Some of America’s biggest corporations on Tuesday plan to pry open the U.S. investment-grade bond market, a key funding spigot that, like cities, businesses and national borders, has been only selectively open amid the spreading coronavirus outbreak.

Bank of America Corp BAC, +7.53%, Exxon Mobil Corp XOM, +6.71% , PepsiCo Inc. PEP, +12.94% , Progressive Corp. PGR, +5.38% and Verizon Communications VZ, +6.47% are among a rash of companies on Tuesday planning to raise funds by borrowing in the U.S. corporate bond market.

The companies are reaching into the most creditworthy segment of the $9 trillion U.S. corporate bond market for funds at a time when industry giants, include Boeing BA, -4.39% , have tapped credit lines held at Wall Street banks to shore up liquidity as the coronavirus outbreak tests the resilience of markets.

“We expect nine to 10 deals today, with about $25 billion of new issues,” said Tom Murphy, head of investment-grade credit at Columbia Threadneedle Investments, in a note Tuesday, adding that demand is expected to be swift, in part because “it’s extremely difficult” to know where most secondary levels are from hour to hour.

“The tone can change by the minute,” Matt Kennedy, portfolio manager at Angel Oak Capital Advisors, said in a telephone interview with MarketWatch.

“Right now, it’s generally stable to positive,” he said, due to expectations that the U.S. government will soon announce details of extensive fiscal stimulus measures to protect smaller businesses and households impacted by the outbreak.

The U.S. airline industry, one of the hardest-hit amid global travel restrictions to help combat the pandemic’s spread, is likely just one of a string of industries that could get coronavirus aid from the government.

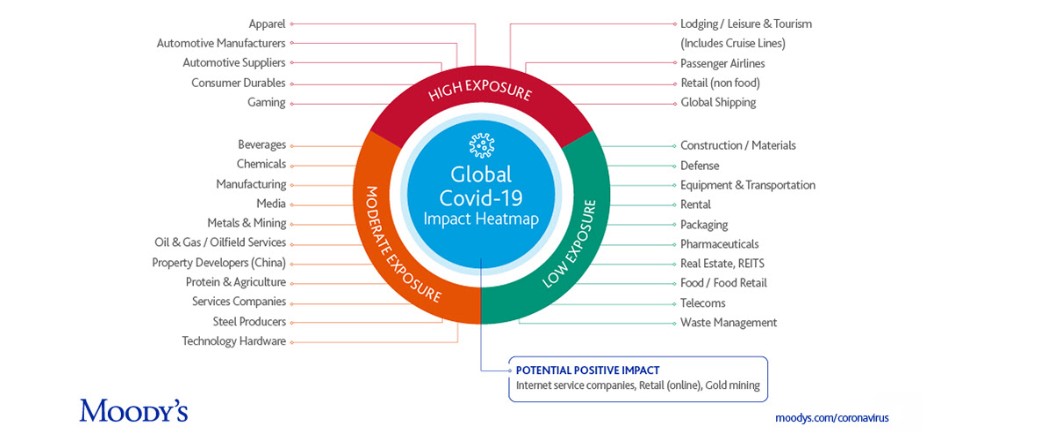

Here’s a heat map that Moody’s Investors Service put together on Tuesday that shows which U.S. industries have the highest exposure to the pandemic:

Moody’s

Moody’s To lock in bond-market funding, Exxon and others in the debt markets on Tuesday are paying more than earlier this year.

For example, Exxon’s new $1.5 billion of five-year bonds are expected to price at a spread of 225 basis points over Treasurys, according to a person with direct knowledge of the deal.

That compares with generic spreads for U.S. investment-grade corporate bonds that had widened to about 229 basis points as of Friday, from about 132 basis points on March 3, according to CreditSights data.

Corporate bonds often are quoted on a spread basis, or the level of compensation that investors get above a risk-free benchmark. Investment-grade spreads have come under pressure, along with U.S. equities, but not as sharply as the high-yield, or “junk bond” market, where energy defaults are expected to spike as U.S. crude prices hold below $30 a barrel.

“This is more of a demand issue, with people staying home,” Kennedy said of the source of recent market stress. “You have a broad swath of small businesses that need a bridge to get them through the period when people start to go about their daily lives again.”

Meanwhile, the Federal Reserve already has slashed benchmark rates to near zero in recent days, beefed up its short-term funding facilities for Wall Street banks and resumed buying Treasury debt and government-backed mortgage bonds as unleashes its balance sheet to keep financial markets functioning.

On Tuesday, the central bank also invoked crisis-era powers to unclog the commercial paper market, a vital corner of the market where highly rated corporations can access short-term funds, an effort it said “will support families, businesses and jobs across the economy.”

See: Federal Reserve launches crisis-era commercial paper funding facility

“In general, the investment-grade market is still in pretty good shape,” Travis King, co-head of investment-grade credit at Voya Investment Management told MarketWatch. “For the right issuer, at the right pricing level, there is liquidity available.”

“Of course, spreads can still go wider from here, and the stock selloff worse,” he said.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>