There’s precisely a 73.1% chance that the stock market will rise next year. But before you get too excited about this apparently good news, you should know that these odds are based on nothing more than the proportion of rising years in U.S. stock market history. So I am not shedding any light on 2021 in particular.

Nonetheless, historical odds and the big picture are important to keep in mind. There is solace in knowing that, across an incredibly wide range of market environments — from a Civil War, two World Wars, a Great Depression, to name a few — the U.S. market’s odds of rising have remained remarkably similar.

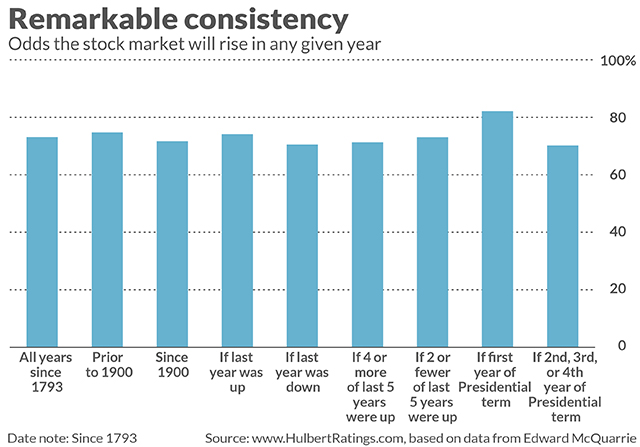

The proportion of years since 1793 in which the U.S. stock market rose varies very little. (The data reflect the broad market, as represented by indices such as the S&P SPX, +0.24% with dividends reinvested.) For example, up to 1900, the proportion of rising years was 75%; it’s been 72% for the years since then. That’s not a statistically significant difference. The same goes when you divide the sample according to how the stock market performed in the immediately preceding year. If it rose, then the odds of it rising again are 74%, versus 70% if the stock market fell in the prior year.

What if stocks are in a strong bull market? I measured that by focusing on periods in which the stock market rose in at least four of the prior five years. In that event the market rose 71% of the time. That contrasts with a 73% chance of rising if the market rose in two or fewer of the preceding five years.

The most pronounced pattern that emerged was when I focused on the first year of the presidential term. In such years, the odds of rising are 82%, versus 70% in the other three years of the term. But even this difference is not significant at the 95% confidence level that statisticians typically use to determine if a pattern is genuine.

Why are the odds reported bunched in such a narrow range? It’s not because of some law of the universe that the stock market must rise in close to three out of four years. Instead, these odds are a function of the stock market’s riskiness, its volatility and investors’ risk aversion. Given these factors, the only way to make equities attractive to more than just a few thrill seekers is to offer these odds.

So long as these factors don’t change, we shouldn’t expect any major change in these odds. And it’s doubtful that they will change, or change much when they do.

Therefore, if the stock market were to become so undervalued that the odds of rising were much greater than three out of four, investors would rush in, bidding prices up sufficiently so as to bring those odds back into line. The reverse would be true if the odds of rising fell significantly below three out of four.

Note carefully that these odds don’t guarantee that the stock market will rise in three of the next four years. The odds reflect an average across a period of many years. There in fact were two occasions since 1793 in which the stock market fell for four straight years — once during the Great Depression and another in the 1840s. But there were many other occasions in which the stock market rose for four straight years — 65, in fact, since 1793.

The bottom line? Success next year is likely but not guaranteed.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]