Nearly all of the U.S. West has been parched by drought this summer, with dry and dangerous conditions exacerbating California’s wildfires and leading to emergency steps to address extreme water shortages.

Conditions have become so alarming that the U.S. government earlier in August issued a first-time declaration of a water shortage on the Colorado River, triggering fears of water-rights wars as communities from Arizona to Mexico grapple with the dramatic drop of large reservoirs.

While Western droughts have been a recurring stress for decades, intensifying as the planet warms, climate risks are being viewed as an increasingly powerful force for financial markets.

“Climate will be the single-biggest influence on investment performance out of any other factor over the next 25 to 30 years,” said Blaine Townsend, director of sustainable, responsible and impact investing at Bailard, a San Francisco Bay Area wealth- and investment-management firm.

“Any investor who doesn’t think that is the case, is really kidding themselves,” Townsend said in a phone interview.

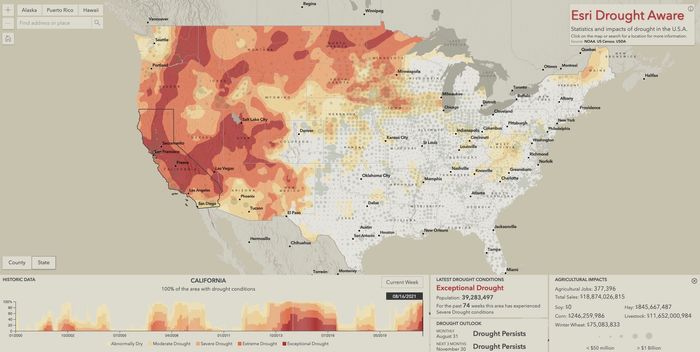

For doubters of the perils of drought, there is a new Drought Aware app from Esri, which compiles layers of public data in one spot to show how conditions have changed in the U.S. over two decades, but also how much agricultural business may be at risk.

Take California, the largest U.S. state by population, which has been under extreme drought conditions for the past 75 weeks, threatening its nearly $20 billion in estimated annual agricultural sales.

Drought currently stretches from U.S. West to Midwest

Esri Drought Aware App, NOAA, U.S. Census, USDA

The Drought Aware app doesn’t make predictions, but it is interactive (and free), providing data on drought conditions going back 20 years, said Dan Pisut, content lead for Esri’s ArcGIS Living Atlas of the World team.

It basically serves as a springboard, Pisut said, adding that USDA agricultural sales figures are based off voluntary figures that are self-reported by farmers, which means they can differ from total sales.

For a deeper dive, the National Integrated Drought Information System recently pegged the annual U.S. cost of drought at over $6 billion each year, a toll it says hurts not only crops C00, -1.47% W00, +0.07% and livestock DJCILV, , but presents a “serious hazard with substantial socioeconomic consequences.”

Living with drought

Drought can spark mass migrations, as it did in the 1930s during the Dust Bowl. More recently, it has threatened the loss of family farms as far east as Minnesota.

“Drought is just one of those perils we are going to have to assess,” said Sean McCarthy, head of municipal credit research at PIMCO, adding that climate risk isn’t something 10 years down the road. “It is here now. I think most people are starting to recognize that as well.”

“I’m not going to say I’m going to downgrade Minneapolis or Minnesota because of drought,” he said, but he does plan to monitor the trend to see if there is further deterioration.

That’s also why McCarthy sees the U.S. West’s long experience with dry and dangerous conditions as a template for elsewhere, particularly if climate change forces more communities to innovate to survive with water shortages.

“California’s water utilities are pretty adept at managing drought,” he said. “I think the point is that other areas across the country are going to have to examine what’s being done in Nevada, New Mexico and California.”

Read: Water market heats up as a parched California scrambles for supplies

Bailard’s Townsend, who grew up in Northern California, experienced firsthand the state’s historic drought of the late 1970s, which inspired a water conservation movement and the start of more eco-friendly forms of finance.

“People have been thinking about drought for a long time, much longer than people realize,” he said, pointed to the first green bonds created in the early 1990s, but also their explosion in popularity in recent years, including by big companies looking for funding to help address climate risks.

Though July, global bond and exchange-traded funds focused on environment, social responsibility and good governance (ESG) grew their assets under management to $329 billion, up 104% from a year before, according to BofA Global.

“It isn’t a political debate for them, they are being strategic,” Townsend said of big companies issuing green bonds. “Climate is just a reality we are dealing with.”