Do you ever get excited by policy proposals to address the Social Security funding shortfall?

You might think that anyone who does needs to get a life. In fact, however, many retirees and soon-to-retirees snap to attention when legislation is introduced to address the Social Security system’s actuarial deficit. The system is currently slated to run out of money in 2034.

But should we nevertheless get excited about the Social Security 2100 Act in particular, which was recently introduced to great fanfare in both the Senate and the House of Representatives? In this column I address this very question to Andy Landis, author of “Social Security: The Inside Story” and a former Social Security Administration representative who has several decades of experience explaining the intricacies of Social Security to retirees and soon-to-be-retirees.

Not to bury my lead too much: Landis is excited by this new legislation. He concedes, however, that he was surprised by his reaction; usually he finds new legislative proposals a “yawn.”

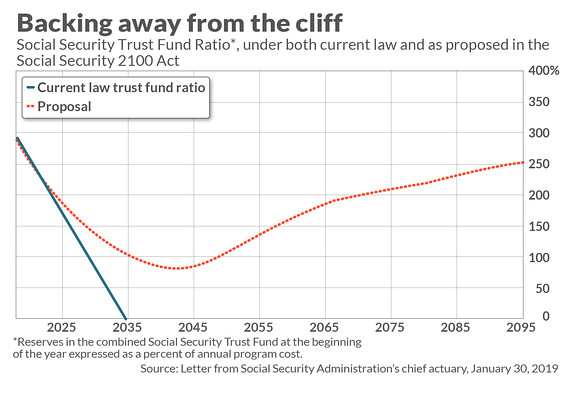

I don’t want to spend much space in this column reviewing the various provisions of this new legislation. You can read the full analysis of it by the Social Security Administration’s chief actuary here. The actuary’s main finding is that the new legislation would assure that the Social Security trust fund would be solvent for at least the remainder of this century.

The act does this without cutting benefits. In fact, it increases them: An across-the-board benefit increase of about 2%, a better cost-of-living adjustment, and an increase in the minimum benefit. To pay for those increased benefits and to address the actuarial deficit, the act would increase the Social Security payroll tax from its current 6.2% to 7.4% in increments over the next 24 years, for both employee and employer, and begin levying the Social Security payroll tax on earnings above $400,000. (Currently that tax isn’t levied on income above $132,900, which means that, if this act became law, income between $132,900 and $400,000 would be untaxed.)

‘But what about me?’

Needless to say, this new Social Security Act is controversial. It does increase taxes, after all. But my job in this column is not to take a position on the act but to assess its impact on our retirement finances, should it become law.

How likely is that? It’s anyone’s guess, of course, and given the political paralysis in Washington it would seem unlikely that it or anything else of substance will ever get passed. But the bill has strong support in the House (over 200 supporters, in fact), and the New York Times has reported that “A strong vote for the bill in the House, combined with political pressure in a presidential election year, could create momentum for the bill in the Senate in 2020.”

Perhaps the biggest impact on us personally, if the act were to become law, is to greatly reduce the worry that our Social Security benefits will have to be cut in future years. Under current funding arrangements, of course, the Social Security Administration will only be able to pay 79% of scheduled benefits in the year 2034.

On the benefit side of the ledger, the enactment of this new legislation would immediately increase your Social Security benefits by 2%. And if your benefits would otherwise be below the new higher minimum, you’d see an even bigger increase. Furthermore, you would benefit from a more liberal cost of living adjustment in future years.

On the cost side, the act would increase the Social Security tax rate by 1.2 percentage points, for both you as well as your employer. Landis downplays the significance of that increase, since it will take place over 24 years, meaning that the increase in any given year (for both you and your employer) will be 0.05 of a percentage point. He says that his “grocery and gasoline bills change more than that every month.”

You will have an even bigger tax increase if you have income of more than $400,000. To illustrate the increase in your effective tax rate in that event, assume that you have $500,000 of income. Under current law you would pay 6.2% of the first $132,900, or $8,239.80, for an effective tax rate of 1.6% on your entire income. If this proposal became law, your tax would go to $14,439.80—for an effective tax rate of 2.9%.

Regardless of what you think of the Social Security 2100 Act, and regardless of its prospects legislatively, I think we can all agree that—absent changes to current law—either future benefits will have to be cut or taxes increased. And I think we can also agree that, the longer we wait, the harder it will be to make necessary changes.

In coming years, therefore, we should expect an increasingly urgent focus on reforming Social Security. And, until it is, we should also expect an increasing level of uncertainty about our future personal Social Security benefits.

I think that also means we will all, sooner or later, learn to become excited about new legislative proposals for reforming Social Security!

For more information, including descriptions of the Hulbert Sentiment Indices, go to The Hulbert Financial Digest or email [email protected].