(Bloomberg Opinion) — Soccer is back. The stadiums might be empty, the training protocols strict and the virus testing frequent, but after a three-month absence, England’s Premier League has returned. The money, however, has not.

Empty grounds mean no ticket sales. More significant is the broadcast revenue, which in English football’s top division represents two-thirds of club income. While bored Brits may be desperate for a televised dose of Liverpool versus Everton on Sunday night — crowd or no crowd — the Covid-19 pandemic has pretty much ended hopes for a new spurt of growth in the value of broadcast rights. (That the Liverpool derby is being shown free-to-air may in itself be a sign of different times.)

The TV money had already shown signs of plateauing before the coronavirus. Since its inception in 1992, the Premier League’s broadcast income has soared by more than 60 times to 3 billion pounds ($3.7 billion) a season. But in the most recent broadcasting deal for the 2019 to 2022 seasons, the price of domestic rights fell for the first time in 15 years, offset only by an increase in the value of overseas rights.

Talks for the next three-year domestic TV package, which will run from 2022 to 2025, will start in the next few months ahead of an auction next year. Clubs had been hoping that well-capitalized online streaming companies such as Amazon.com Inc. and Len Blavatnik’s DAZN would push up the price by bidding against the incumbents, Comcast Corp.’s Sky unit and BT Group Plc.

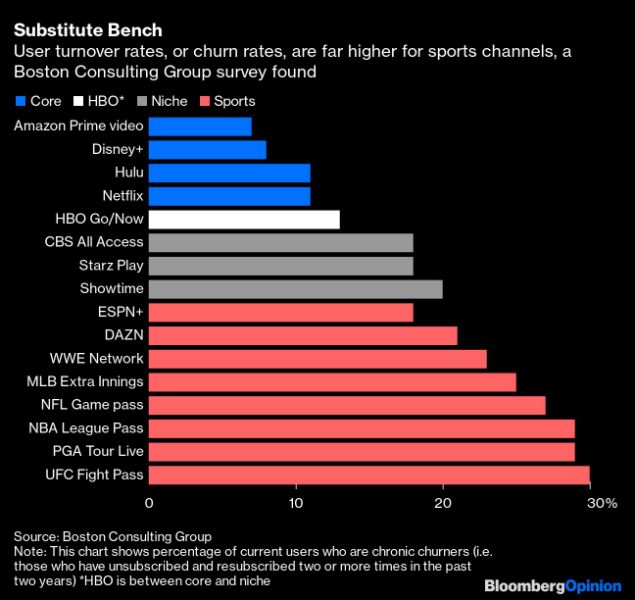

The virus has put paid to those dreams. Sports-specific online streaming services have been hit hard during the pandemic. While pay-TV stations often tie their customers into long contracts, internet streamers operate on a month-to-month basis, so they endure far higher customer losses when there’s no sport to be shown. DAZN, a British company that bills itself as the Netflix of sport, has been scrambling to secure new funding after committing billions of dollars on rights.

Last time around, the Premier League succeeded in selling two small packages of games to Amazon. The idea was to whet the e-commerce giant’s appetite by demonstrating how soccer could drive new subscriptions to its Amazon Prime service. Ostensibly, that effort seems to have been a success. Amazon said it signed up millions of new subscribers after the games it showed in December.

But that may not be enough to convince Jeff Bezos’s company to splash out billions of dollars on the major packages of English games (Amazon spends just 90 million pounds per year on its current rights). That’s because Premier League football is more of a customer acquisition tool for Amazon than one of retention: It convinces people to sign up for Prime, and the hope is that they stick around once they see the corollary benefits like cheap deliveries of Amazon goods and plentiful television box sets and films.

Bezos doesn’t really need a package of games that stretches across a whole season, he just needs enough to convince people to try Prime once. So while Amazon might come back for another package next year, it’s likely to be another small one. The possibility of a rival tech player entering the market — Netflix Inc., Facebook Inc., Apple or Alphabet Inc.’s Google – appears minimal. With each game costing 9 million pounds to show, they see more value investing in content with a longer shelf life. Episodes of Netflix’s The Crown will attract audiences for years, in a way that Wednesday’s 0-0 draw between Aston Villa and Sheffield United will not.

The Premier League’s 20 teams will probably see their cumulative revenue drop by 17% this year to 4.3 billion pounds, Deloitte estimates. About 500 million pounds of that is lost sales, so a timeout might be called on mega-transfer fees and mega-wages. The Premier League may have already passed its peak.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Alex Webb is a Bloomberg Opinion columnist covering Europe’s technology, media and communications industries. He previously covered Apple and other technology companies for Bloomberg News in San Francisco.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”52″>For more articles like this, please visit us at bloomberg.com/opinion

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Subscribe now to stay ahead with the most trusted business news source.” data-reactid=”53″>Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.