Insight into Himalaya Capital’s Latest Investment Moves

Li Lu (Trades, Portfolio), the founder of Himalaya Capital, has made notable investment moves in the second quarter of 2024, as revealed by the latest 13F filing. Born in China and a triple alumnus of Columbia University, Li Lu (Trades, Portfolio) has established himself as a prominent figure in the investment world. His firm is known for its long-term investment strategy, focusing on high-quality companies in Asia and the U.S. Li Lu (Trades, Portfolio)’s investment philosophy is deeply influenced by the principles of legendary investors like Benjamin Graham, Warren Buffett (Trades, Portfolio), and Charlie Munger, emphasizing substantial economic moats and trustworthy management.

Summary of New Buys

During the second quarter of 2024, Li Lu (Trades, Portfolio) made a significant new addition to his portfolio:

-

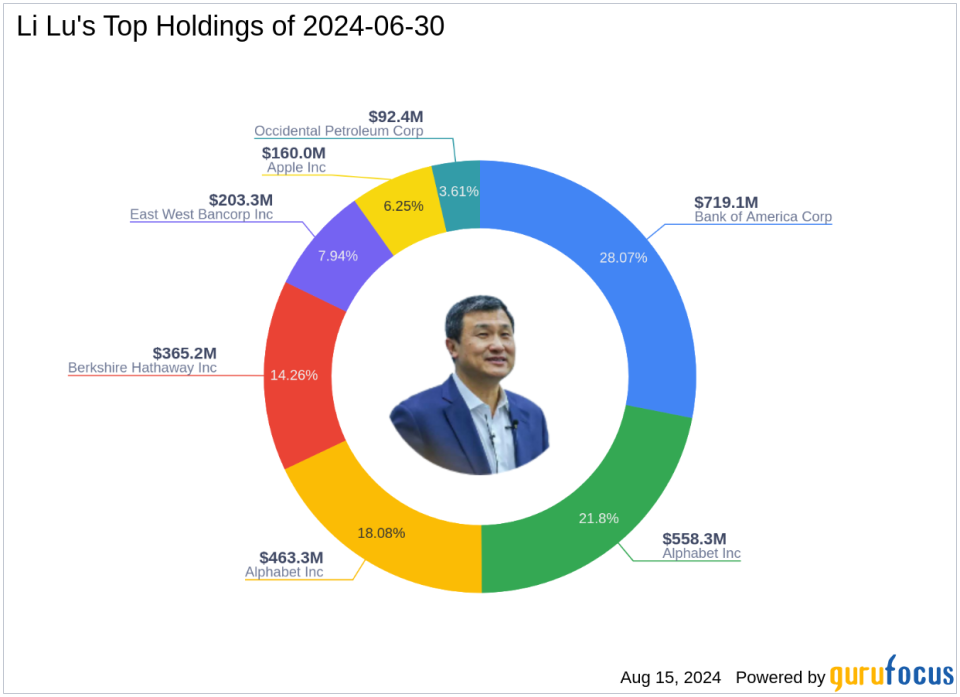

Occidental Petroleum Corp (NYSE:OXY) was the standout new buy with 1,466,500 shares, representing 3.61% of the portfolio and valued at approximately $92.43 million.

Portfolio Overview

As of the second quarter of 2024, Li Lu (Trades, Portfolio)’s investment portfolio comprised 7 stocks. The major holdings were:

These investments are predominantly concentrated in four industries: Financial Services, Communication Services, Technology, and Energy.

Li Lu (Trades, Portfolio)’s strategic choices reflect his disciplined investment approach, focusing on sectors and companies where he sees long-term value and growth potential. The addition of Occidental Petroleum Corp to his portfolio underscores a keen interest in the energy sector, aligning with global economic trends and the potential for significant returns. As always, Li Lu (Trades, Portfolio)’s moves are closely watched by investors seeking insights from one of the most disciplined practitioners of value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.