What’s up with transportation stocks? Or, really, what’s “down” with them?

Even as new all-time highs have been registered by broad-market U.S. indices such as the Dow Jones Industrial Average DJIA, +0.85% and the S&P 500 SPX, +0.23% , the market’s transportation sector has lagged. The Dow Jones Transportation Average DJT, +0.96% , for example, is more than 6% below its April high, and more than 10% below its all-time high set in 2018.

Dow Theorists will immediately recognize the significance of this divergence: it sets up a potentially bearish “non-confirmation” which, if it continues, could turn this oldest of stock market timing systems negative on the major trend. To some, this recent divergence is eerily reminiscent of a similar divergence prior to the bursting of the internet bubble in early 2000: near the top of that bull market, in March 2000, the Dow Transports hit a then all-time high in May 1999, almost a year prior to the broad market.

The lagging transports might worry you even if you’re not a follower of the Dow Theory. That’s because the transportation sector is widely considered to be a leading economic indicator, on the basis that this sector will be among the first to signal coming economic weakness.

As I’ve pointed out before, there is empirical support for this theory. According to research conducted by the Bureau of Transportation Statistics of the U.S. Department of Transportation, declines in the sector have, at least over the last three decades, led economic slowdowns by an average of four to five months.

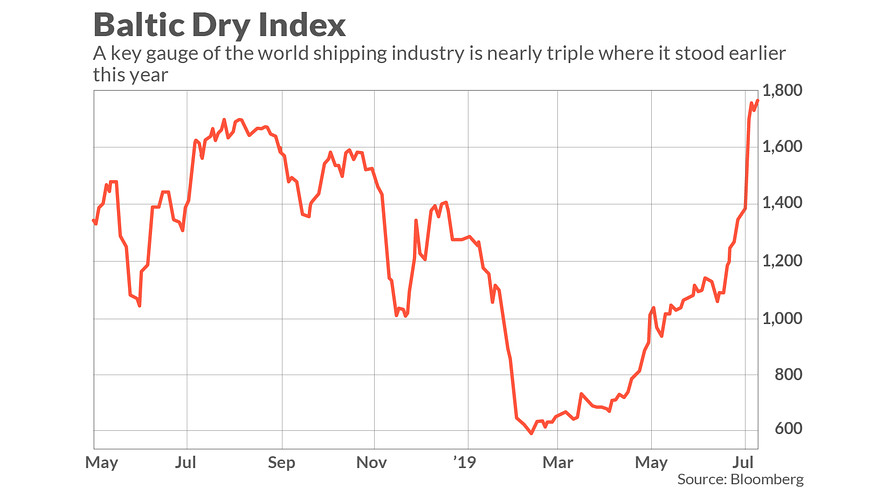

This is certainly enough reason to sit up and take notice. This backdrop provides context for the extraordinary rally of the Baltic Dry Index, which reflects the cost of moving raw materials by ship. Many analysts pay close attention to this index, and it has many notable successes in presaging economic downturns, as detailed in a 2016 New Yorker article entitled “The Surprising Relevance of the Baltic Dry Index.”

I wrote about the Dow Transports and the Baltic Dry Index in late April, when both benchmarks were well-below their previous highs. Today, in contrast, the picture painted by the latter benchmark couldn’t be more different. In fact, the Baltic Dry Index has practically tripled since its low earlier this year, and is now higher than where it stood in the summer of 2018. (See accompanying chart.)

Which economic benchmark is painting a truer picture? There’s no way of knowing for sure, of course. But note that the Baltic Exchange in March altered how it calculated the Baltic Dry Index, and its alterations are controversial. The Exchange argues that the changes are necessary to better reflect the relative weights that various segments have in the global shipping market, but Bimco, the world’s largest international shipping association, believes that, because of the changes, the Index is no longer an accurate reflection of that market.

Without taking sides in this methodological debate, however, what’s important to note for this column is that the Baltic Dry Index’s explosive rally since March can’t be explained away by the changes in the way it is constructed. For example, the segment of the shipping industry that has performed the best since March enjoys a 40% weighting in the Index’s new construction method, versus a 25% weighting before. It’s fair to say that the Index would have risen markedly even if there had been no change in the Index’s methodology.

To be sure, even if you believe that the Baltic Dry Index is painting the more accurate picture, it’s clear that the transportation sector needs to catch up with the broad market, and soon. It’s hard to imagine a healthy economy without the transportation sector’s participation, after all.

The sector’s performance on Thursday of this week is a small, but helpful, sign in this regard: The Dow Transports were up 0.96% for the day, versus 0.23% for the S&P 500. Still, the Dow Transports have a deep hole out of which to dig. Pay close attention.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

Read: The S&P 500 just hit a record high — so did these stocks

More: Strategist warns of a ‘huge recipe for a really sharp correction’ within 18 months