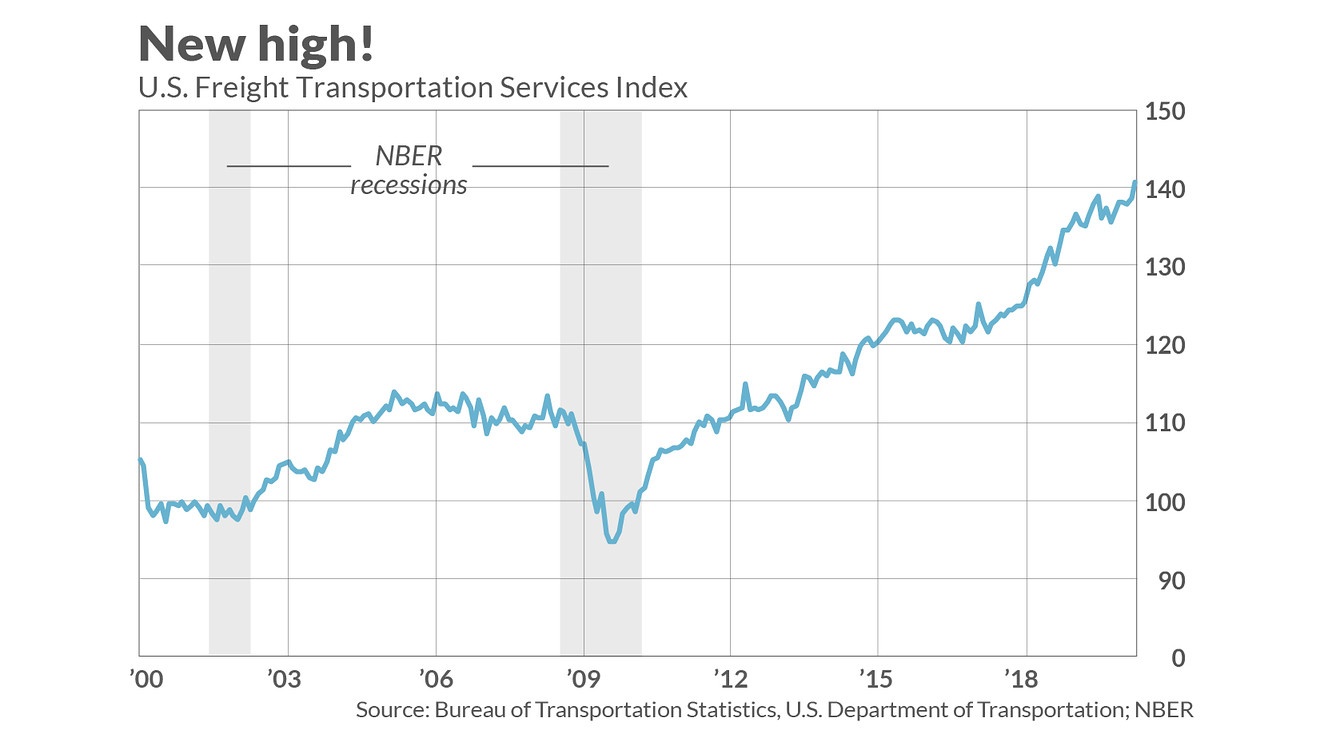

CHAPEL HILL, N.C. (MarketWatch) — By at least one measure, the transportation sector just rose to a new all-time high — suggesting the economy is not as weak as otherwise thought.

I’m referring to the Freight Transportation Services Index, which is compiled by the Bureau of Transportation Statistics at the U.S. Department of Transportation. The Bureau last week reported that this Index rose 1.4% over the previous month and is now at an all-time high, as the chart above shows.

This is noteworthy because other gauges of the transportation sector have been painting a far less optimistic picture. Even as the Dow Jones Industrial Average DJIA, -0.11% has risen this year to several all-time highs, the Dow Jones Transportation Average DJT, -0.35% has seriously lagged. Currently, for example, it’s 11% below its all-time high (from the fall of 2018) and is more than 7% below its 2019 high (from April).

This lagging performance has been of special concern to Dow Theorists, since to them a healthy bull market is one in which both Dow averages are jointly reaching new highs. When one average doesn’t, a situation referred to as a “non-confirmation,” many Dow Theorists conclude that a major bear market could be imminent.

But it’s not just the Dow Theorists who have been worried. Many economists regard the transportation sector as a leading indicator of the economy as a whole, on the theory that the sector would be one of the first to show signs of weakness if a recession were imminent.

None of this weakness is apparent in the latest reading of the Freight Transportation Services index, however. The index measures “the amount of freight carried by the for-hire transportation industry” and reflects “trucking, rail, inland waterways, pipelines and air freight,” to quote the Bureau of Transportation Statistics.

Bureau researchers have analyzed the Freight Transportation Services index back to 1979 and found that it “shows a strong leading relationship to the economy.” They report that “when the accelerations and decelerations of the freight TSI (the turning points in the detrended series) are compared to the growth cycles of the economy, the freight measure leads by an average of approximately four months.”

Assuming the future is like the past, therefore, and assuming that the freight index’s lead time is equal to the historical average, then the index’s new high means that a deceleration of economic growth is at least four months away—and very well may be further into the future than that.

To be sure, the Freight Transportation Services index is just one indicator. And there are plenty of others that are painting a less rosy picture. But it is welcome news indeed for a lagging sector to register a new all-time high.

If you want to bet the sector’s relative strength in coming months, perhaps the easiest way is with an exchange-traded fund that is benchmarked to the industry. Two of the largest are the SPDR S&P Transportation ETF XTN, -0.09% and the iShares Transportation Average ETF IYT, -0.32%.

Among individual stocks within the transportation industry, FedEx FDX, +0.85% currently is recommended the most by the top-performing newsletters I monitor. In fact, it is tied for first place in a ranking of all stocks (regardless of industry) based on the number of recommendations from those newsletters. Another transportation stock on that list, though ranked lower than FedEx, is Norfolk Southern NSC, +0.02%.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].