Individual investors are back in love with the stock market, but a newfound passion for options are making some market veterans nervous.

“What we have seen is a focus on short-term, out-of-the-money call options because they have these lottery-like payoffs,” said Garrett DeSimone, head of quantitative research at OptionMetrics, an options database and analytics provider for institutional investors and academic researchers.

Those bets have been paying off in dramatic fashion, in some cases. But it also stirs memories of the 1990s dot-com boom, when a surge in day trading contributed to the inflation of an epic market bubble.

A call option is a financial instrument that gives the holder the right, but not the obligation, to buy the underlying security at a set price, known as the strike price, by a certain date. By buying far “out of the money” calls, which have a strike price well above the stock’s present level, investors are betting that a surge in the stock price will net them a healthy profit.

That activity has been amplified, in some cases, as options investors gather on Reddit’s Wall Street Bets forum and elsewhere to brag about wins, commiserate about losses and, in particular, urge each other to pile into a particular stock and to hold the fort when suffering setbacks.

Squeeze plays

It’s that kind of concerted action that’s been cited as a primary driver of a 300% rally by shares of videogame-retailer GameStop Corp. GME, +18.12% since the end of last month. The GameStop rally underlined a phenomenon in which small investors have aggressively bought calls of companies that have been heavily shorted by hedge funds and other large investors, forcing them to exit and accelerating a rise in the price as they scramble to exit their bets that share prices would fall.

GameStop ended at another all-time high on Monday, while the S&P 500 SPX, +0.36% and Nasdaq Composite COMP, +0.69% both closed at records as the Dow Jones Industrial Average DJIA, -0.12% lost ground for a third straight session.

Read: Reddit moderator slams Wall Street ‘fat cats’ as GameStop’s wild ride continues

That’s a new wrinkle compared to the dot-com era or even the recent past.

The ability of individual investors to muscle heavily shorted shares represents “a new facet of the market that didn’t exist five years ago and needs to be respected,” Mike Zigmont, head of trading and research at Harvest Volatility Management, in an interview.

Dumb money?

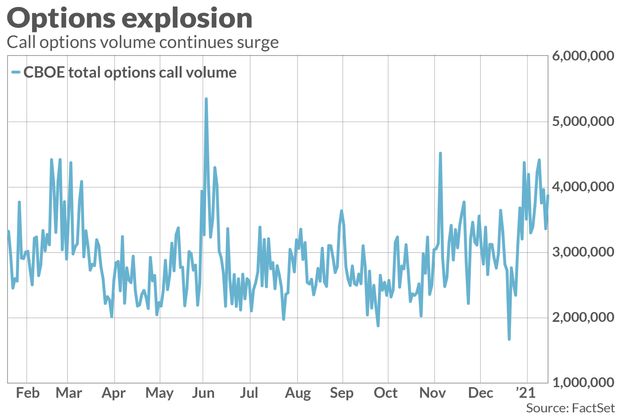

Call volumes have been surging since last year, and have outpaced volumes for put options, which gives the holder the right, but not the obligation, to sell the underlying security at a set price, since May, noted analysts at Deutsche Bank, in a Monday note.

Average daily call volumes over the past three months have hit a new peak, with the bulk of the increase driven by “very small” contract sizes, the analysts noted, which reflect retail buying.

And don’t call it “dumb money.”

The Deutsche Bank analysts said that call volume is “largely responsible for elevated equity multiples” because institutional investors of all stripes have been “chasing since March.”

Sharp gains in thinly traded stocks aren’t due solely to short covering, either.

Feedback loops

Market makers that sell the call options to individual investors are left short the market. To bring their positions back to neutral, they buy the underlying stocks. Broadly speaking, if the stock continues to rise, the market makers must buy more to maintain their hedge.

An overall surge in online trading has been attributed to a number of factors, including cooped-up investors looking for ways to spend their stimulus checks last spring.

Of course, not all retail options investors are looking to force a short covering rally.

“What is often lost in the narrative is that retail investors have to manage capital really well,” said J.J. Kinahan, chief market strategist at brokerageTD Ameritrade.

For many options-trading clients, the instruments are a substitute for expensive tech stocks, he said. Buying a call allows the trader to clearly define risk since they’re only out the premium they pay for the option if the stock fails to rally.

Also, while the pickup in call buying has attracted attention, the “primary strategy” used by most retail options traders centers on covered calls, Kinahan said — a strategy in which an investor sells call options, garnering an income stream from the premiums, while holding the underlying security in an equivalent amount.

Fundamental disconnect

While the Reddit phenomenon has raised legal questions around coordinated activity, the bigger concern among some market veterans is the disconnect between price action and market fundamentals.

The surge in call volume comes alongside other signs of froth, including low levels of overall short interest and high margin levels, said Tom Martin, senior portfolio manager with Globalt Investments, in an interview.

And when prices are being moved more by blind trading flows than new information, fundamentally focused investors face heightened challenges, Martin said.

Indeed, while the ability of individual investors to effectively “hunt” short sellers is a wrinkle that wasn’t enjoyed by dot-com-era day traders, it’s another reason for investors to worry that the broad equity-market rally is entering a dangerous phase, Zigmont said.

Instead, trading in certain stocks has become more about muscle, pitting individual investors against hedge funds and institutional players.

“It strikes me as dangerous, because at some point [individual investors] are not going to win the battle,” he said. It isn’t difficult to imagine a scenario in which individual investors fail to force a short seller to capitulate, eventually running out of buyers and leading to an implosion that could have ripple effects.

“Call buying on its own is unbelievable, but it’s also dwarfing put buying at the moment too,” wrote technical analyst Andrew Adams of Saut Strategy, in a note last week.

“It hasn’t mattered yet, but I am very afraid of what could happen if it ever does start to matter. Leverage and falling prices is never a good combination.”