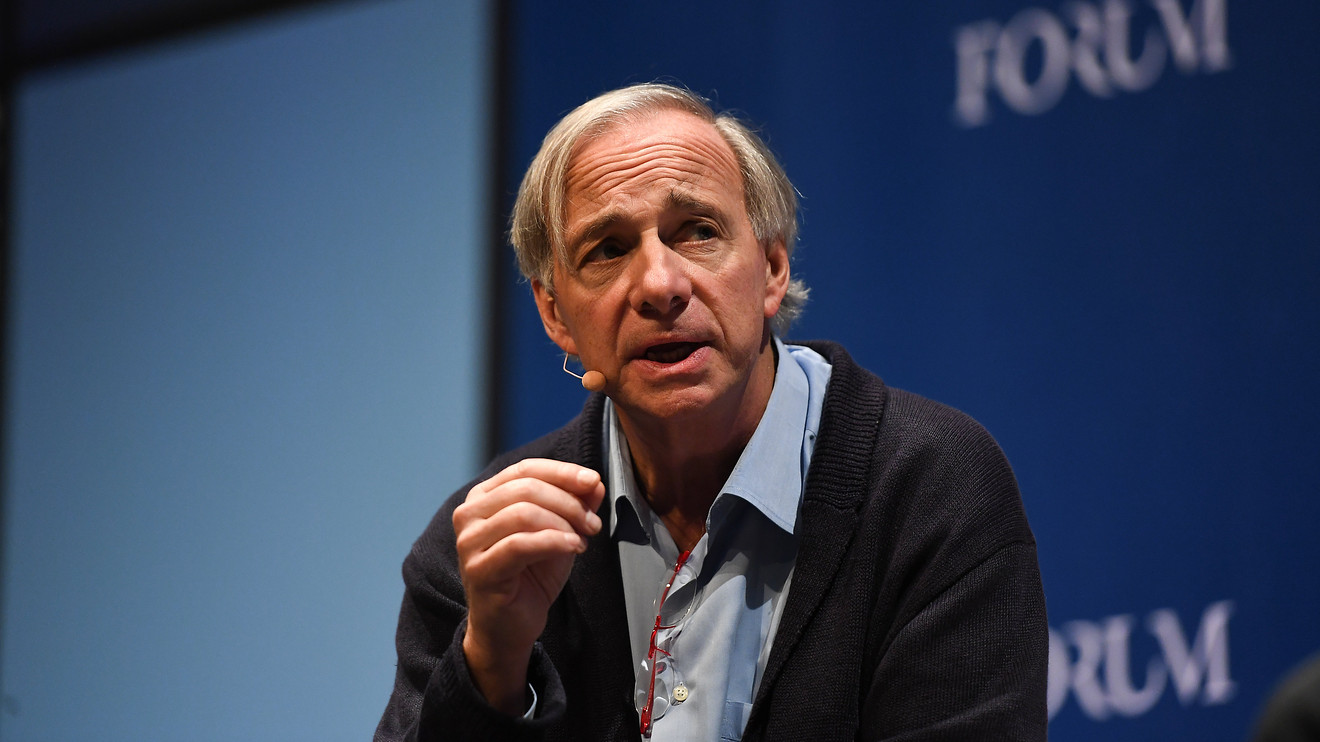

The founder of the world’s largest hedge fund says the clash between the U.S. and China is bigger than just a trade war, and the U.S. may be escalating it to a dangerous level.

In a LinkedIn blog post published Wednesday, Ray Dalio, founder and co-chairman of Bridgewater Associates LP, said the U.S. is “weaponizing export controls” with its move to shut off U.S. supplies to Chinese tech giant Huawei Technologies Co.

Dalio noted that the move could lead to China retaliating by shutting off the supply of rare-earth metals to U.S. companies, a “critical import” necessary for the manufacturing of mobile phones, night-vision glasses, gyroscopes in jets and LED lights, among others.

“History shows that countries in conflict have seen that such conflicts can easily slip beyond their control and become terrible wars that all parties, including the leaders who got their countries into them, deeply regretted, so the parties in the negotiations should be careful that that doesn’t happen. Right now we are seeing brinksmanship negotiations, so it is a risky time.”

Dalio also explained that the trade war is just one part of a greater conflict.

“It is an ideological conflict of comparable powers in a small world. It’s about 1) China emerging to challenge the power of the U.S. in many areas and 2) these two countries having two different approaches to life — one that’s top down and one that’s bottom up,” he wrote. “These conflicts extend to American and Chinese businesses, technologies, capital markets, influences over other countries, militaries, ideologies, and most everything else.”

Dalio said both countries are moving toward being less dependent on each other. “That is a big deal because it is a major, multi-year undertaking that will take resources away from other development,” he said, adding that the uncertainties caused by the conflict will be “major disruptors” to people, companies and governments.