A trade war with China that is possibly escalating is not the real reason why the U.S. stock market has performed so poorly in recent weeks — including the 286-point decline in the Dow Jones Industrial Average on Thursday of this week.

The culprit is the remarkable complacency of short-term stock market timers.

This isn’t to say that a trade war isn’t something to worry about. But it insults traders’ intelligence to think that they are basing their trades on the latest presidential tweet on whether the U.S. and China might possibly someday meet again to talk trade. Optics aside, not much changes from day to day on whether or not there will be a full-scale trade war.

Trader sentiment helps us to understand what’s really going on. To be sure, the mood on Wall Street is not irrational exuberance, as I pointed out earlier this week. That said, the prevailing mood by no means is the pessimism and despair that typically accompanies tradable lows. Until it does, according to contrarian analysis, the market will struggle to mount a sustainable rally.

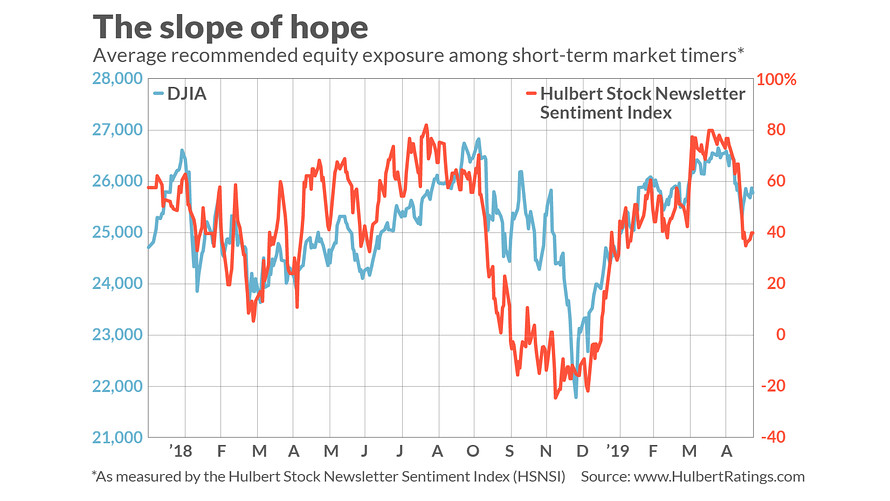

Consider the average recommended equity exposure among a group of short-term market timers that I regularly monitor (as measured by the Hulbert Stock Newsletter Sentiment Index, or HSNSI). This average currently stands at 37.5%. Though that is down from the 79.9% reading that was registered in mid-April, it’s still equal to the median of all daily readings since 2000.

Contrarians won’t become interested in betting on the long side until the HSNSI drops down to around minus 20%, which would mean that the average timer has shifted to being short the market. The last time that occurred was in December 2018.

In the meantime, the U.S. market is vulnerable to keep descending a “slope of hope,” to use a favorite contrarian phrase. It’s going to take more time to work off the excessive bullishness that prevailed in mid-April; the HSNSI reading of 79.9% was one of the highest ever recorded.

A slightly more encouraging story is being told by another sentiment index that focuses on Nasdaq-oriented timers in particular. The average recommended equity exposure among these timers currently stands at minus 19.4%, as judged by the Hulbert Nasdaq Newsletter Sentiment Index (HNNSI). So this particular group of extremely short-term traders is not as sanguine as their brethren who focus on the Dow DJIA, +0.37% and other broad-market indicators.

Nevertheless, even these Nasdaq-oriented timers aren’t so pessimistic as to set up a contrarian buy signal. Their current exposure level is higher than 21% of all daily readings since 2000. Last December, for example, the HNNSI fell to minus 72.2%.

My hunch is that, here too, it’s going to require more time to work off the excessive bullishness that was registered in mid-April. The HNNSI then got as high as 85.9%, which was higher than more than 96% of all daily readings since 2000. (Full disclosure: My firm calculates the HSNSI and HNNSI and shares the data with paying clients.)

To be sure, there are some bright spots. As the latest HNNSI reading indicates, the shortest-term market timers are already slightly pessimistic. Since they often lead the timers who focus on the broader market, it’s entirely conceivable that the HSNSI will also drop, and that both of these sentiment indices will soon fall into the range suggesting a tradable low is at hand.

But there is no need to jump the gun, as the market will tell its story in its own timing.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Read: Why one stock-market bull thinks investors are overreacting to trade-war rhetoric