CHAPEL HILL, N.C. — To find a prince you sometimes have to kiss a frog.

That’s what we learned from fairy tales when we were children, and it may still be true on Wall Street. Consider Fortune magazine’s annual ranking of the most admired companies in America, the latest version of which was released in January. Historically, companies at the bottom of that ranking — the ones that are most despised — have outperformed those of the most admired.

To be sure, last year’s most-admired company — Apple AAPL, -0.14% — provides a glaring counterexample to this historical pattern: Its stock has more than doubled since last year’s ranking was released.

But Apple may be an exception that proves the rule. The stocks of the other nine companies at the top of last year’s most admired ranking have gained an average of 22.9% since then, according to FactSet, lagging behind the S&P 500’s SPX, +0.31% 26.3%. (These returns were calculated assuming the reinvestment of dividends.) In contrast, the 10 companies at the bottom of the Fortune ranking produced an average gain that was 3.4 percentage points better than the admired companies, thereby equaling the return of the S&P 500.

This result doesn’t appear to be a fluke.

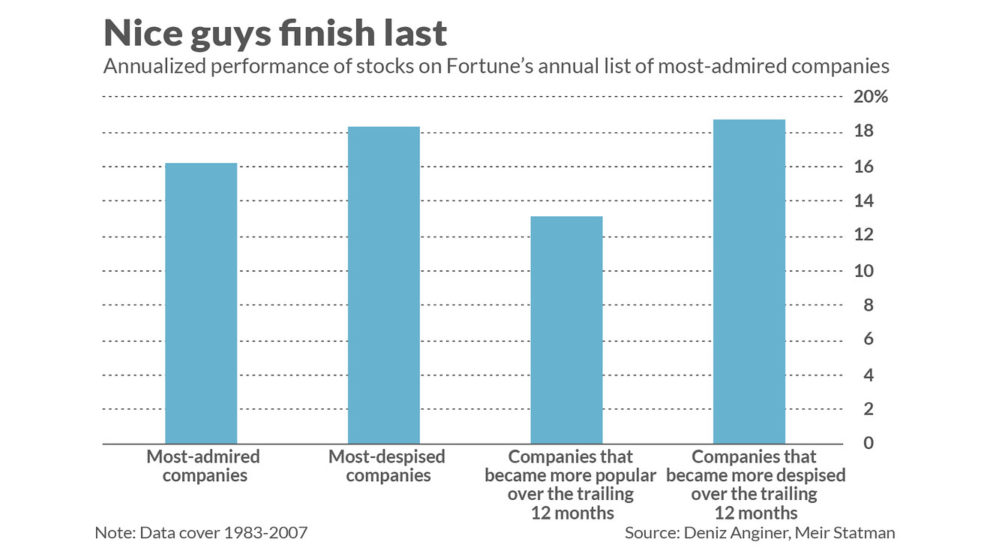

Consider an academic study published a number of years ago by Deniz Anginer, an Assistant Professor in Finance at the Simon Fraser University, and Meir Statman, a finance professor at Santa Clara University. The professors constructed two hypothetical portfolios: The first contained the most admired companies in each year’s Fortune ranking over a nearly 25-year period through 2007, while the second contained the companies that were most despised.

They found that the despised company portfolio outperformed the portfolio of admired company stocks by nearly two annualized percentage points per year. Perhaps even more revealingly, the researchers found that increases in admiration were, on average, followed by lower returns, as the chart above shows.

There are a number of contrarian lessons to learn from this study’s findings. One of the most important is that we should be choosing companies based on their fundamentals rather than their reputations. You pay a steep price for buying the stocks of popular companies, making it that much more difficult for them to produce a handsome return going forward.

That’s why contrarians prefer to buy stocks that are out of favor. You can find some real bargains that way.

To be sure, not every despised stock will be a winner, just as not every admired stock will lag the market. So be persnickety, starting your search for some diamonds in the rough by carefully picking and choosing among the list of most despised companies.

Unfortunately, we can’t know which companies are most despised on this year’s Fortune list, since they are only listing the 50 firms at the top of their most-admired ranking. But you can turn to another ranking: The Axios Harris Poll 100, which ranks the reputations of the 100 most visible U.S. companies. Among the 10 stocks at the bottom of their most recent poll, here are four that are currently recommended for purchase by at least two of the top-performing newsletters that I monitor:

• Bank of America BAC, +1.42%

• Comcast CMCSA, +1.89%

• Facebook FB, -6.14%

• Goldman Sachs GS, +1.67%

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected].