Odds are good that the U.S. stock market will be higher at the end of December. Don’t get too excited; these odds have nothing to do with how strong the U.S. economy is right now or the stock market’s impressive returns so far this year. In fact, the chance of a winning second half of 2021 would be the same even if stocks were in a bear market or the economy was in recession.

The reason why has to do with the stock market’s efficiency. Its level at any given point reflects all available information up to that point. For example, if on June 30 the odds were better-than-usual that stocks would be higher in six months’ time, traders would have already bid up prices to take those better odds into account. They wouldn’t wait until later in the year to up their bets.

That’s also true if the odds of a higher market were worse than usual. If traders at the midyear mark knew that the market would most likely be lower in six months’ time, they would sell immediately rather than wait.

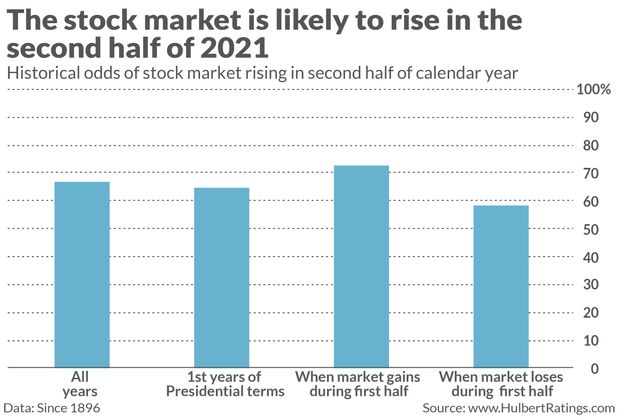

The net result of their actions in both cases would that the market’s odds of rising in the second half of the year are more or less the same. Those odds are 66.9% — about two out of three — based on the Dow Jones Industrial Average DJIA, -1.58% back to its creation in the late 1890s.

Notice from the chart below that these odds are largely the same regardless of what has happened with the Dow through mid-year. In those calendar years in which the Dow rose over the first six months, it in the second half rose 72.4% of the time. The increase from 66.9% to 72.4% is not significant at the 95% confidence level that statisticians often use when determining if a pattern is genuine.

Or take the first years of the presidential four-year term, which is the year we’re in now. Over the second halves of those years, the stock market has risen 64.5% of the time. That is not statistically significantly different than the odds that apply to all years.

You may be disappointed that a strong first half doesn’t increase the odds of a strong second half. Yet no one complained a year ago when the identical statistical analysis suggested that there was a two-out-of-three chance the stock market would be higher at the end of 2020. Sure enough, it was: Following a 9.6% decline for the first half of last year, the Dow rose 18.6% in the second.

It’s because of the market’s efficiency that a buy-and-hold strategy is so hard to beat over the long term. When you deviate from that buy-and-hold approach, you’re in effect betting that you know more and have greater insight than the collective wisdom of millions of other stock market investors. It’s not out of the question that you do, but — as history has shown numerous times — it’s a low probability bet.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: The S&P 500 now is top-heavy in 5 big tech stocks but that alone won’t end this bull market

Plus: Here are the biggest short squeezes in the stock market, including Virgin Galactic and AMC