(Bloomberg Opinion) — Coty Inc. just turned into Koty Inc.

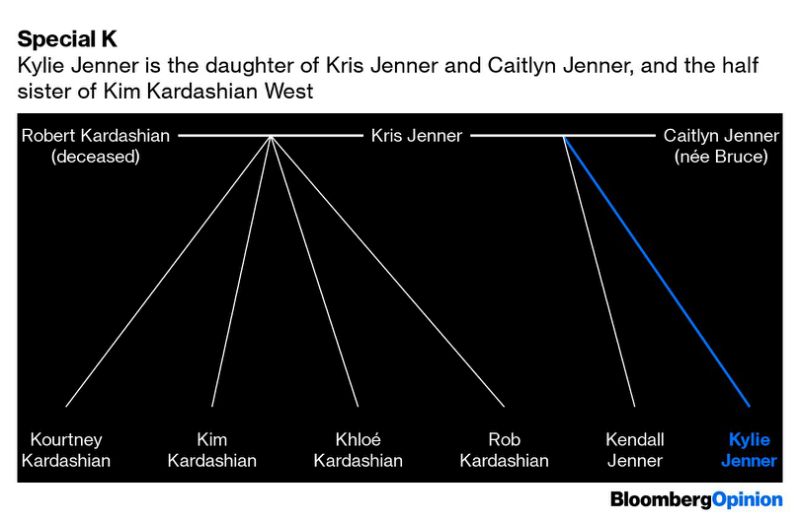

The American beauty group controlled by Germany’s billionaire Reimann family has agreed to pay $600 million for a majority stake in the cosmetics brand founded by Kylie Jenner, the youngest member of the Kardashian-Jenner clan. The deal, in which Coty will acquire a 51% stake, values Jenner’s Kylie Cosmetics business at about $1.2 billion, not bad for the line of lip kits the reality TV star created when still a teenager.

You can see why Coty is paying up for a piece of the “Konsumer” action. Jenner, with 270 million social media followers is at the vanguard of the celebrity-influencer beauty industry, where company founders engage their fans via Instagram and YouTube and turn them into customers.

Jenner — alongside other new media stars such as pop singer Rihanna, who’s partnered with LVMH Moet Hennessy Louis Vuitton SE, and the makeup artist Huda Kattan — is reshaping the beauty industry. Traditional cosmetics houses need to find ways to keep up. The mass beauty market, in which Coty has brands such as CoverGirl and MaxFactor, has been hit hard by the celebrity competition.

Coty’s deal values Kylie Cosmetics at 6.7 times the last 12 months’ revenue. That compares with the 3.6 times multiple paid by Sweden’s EQT Partners for Nestle Skin Health, a brand catering for a slightly older demographic. It seems contouring for millennials is twice as valuable as hiding crow’s feet.

Jenner’s company sells only make-up and skincare products currently; Coty will license it fragrances and nail merchandise too. If the new parent can broaden Kylie’s appeal into everything from false eyelashes to gel nail varnish, and pump them through its global distribution network, then it has a chance of bolstering revenue and squeezing value from the deal price. The business is already growing quickly and has an Ebitda margin of more than 25%.

The danger of buying a “name” brand is that fashion is fickle. Coty’s purchase assumes that Kylie will keep inspiring young women to highlight their cheek bones and plump their lips. Yet what if she falls from favor with her young followers, who move onto the next Instagram or TikTok sensation. Already we may be past peak Kardashian, with the family’s TV show now into its 17th series.

Coty is eager to stress that this is a partnership, and that Jenner will remain heavily involved. But operating inside a behemoth is very different to being an entrepreneurial startup.

Let’s not forget the fate of the celebrity fragrance boom that emerged in the 2000s. These products are waning in popularity as millennials demand more personalized and artisanal scents. Coty itself has been moving away from some traditional collaborations, for example stopping producing perfumes for Jennifer Lopez, Lady Gaga and Celine Dion — although it still has Katy Perry in its stable.

Yet perfume tie-ups were for the analogue age; capturing a Kardashian is for the digital era. Investors will hope that doesn’t also mean an acceleration of the process of falling out of fashion.

–With assistance from Chris Hughes.

To contact the author of this story: Andrea Felsted at [email protected]

To contact the editor responsible for this story: James Boxell at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andrea Felsted is a Bloomberg Opinion columnist covering the consumer and retail industries. She previously worked at the Financial Times.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”55″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.