Stockholders should think twice before celebrating lower interest rates.

That’s because lower rates reduce the value of higher-priced stocks. While stock portfolios become more valuable, the income from those portfolios declines. The net effect is to leave investors little better off than they were before rates fell.

This unfortunate fact of life puts into new light President Donald Trump’s statement that the Dow Jones Industrial Average DJIA, -2.25% would be between 5,000 and 10,000 points higher if the Federal Reserve “had done its job properly.” Even if his words were accurate, it’s not clear that investors’ future standard of living would be much different than it is now.

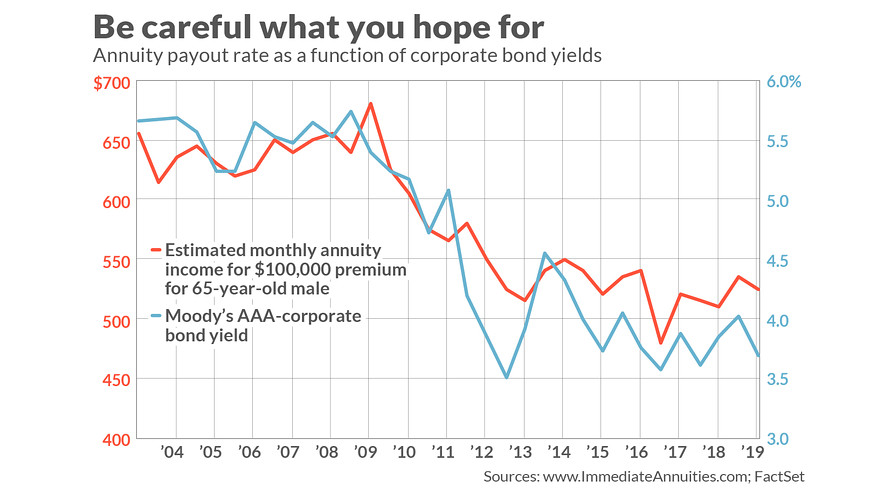

Perhaps the best way to illustrate this is by focusing on how much guaranteed monthly income you could purchase with your stock portfolio. That’s just another way of asking what annuity can you purchase with your portfolio. And it turns out that annuity payouts fluctuate more or less in lockstep with long-term interest rates.

Over the last 15 years, for example, the $100,000 annuity that paid out the most was sold in 2008, when a 65-year old male could have locked in a monthly payout of around $680, according to ImmediateAnnuities.com. The lowest payout rate came in 2016, when this same hypothetical 65-year old male could have converted his $100,000 into a guaranteed monthly payout of $485.

As you can see from the chart, above, this high and low coincided almost perfectly with fluctuations in Moody’s AAA-rate corporate bond yield. Its high over the last 15 years was at 6.3%, in 2008, while its low of 3.3% came in 2016.

What this means: when corporate bond rates were 3.3%, your stock portfolio would have needed to be worth 40% more than when rates were at 6.3% in order to produce the same guaranteed monthly income.

Interest rates, annuity payout rates, and the stock market have entered a tightly-choreographed dance

To be sure, there are other factors that impact annuity payout rates besides interest rates, such as dividend yield and valuation. But in recent months it appears as though interest rates, annuity payout rates, and the stock market have entered a tightly-choreographed dance. When the Fed hiked rates late last year, the stock market plunged. When it abruptly reversed course around New Year’s, the market soared.

This news isn’t all bad. The inverse relationship between rates and annuity payout rates means that, just as lower rates can cancel out the benefit of higher stock prices, higher rates can soften the blow of lower stock prices. That’s because, even though your stock portfolio will be worth less, dollar for dollar it could be converted into a greater monthly guaranteed income.

The bottom line: Annuity payout rates and interest rates are in a rough equilibrium. Those who celebrate lower interest rates are focusing on just one half of the equation.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Also: Easily available home equity lines of credit threaten homeowners and the economy

Add Comment