Here’s some good news for U.S. stock market investors: consumer sentiment is plunging.

That would be welcome news at any time, but especially after the almost 300-point drop in the Dow Jones Industrial Average DJIA, -1.08% on the first trading day of September.

Consumer sentiment is a contrarian indicator for stocks. Most recently, for August, the closely watched University of Michigan Consumer Sentiment Index posted its biggest monthly decline in almost seven years.

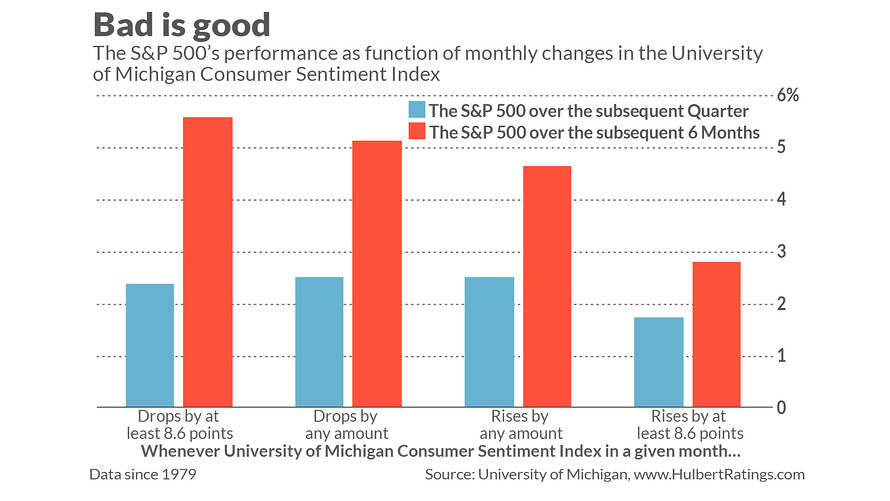

To show that drops this big are good news, I measured the correlations between monthly changes in the University of Michigan index since 1979 and the S&P 500’s SPX, -0.69% subsequent performance. The findings show that whenever the Michigan index dropped by at least as much as it did in August (8.6 points), the S&P 500 over the subsequent six months produced an average gain of 5.6%. That contrasts with a 2.8% average return subsequent to months in which the index rose by at least 8.6 points. (See chart below.)

This result is consistent with the conclusions of a study several years ago conducted by Meir Statman, a finance professor at California’s Santa Clara University, and Ken Fisher, the well-known money manager. In addition to focusing on the University of Michigan index, they also analyzed the Conference Board’s Consumer Confidence Index. They report that “investors need not fear that declines in consumer confidence would be followed by low stock returns. Low consumer confidence is followed by high stock returns more often than it is followed by low stock returns.”

In any case, as I’ve pointed out before, the strongest statistical correlations in the data are between the S&P 500’s trailing performance and changes in consumer sentiment. That is, consumer sentiment and the S&P 500 are coincident indicators — rising and falling more or less in unison. So it’s not a big surprise that, given the stock market’s recent turmoil, the University of Michigan index should also have fallen.

For investment purposes, furthermore, it matters little which of these coincident indicators caused the other. The important point is that, because consumer sentiment is a contrarian indicator, you should not react to falling consumer sentiment by selling your stocks.

Watch what consumers do — not what they say

A reality check when analyzing consumer sentiment is to focus on actual consumer behavior — specifically total consumer expenditures. Since such expenditures represent an estimated 70% of GDP, it would be worrisome indeed if consumers stopped spending.

Fortunately there is no evidence of that, despite the recent plunge in consumer sentiment. The federal government reported last week that personal consumption expenditures (PCE) surged in the most recent reporting month. Furthermore, the latest month’s PCE is 4.1% higher than the year-ago level. That’s higher than the average 12-month gain over the past decade of 3.5%.

So it’s important to watch what consumers do in addition to what they are saying. The last time PCE 12-month rate of change was negative was during the Great Recession, more than a decade ago. We’re seeing nothing like that now.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Read: 5 reasons why you shouldn’t dump stocks just because September is here

More: Americans’ confidence in the economy droops in August, sentiment survey shows