iStockphoto

iStockphoto

With U.S. stocks on pace for their first loss in May since 2012, the next few months are shaping up to be a rocky time for the market. But as the U.S. marks the unofficial beginning of the summer this week, there are still plenty of stocks that promise to sizzle in an otherwise bleak landscape dominated by trade-war turmoil.

One of the stocks that tend to hold out well between the summer doldrums bookended by Memorial Day and Labor Day is Dow DJIA, -0.93% component Apple Inc. AAPL, -0.41% among the most widely held names with hedge funds.

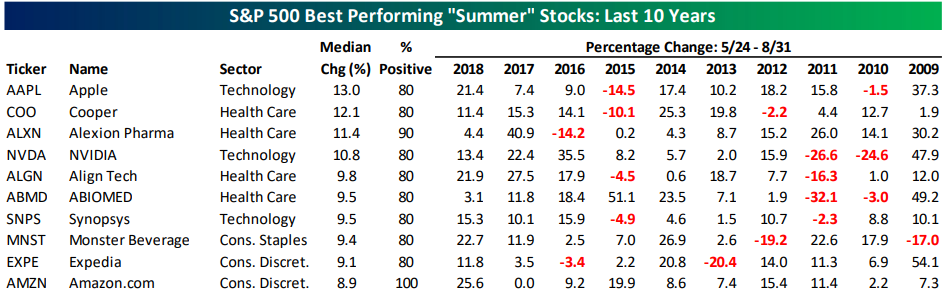

“Apple ranks first with a median gain of 13% over the last 10 years with gains 80% of the time. Apple has gained at least 7% in each of the last three summers, and the stock’s only decline of any significance came in 2015 when it dropped 14.5%,” said analysts at Bespoke Investment Group in a report.

As the table below shows, Cooper Cos. COO, -1.59% ranked second with a median gain of 12.1%, followed by Alexion Pharmaceuticals Inc. ALXN, -1.69% and Nvidia Corp. NVDA, -1.25% Amazon.com Inc. AMZN, +0.72% came in at no 10 with a median gain of 8.9%.

“For Amazon, its median gain isn’t quite as strong as stocks like Apple or Nvidia, but it hasn’t fallen once from Memorial Day to Labor Day over the last 10 years,” said the analysts.

Still, the summer of 2019 is likely to test the overall stock market’s resilience and investors’ patience all at once.

Mike Wilson, chief equity strategist at Morgan Stanley, warned that corporate earnings and economic risks are much greater than most people expect with recent economic data, including durable goods and capital spending, coming in soft.

“All reflect April data which means it weakened before the re-escalation of trade tensions,” Wilson said in his latest missive to clients. “In addition, numerous leading companies may be starting to throw in the towel on the second-half rebound — something we have been expecting but we believe many investors are not.”

Orders for products meant to last at least three years dropped 2.1% last month while a key measure of business investment slowed to 1.3% in the 12-month period ending April from 3.8%.

Wilson, who tends to strike a cautious tone even during the market’s most ebullient moments, believes that a dramatic detente between the U.S. and China won’t be enough to save stocks.

“Get ready for more potential growth disappointments even with a trade deal,” he warned.

As things stand, a trade deal between the two economic superpowers appears as elusive as ever.

President Donald Trump, on a state visit to Japan, indicated that the U.S. is not ready to make a trade deal with China.

“They (China) would like to make a deal. We’re not ready to make a deal,” Trump said at a press conference with Japan’s Prime Minister Shinzo Abe, according to Bloomberg. He added that tariffs on Chinese products could go up “very, very substantially.”

China has responded to the U.S.’s tough stance with similar belligerence, framing the trade war as an attack on the country and whipping up nationalism as it attempts to unite a more dynamic and an increasingly affluent population behind the government’s agenda.

Even so, there is some good news in the near term for investors. Historical data show that the S&P 500 SPX, -0.84% has posted an average gain of 0.53% during the four-day Memorial Day week since 1971 when Memorial Day was designated a national holiday, according to Bespoke.

During years when the large-cap index is up more than 10% going into Memorial Day week such as this year, the median gain has been 0.63% for this week.