Earnings season is in full swing, with a notably stacked reporting docket for the week. The expectation is for another period of positive growth, underpinned by strength within tech.

And concerning the notable releases next week, two Mag 7 members, Alphabet GOOGL and Tesla TSLA are on the reporting docket. But how do expectations stack up heading into each respective release? Let’s take a closer look at estimates and a few key metrics.

Can Alphabet Shares Soar Again?

Mega-cap titan Alphabet will reveal its quarterly results next Tuesday on July 23rd after the market’s close. Recent quarterly prints have been favorable for the company, with it exceeding the Zacks Consensus EPS estimate by an average of 11% across its last four releases.

Shares enjoying bullish activity following its latest print, sparking a rally. The company has enjoyed a nice growth phase, with earnings and revenue from the release climbing 61% and 15% year-over-year, respectively.

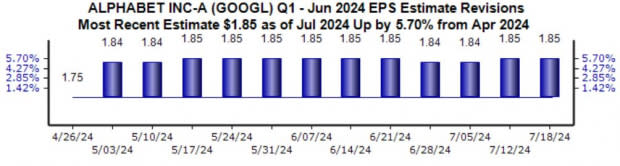

Analysts have taken a favorable stance on the company’s outlook for the quarter to be reported, with the $1.85 Zacks Consensus EPS estimate up nearly 6% since mid-April. The value reflects a 28% change from the year-ago period, continuing its recent growth trajectory.

Image Source: Zacks Investment Research

Cloud and AI optimism fueled shares following its latest release, with investors likely to be laser-focused on the same topics again. The company’s Cloud results have recently exceeded our expectations in back-to-back releases, easing prior fears of an overall slowdown in the space.

Image Source: Zacks Investment Research

Shares aren’t expensive heading into the release despite the strong share performance, with the current 21.8X forward 12-month earnings multiple sitting beneath the 22.4X five-year median. And the current PEG ratio works out to be 1.2X, reflecting that investors are paying a fair price for the forecasted growth.

The stock sports a Style Score of ‘C’ for Value.

Tesla Margins are Key

Shares popped following the release of Tesla’s delivery/production data. The EV leader’s Q2 deliveries reached 444k, and EVs produced totaled 411k. The results pleased investors, though it’s worth noting that deliveries were down a modest 4.1% on a year-over-year basis.

Margins will undoubtedly be in focus for the company’s quarterly release, which is expected on next Tuesday, July 23rd. Recent margin pressures have been a focus among investors, helping explain the stock’s slow start to 2024.

Please note that the chart below is on a trailing twelve-month basis.

Image Source: Zacks Investment Research

Earnings expectations are overall down since the end of April, but positive revisions did hit the tape just recently near the beginning of July, a favorable development leading into the release. The $0.62 per share expected suggests a 14% climb from the year-ago period, getting the EV titan back into positive territory.

Image Source: Zacks Investment Research

Despite a slow start to the year, Tesla shares have gained a remarkable 70% just over the last three months, showing notable outperformance and bullish sentiment. A favorable quarterly release could easily keep shares melting higher, particularly if the company speaks favorably about margins.

Bottom Line

Earnings season kicks into a much higher gear this week, with many notable companies scheduled to report, including the two Mag 7 members Alphabet GOOGL and Tesla TSLA.

Concerning Alphabet, investors will be looking for further color on the cloud computing / AI environment, whereas Tesla investors will be zeroed in on margins and future plans surrounding autonomous driving.

Both companies report after the market’s close on July 23rd.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.