Look for gold to rally over the next couple of weeks in anticipation of the showdown in Congress over the U.S. federal debt ceiling. Similarly, don’t be surprised if stocks and Treasury yields fall.

These are the conclusions I draw from an analysis of these asset classes’ returns over the weeks prior to the five prior occasions over the past decade in which congressional wrangling over the debt ceiling brought the federal government to the brink of financial default, according to the Bipartisan Policy Center. Those five instances came in August 2011, October 2013, September 2017, February 2018 and August 2019.

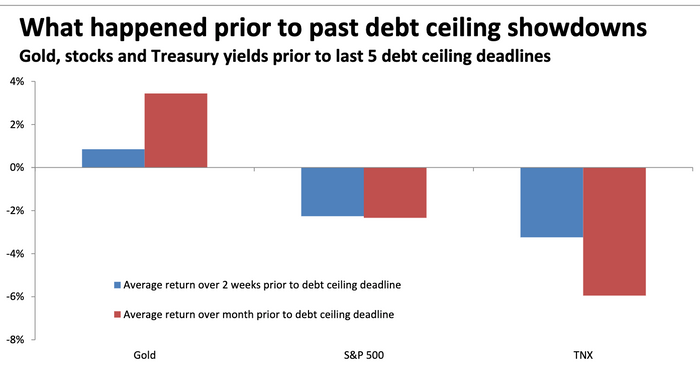

The chart below shows how U.S. stocks, gold GC00, +0.28% and the 10-year Treasury yield TMUBMUSD10Y, 1.343% performed on average prior to those five occasions. The S&P 500 SPX, -0.16% fell an average of 2.3% over the month prior while the 10-year Treasury yield fell 6.0%. Gold rose an average of 3.4%.

It’s unclear when the comparable one-month period would begin in the current instance. The U.S. Treasury has said that it would run out of the ability to pay its bills sometime in October. However, Democratic leaders are reportedly considering attaching an increase in the debt ceiling to a spending bill that must pass before the end of September if the government is to stay open.

Read: McConnell digging in on debt limit, risking turmoil for Biden

If we focus on that end-of-month deadline, then there’s just half a month remaining. For that reason the accompanying chart also shows average performance over the two weeks prior to past deadlines. Notice that the bulk of the average move over the months prior to those deadlines occurs in this two-week period.

It makes sense that gold would rally and the stock market would fall as Congress takes the government up to the brink of shutdown and default. The former tends to rally in the face of uncertainty, while the latter tends to fall.

It is less clear why Treasury yields would fall in the face of this brinksmanship. One theory among some of the advisers I monitor is that, in the days leading up to the debt ceiling deadline, the Treasury Department as much as possible will postpone new debt auctions. To the extent this is so, we would anticipate Treasury yields to jump after the debt ceiling is eventually raised and the government’s debt-financing operations return to normal.

Stock investors haven’t noticed — yet

When making projections based on historical averages, we should always ask why we know something that the market hasn’t already taken into account. After all, the historical precedents to which I refer are hardly secret.

My hunch in this case is that the looming deadline over the debt ceiling and possible government shutdown have not yet have made it onto most investors’ radar screens. According to Google Trends, recent interest in the search terms “debt ceiling” and “government shutdown” has been insignificantly higher than the past 12 months’ average.

Many investors may therefore be taken by surprise in coming days as they begin to focus on the brinksmanship that Congress is playing with the government’s finances. If so, stocks, gold and bonds are likely to respond accordingly.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: Why some lucky investors are likely to be as good as gold in September

Plus: Not even U.S. Treasury investors can escape the ‘gravitational pull of zero’