Kohl’s shares tumbled more than 16% Tuesday after the retailer slashed its profit outlook for the year, as quarterly earnings and sales fell from last year and missed estimates.

The retailer cast blame on an “increasingly competitive promotional environment” and warmer weather at the start of the fall season. It said its women’s business was its weakest during the quarter, under-performing all other segments. Kohl’s said it lowered its forecast because it expects heightened discounting among competitors to continue for the remainder of 2019.

The entire department store sector has been under pressure this year, and the weak results from Kohl’s sparked selling in the sector. Brands like Nike are investing more in their own stores and website to sell merchandise, moving away from middlemen. Companies like Kohl’s, Macy’s and J.C. Penney are having to look for new ways to win shoppers. Sears and Barneys New York fell victim to bankruptcy.

At the market’s open, shares of Macy’s were trading down more 6%, while Nordstrom fell nearly 7%.

Here’s how Kohl’s did for its fiscal third quarter compared with what analysts were expecting, based on Refinitiv data:

- Earnings per share: 74 cents, adjusted, vs. 86 cents expected

- Revenue: $4.36 billion vs. $4.40 billion expected

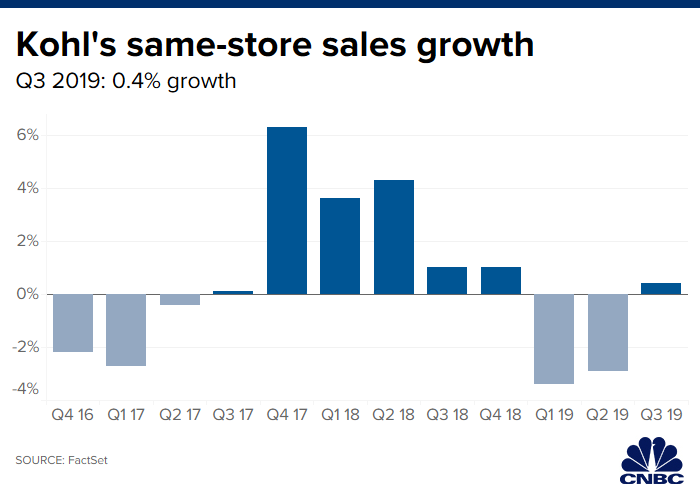

- Same-store sales: up 0.4% vs. growth of 0.8% expected

A weak September

“The quarter started off positive in August with another successful back-to-school season and ended strong in October,” CEO Michelle Gass said in a statement.

During a conference call, she said September was the weakest month, with rivals’ promotions picking up, and because of some “disruption” in stores as Kohl’s launched a slew of new brands and expanded space in certain categories like active wear.

The company responded by slashing prices on hot items and pushing refreshed marketing materials, the CEO explained, getting Kohl’s back to a stronger October.

“We enter the holiday period with momentum and are strategically increasing our investments,” Gass said, adding that “investing in the short-term” should help the company “drive profitable growth over the long-term.”

Kohl’s said it now expects to earn an adjusted $4.75 to $4.95 per share for fiscal 2019, compared with a prior range of $5.15 to $5.45. Analysts had been calling for $5.19 a share.

During the period ended Nov. 2, net income fell to $123 million, or 78 cents per share, compared with $161 million, or 98 cents a share, a year earlier. Excluding one-time items, Kohl’s earned 74 cents per share, short of expectations for 86 cents, based on Refinitiv data.

Net sales fell to $4.36 billion from $4.37 billion a year earlier, missing expectations for $4.4 billion.

Sales at Kohl’s store open for at least 12 months and from its website were up 0.4%, short of expected growth of 0.8%.

New celebrity brands

Kohl’s has been launching some of its own brands and relying on celebrity partners to generate buzz. Last month, it rolled out a home goods line designed by HGTV’s ‘Property Brothers’ stars Drew and Jonathan Scott, called Scott Living. It has also started selling a new pet brand, in a partnership with celebrity comedian and TV host Ellen DeGeneres, called ED Ellen DeGeneres Pets collection, for pet costumes and play toys.

In 50 stores, it is testing pop-up marketplaces, where younger brands will rotate in and out. In 200 stores, it has been adding “beauty impulse” areas, showcasing 20 top beauty brands.

In 2017, Kohl’s started working with Amazon to accept Amazon returns at some of its stores, and that option has now grown to be available at all of Kohl’s more than 1,000 locations in the U.S. It remains to be seen if this can prove to be a profitable sales driver for the retailer, however.

Gass said Tuesday that, so far, Kohl’s is “very pleased” with the Amazon tie-up. She said it’s bringing younger shoppers to Kohl’s stores.

“We will have Amazon returns in stores nationwide this holiday, for the first time, which will drive additional traffic into our stores,” Gass said.

Kohl’s shares, as of Monday’s market close, have fallen roughly 12% this year. The department store chain has a market cap of about $9.3 billion.