Do investors in Meta Platforms stock know something that the rest of Wall Street doesn’t? Since the company changed its name from Facebook FB, +1.69% in late October, the stock is up 8%. Yet there’s been no corresponding increase in the consensus estimate of the company’s future earnings.

On the contrary, the recent trend among Wall Street analysts has been to revise estimates downward. Over the last month, far more of the four dozen analysts monitored by FactSet have downgraded their earnings estimates for Meta Platforms than increased it.

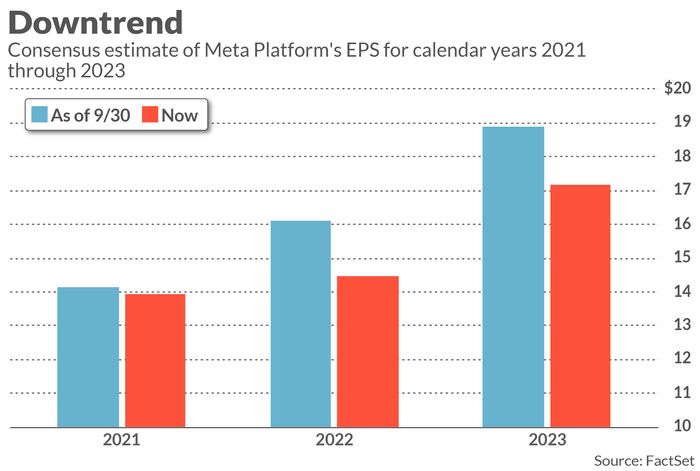

At the end of September, as I pointed out a couple of weeks ago, the consensus analyst EPS estimate for calendar 2022 was $16.12. Now it is $14.45. There has been a similar reduction in the consensus estimate for the 2023 calendar year. (See the chart below.)

What has caused the stock’s rally in the face of declining earnings estimates? The most obvious culprit is the company’s name change, since — as I reported before the company changed its name — the market typically reacts favorably to name changes that eliminate unfavorable references. But could Facebook’s name change really have led to this big of a rally in the face of declining earnings estimates?

For insight, I reached out to Michael Cooper, a finance professor at the University of Utah and chair of its finance department. In an interview, he said he was not particularly surprised. In fact, he added, it would be consistent with the results of his past research if Meta Platforms’ stock continues to beat the market for several more weeks. He and other researchers have found that the honeymoon glow of a name change can last for as long as a couple of months.

Neither Cooper nor other researchers I am aware of have studied the long-term effect of name changes. But it’s difficult to see how it will lead to a permanent increase in the stock price. Eventually earnings have to catch up.

For the moment, though, Meta Platforms has shrewdly changed the narrative away from the awful publicity about Facebook’s effect on our society, and towards the huge potential of the so-called metaverse. Few can even agree on a precise definition of the metaverse, and yet many are already asserting breathlessly that it could be just as big and profitable as the internet. Stocks remotely associated with the metaverse are soaring.

This all seems scarily reminiscent of the irrational exuberance at the top of the internet bubble. Unless the downtrend in Wall Street consensus estimates reverses in coming weeks, you might want to use this exuberance as a reason to lighten exposure to Meta Platforms stock.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at [email protected]

More: Wall Street will tell you that stocks shine in November but here’s the unvarnished truth

Also read: Meme stocks are moving on real news, both good and very, very bad