EV maker Lucid Motors (LCID) revealed new information today about its upcoming full-size Gravity SUV at its Technology & Manufacturing Day, along with updated delivery numbers for 2024 and a glimpse of its upcoming midsize SUV.

The Gravity is still on track for a late 2024 release, CEO Peter Rawlinson said, and it will be made cost-effectively too. Rawlinson believes there is a misunderstanding in the marketplace regarding how expensive it is for Lucid to make its EV tech.

“If you look at our [electric] drive units, not only are they very competitively priced for the power, they’re incredibly cheap, but what they enable is a significantly smaller battery, which leads to a very considerable cost saving,” Rawlinson told Yahoo Finance.

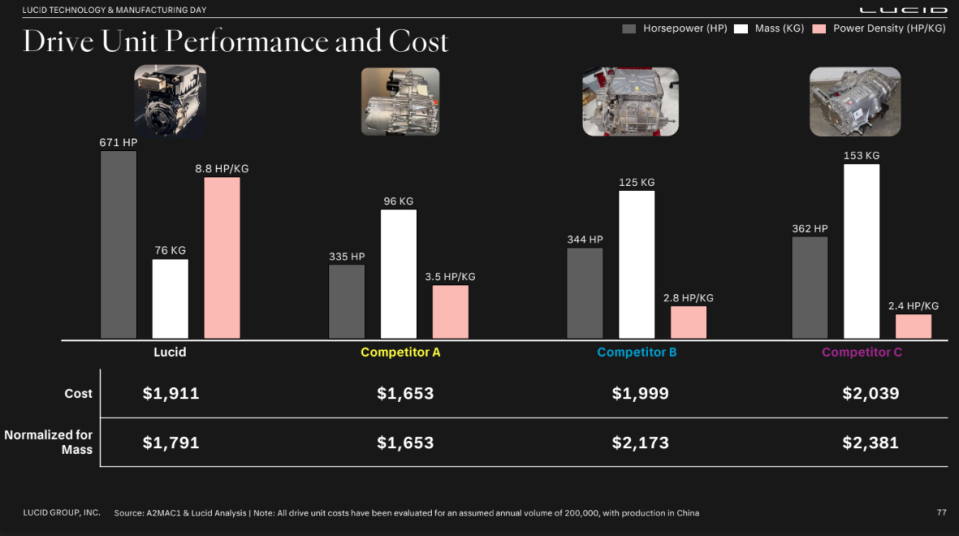

German engineering firm A2MAC1 looked over the data and found a number of cost efficiencies and metrics that showed Lucid topping some competitors in some areas and at least nearing them in others.

With regards to drive units, A2MAC1 found that the Lucid’s drive unit cost $1,911 to manufacture, cheaper than two of the three competitors it was baselined against; however, the drive unit produced more power and weighed significantly less. When normalized for the mass of the drive unit, Lucid’s drive unit costs approached the cheapest, which was Competitor A ($1,791 vs. $1,653). Though unsaid, Competitor A is most likely Tesla.

With regard to batteries, Lucid found that when normalized for size (128 kWh), Lucid’s batteries were cheaper than the two other competitors in the study. However when normalized for competitor range, Lucid’s batteries — due to their efficiency — produced even more cost savings.

While the data is good to see, cost efficiencies may come as a surprise to investors since Lucid lost $790 million in the second quarter, or nearly $330,000 per unit delivered in Q2. Rawlinson stressed he is only talking about costs associated with the powertrain — meaning electric motors, drive units, and batteries — which he said are competitive compared to the industry.

However, investors and Wall Street analysts are likely in “prove it” mode when it comes to profits or lack thereof, with the stock down nearly 19% in 2024.

On the bright side, Rawlinson revealed that the company hit a new sales milestone. “I’m not giving guidance for Q3, but I can announce at this juncture by Aug. 31, we’ve actually delivered more cars in 2024 by Aug. 31 than we had in the whole of 2023 where we delivered 6,001 [vehicles],” Rawlinson said. Rawlinson did not give a specific figure (third quarter deliveries come out next month), but he acknowledged it was above 6K.

The boost comes as the company has begun selling lower-cost versions of its Lucid Air sedan. The upcoming full-size Gravity SUV should help those numbers considerably, Rawlinson has said in the past, when the base model goes on sale for around $80,000, which is the federal EV tax credit threshold.

The Gravity will ship with Tesla’s NACS charging inlet built in, providing native access to the substantial Tesla Supercharger network, another bonus for the vehicle. Lucid isn’t taking preorders for the Gravity yet but will do so soon.

Read more: Are electric cars more expensive to insure?

Midsize vehicles are coming

Looking ahead, Lucid and Rawlinson are most excited about the upcoming midsize SUV, unnamed at the moment, which will be powered by the just-revealed Atlas drive unit and cost around $50,000 when it goes on sale in 2026.

Rawlinson said the Atlas unit is made entirely in-house, smaller, more efficient, and cheaper to make than its current drive units. The Atlas could also find its way up the food chain to cheaper Air sedans and Gravity SUVs.

Rawlinson also gave up more details on the future of the midsize vehicle (or vehicles).

“There’s not just one midsized vehicle, there’s a plural. I’ve not disclosed how many based upon the midsized platform, but I mean that is going to take on the Tesla Model 3, Model Y — bestselling car in the world — but it’s going to have Lucid advanced technology,” Rawlinson said.

The CEO also believes that Lucid’s midsize vehicles will be able to go further distances than the Model Y, for instance, with similar batteries, and that they will be more cost-effective to manufacture down the line.

Rawlinson isn’t shy about making these claims, and that might be the point. He’s confident in Lucid’s ability to deliver, but the market may not be so sure and will need more time to see if Lucid’s goals become reality.

That’s fine with Rawlinson. Lucid is a long-term bet, he said, and one that Saudi Arabia’s PIF sovereign wealth fund is deeply committed too.

“My view is [Lucid] is a long-term play; it’s like Tesla, it’s like Amazon. We’ve got a long-term strategy.”

Pras Subramanian is a reporter for Yahoo Finance. You can follow him on Twitter and on Instagram.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance