The U.S. stock market is likely to rise to all-time highs soon and potentially extend gains even further.

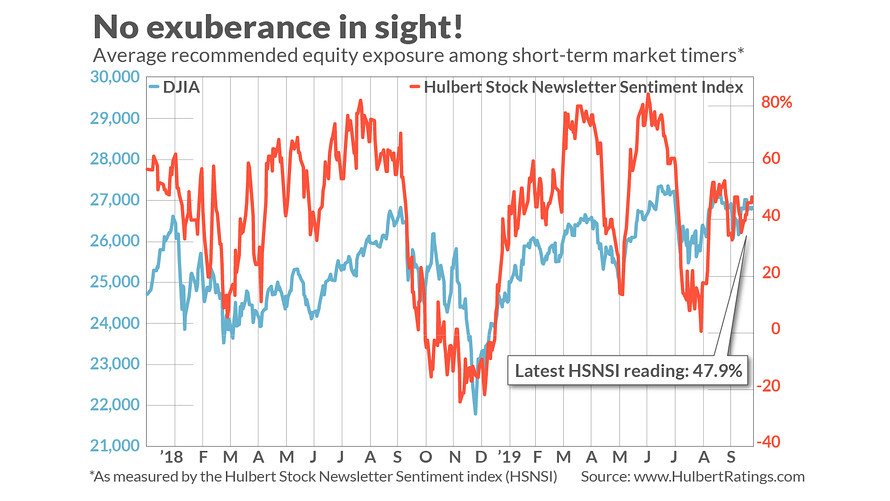

That’s because there is no sign of the extreme optimism and exuberance that is the hallmark of stock market tops. On the contrary, the mood among the stock market timers that I monitor is subdued.

This is surprising since the normal pattern is for bullishness to rise and fall more or less in lockstep with the market. And with benchmark indexes within shouting distance of all-time highs — the Dow Jones Industrial Average DJIA, -0.11%, the S&P 500 Index SPX, +0.19% and the Nasdaq Composite COMP, +0.81% are less than 2% away — you’d expect bullishness to be close to a new high.

However, it’s anything but — and that’s bullish from a contrarian perspective. It means there remains a healthy enough “wall of worry” to propel the major market averages well into record territory.

Read: These stocks have the highest dividend yields in the hot real-estate sector

Consider the average recommended equity exposure among a subset of short-term stock market timers tracked by the Hulbert Financial Digest (as measured by the Hulbert Stock Newsletter Sentiment Index, or HSNSI). The average currently stands at 47.9%, well off its all-time high of 84.2%. In fact, nearly a quarter of all trading days (24%, to be exact) since 2000 have seen the HSNSI to be higher than it is today.

Even more remarkable is the picture of apathy expressed by timers who focus on the Nasdaq, as measured by the Hulbert Nasdaq Newsletter Sentiment Index, or HNNSI. Among those timers, the average recommended equity exposure currently stands at just 39.2%, which is lower than 42% of daily readings since 2000.

Plenty of risks remain

Note that, in interpreting this data to be bullish, contrarian analysts aren’t denying that there are plenty of things to worry about. There are right now, everything from the increasing odds of a recession, an escalating trade war and the possibility of a messy impeachment trial on Capitol Hill.

But contrarians’ point is that there are always lots of things to worry about. What changes aren’t the number and magnitude of those worries but how investors react to them. And right now, they aren’t reacting as positively as we would otherwise expect them to do.

The usual qualifications apply. No market-timing system works all the time. And even when contrarian analysis does get it right, its insights apply only to the very short-term — just the next several weeks, according to econometric tests to which I have submitted the HSNSI and the HNNSI.

That means the stock market, for example, could very well be headed for a bear market. All the contrarians are saying is that, if so, the path the market takes on the way toward that decline would first take the major market averages higher.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].

Add Comment