Wall Street professionals have been known to exhibit a haughty attitude toward retail traders. But, as it happens, the “dumb money” — a phrase occasionally attached with more than a dollop of derision to mom-and-pop investors — might be smarter than the pros think.

At least, that’s the conclusion — or, rather, one of many conclusions — arrived at by a team of Bank of America Global Research quantitative and equity strategists led by Savita Subramanian in new annual primer on quantitative research, titled “Everything you wanted to know about quant.”

The opus, which is nearly 300 pages long, is packed full of charts and exposition as the team takes an analytical approach to validating (or rejecting) conventional investing wisdom on a range of topics.

‘Smart’ vs. ‘dumb’ money

One of the first investing “myths” addressed in the report is whether retail interest in a stock serves as a reliable “contrary indicator” — that is, if rising retail-investor interest is a sign that a stock might be headed for a rough patch.

Much to the chagrin of the hedge-fund industry, the B. of A. strategists found that this isn’t exactly true. Instead, they found that retail inflows, on average, have been better indicators of performance than hedge-fund flows — if only slightly.

“In fact, returns following periods of retail inflows have been above average and returns post-retail selling have been below average. And retail flows have been slightly better positive indicators than hedge-fund flows,” the analysts wrote.

The team’s data-driven analysis found that stocks with strong retail inflows tended to outperform their benchmarks over the following four weeks by 1.1 percentage point, compared with 1 percentage point of outperformance for stocks with inflows from hedge funds.

And when markets are falling, stocks with high retail ownership have tended to outperform stocks with low retail ownership.

Value vs. growth

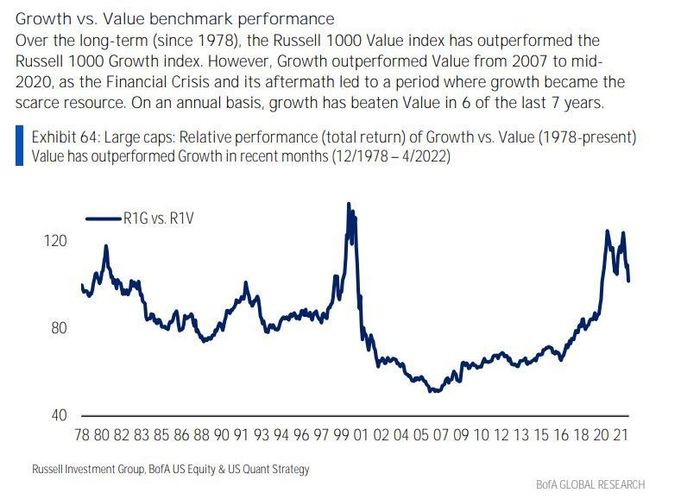

Another theme explored in the B. of A. report is the historical performance of value and growth stocks compared with their benchmarks (which for U.S. equities is the S&P 500 index SPX).

For example, over the long term, Russell 1000 Value index RLV, -1.32% has outperformed the Russell 1000 Growth index . But during “late cycle” periods, the trend reverses, and growth outperforms. The B. of A. team found that while value stocks have outperformed since 1978, growth stocks tended to outperform from 2007 to mid-2020.

On an annual basis, growth has beaten value in six of the last seven years.

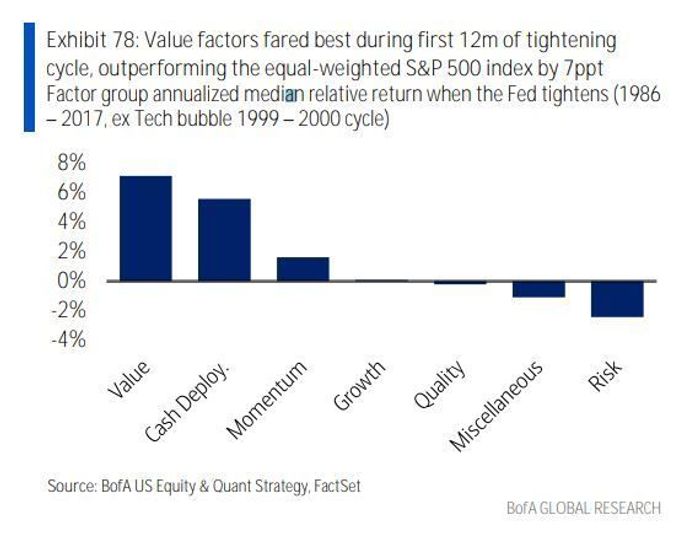

Value stocks also tended to put in their best performance during the first 12 months of a tightening cycle. The Federal Reserve started the process of raising interest rates in March, and most economists expect the central bank to continue raising rates for the rest of the year, and into 2023.

Will corporate buybacks rescue stocks?

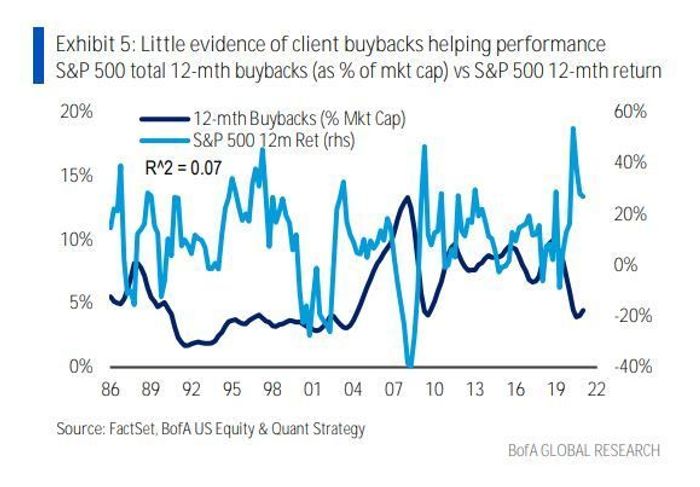

In recent weeks, equity analysts at JPMorgan have advised clients that hundreds of billions of dollars of corporate buybacks should help but a floor under stocks during the second half of the year.

But the team at Bank of America advised clients that, historically, corporate buybacks haven’t had much of an impact on equity performance.

“Some expect this earnings season’s market volatility to be quelled by the resumption of buybacks after company’s blackout periods end. But the relationship between S&P 500 buybacks and index performance since 1986 is a minimal 0.07 R-squared,” the team wrote.

To be sure, historical data do not guarantee future performance. But as the team points out in its note, Wall Street increasingly has been gravitating toward the type of “quantitative” analysis on display in the note, while becoming less dependent on “fundamental” analysis that relies on more of a big-picture approach to investing.

As the team points out, the number of jobs on Wall Street being advertised for data scientists and other quant-type roles outnumbers those for fundamental analysts by a factor of eight. The number of “factor” screens incorporated in Wall Street firms’ models also has been increasing at a rapid rate, rising from an average of fewer than 10 in 1990 to more than 20 as of last year.