A previously beaten-down U.S. dollar is bouncing with a vengeance this week, appearing to kill demand for gold and weighing on other commodities. Investors are wondering how much further the currency can rise.

The ICE U.S. Dollar Index DXY, +0.26%, a measure of the currency against a basket of six major rivals, is up 1.2% so far this week and more than 2% month-to-date, trimming its 2020 decline to around 2.4%, according to FactSet.

The dollar has rallied as stocks have suffered a steep September pullback, perhaps showing the U.S. currency is still a haven during periods of rising financial market volatility, perhaps soothing concerns it was losing some of its shine amid questions over potential political instability and institutional decay ahead of this November’s presidential election.

But analysts said there was more to the rise than just haven demand, as shown by its continued gains Tuesday as U.S. equities bounced. Stocks were struggling to continue that bounce Wednesday, with the Dow Jones Industrial Average DJIA, -0.15% flipping between small gains and losses, while the S&P 500 SPX, -0.52% was off 0.2%.

The previously surging euro EURUSD, -0.27%, which earlier this month had tested the $1.20 level for the first time in over two years, subsequently turned south and is down more than 2% for the month near $1.1683 in recent action. Renewed lockdown measures in reaction to rising COVID-19 cases in several European countries have undercut ideas that Europe was handling the pandemic better than the U.S., said Kit Juckes, global macro strategist at Société Générale, in a note

The prospect of additional easing by other central banks, with the Bank of England and New Zealand’s central bank weighing negative rates and the Reserve Bank of Australia expected to cut its key lending rate to 0.1% by the end of the year, have also been positive for the dollar, he said. But that doesn’t mean the dollar’s downtrend has come to an end.

“None of this…seriously challenges the notion that the dollar’s made a cyclical turn, and brought the 2011-2020 rally to a close,” Juckes said in a Wednesday note.

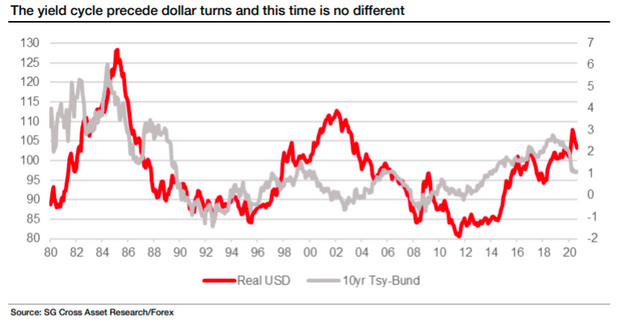

He pointed to the chart below, which shows the Fed’s measure of the real trade-weighted dollar, plotted against the 10-year yield difference between the U.S. and Germany. The difference in bond yields between countries are seen as a major driver of currency movements.

“Yields have led the dollar turns in the past and this time is no different. The (huge) exception to this pattern is the way the dollar surged during the Asian crisis and that was the curveball which led to fear that a scramble for dollar liquidity would delay a dollar turn during the pandemic,” he wrote. “But the Fed’s policy aggression in March has significantly reduced that risk, even if we will doubtless hear echoes of it in the coming days. ”

A big buildup in speculative short positions against the dollar also provided fuel for a rebound, argued Viraj Patel, global macro strategist at Ankera. Meanwhile, moves toward more stimulus by other central banks could give the dollar more room to rise, he said.

The dollar got an added boost on Tuesday, analysts said, following remarks by Chicago Federal Reserve Bank President Charles Evans, who said the central bank might not wait until core inflation averages 2% year-over-year before it begins raising rates — a remark analysts saw at odds with other Fed speakers following last week’s policy meeting.

“This seems to fly somewhat in the face of the concerted guidance out of most of the rest of the committee that monetary policy will remain very accommodative through a period of inflation running ‘hot,’” wrote rates strategist at BMO Capital Markets in a Wednesday note.

Gold bulls would likely welcome the end of the dollar bounce.

“Gold bugs may be getting nervous that they are about to be squashed by a rising dollar, as the precious metal’s price is now trading back below $1,900 an ounce,” said Russ Mould, investment director at U.K.-based brokerage AJ Bell, in a note.

December gold GCZ20, -1.96% was down $35.10, or 1.8%, at $1,872.10 an ounce on Comex, contributing to a loss so far this week of more than 4%. A stronger dollar is seen as a negative for commodities priced in the currency, making them more expensive to users of other currencies.