Meta (META) stock hit a new 52-week high on Thursday as investors celebrated the company’s return to revenue growth. One of the key drivers: artificial intelligence.

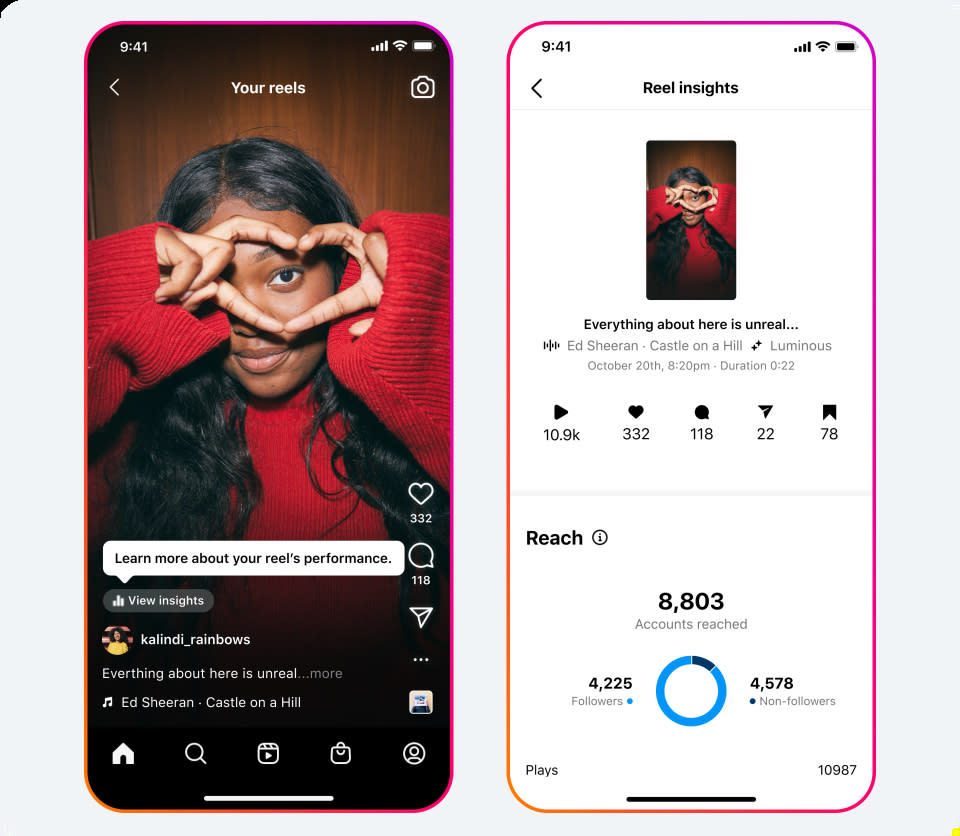

Further integration of A.I. helped drive Meta’s first revenue increase in three quarters, the company said on Wednesday. Reels monetization is up over 30% on Instagram and over 40% on Facebook on a quarterly basis as A.I. plays a larger role in the platforms.

Time spent on Instagram went up by 24% since Meta launched A.I.-powered Instagram reels.

“(Generative A.I.) is going to also help create more engaging experiences, which should create more engagement,” Meta Founder and CEO Mark Zuckerberg said on the company’s earnings call Wednesday evening. “And that by itself creates more opportunities for advertisers.”

In the first quarter, Meta delivered advertising revenue of $28.1 billion, above Wall Street estimates of $26.76. The company’s $2.20 earnings per share also topped analyst expectations of $2.01. Meta projects second quarter revenue in a range of $29.5 billion to $32 billion, above estimates of $29.48 billion.

The stock of the company, formerly known as Facebook, rose as much as 14% in intraday trading on Thursday.

A.I. is having its moment on tech earnings calls for the second consecutive quarter, following the widely popular launch of OpenAI’s ChatGPT in late November. But not every company has the same plans for the new technology.

Nvidia (NVDA) is selling A.I. powered supercomputers. Microsoft (MSFT) is integrating ChatGPT into its search engine to compete with Google (GOOGL), which has its own A.I. searchbot.

Meta’s approach is slightly different. The core business for Meta since the early days of Facebook has been advertising sales, which still account for 98% of the company’s quarterly revenue. So naturally, enhancing advertisements with A.I. is where Meta believes the new technology can be most impactful.

“We’re just playing a different game on the infrastructure than companies like Google or Microsoft or Amazon, and that creates different incentives for us,” Zuckerberg said when explaining why Meta is open-sourcing its A.I.

Meta’s push into A.I. comes as the company is still bleeding from its steep Metaverse investments. Meta’s Reality Labs reported an operating loss of $4 billion in the first quarter, compared to an operating loss of $3 billion in the same period last year.

Those losses had weighed heavily on Meta’s stock in the past, but amid Meta’s “year of efficiency,” cost-cutting efforts and A.I. benefits have Wall Street turning more bullish. In a note to clients on Wednesday, Deutsche Bank research analyst Benjamin Black highlighted AI-driven ad performance as a catalyst for accelerating revenue growth through the rest of 2023.

“The improvement in Meta’s (A.I. and machine learning) capabilities are not only improving Reels’ content ranking and recommendation algorithm, which in turn drives user engagement, but [it] also increases the efficiency of ad delivery, which increases monetization of the service,” Black wrote.

Zuckerberg noted on the earnings call he feels Meta is “no longer behind” in building out an A.I. infrastructure. Now, the focus shifts to finding new ways to integrate and optimize the technology.

“This is literally going to touch every single one of our products and services in multiple ways,” Zuckerbeg said. “This is just a very big wave and new set of technologies that’s available, and we’re working on it across the whole company.

Josh is a reporter for Yahoo Finance.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance