The boom in loans to U.S. companies already awash in debt has become a source of angst for regulators and the market.

But Barings, an investment arm of Massachusetts Mutual Life, said on Friday that now actually might be the right time for to buy loans to debt-laden American companies, even as other investors head for the exits.

“Interest rate expectations have gone down materially this year, contributing to a notable shift in investor sentiment and material outflows from loan retail funds,” wrote Barings’ Thomas McDonnell, a high-yield portfolio manager, in a post Friday.

“[But] in a somewhat contrarian view to what’s happening in the market—there is a good argument for investing in loans, particularly in the U.S., where the economy appears to be marginally stronger than in Europe.”

Broad market volatility this week, stoked by another flair up of U.S.-China trade war tensions, caused stocks on Monday to suffer their biggest one-day decline of 2019, with the Dow Jones Industrial Average DJIA, -0.34% shedding almost 770 points, the S&P 500 index SPX, -0.66% losing 87 points and the Nasdaq Composite Index COMP, -1.00% falling 278 points.

Jitters remained throughout the week and spiked again on Friday, after President Donald Trump said that planned trade talks for September with China could be cancelled. The Dow later erased a near 300-point drop in afternoon trade and turned positive.

The volatility also brought another round of outflows to leveraged loan funds this week, which have now lost $32.2 billion since November of last year when sentiment started to sour, equating to about a 28.2% loss of assets under management, according to a Goldman Sachs report on Friday.

Still, as demand has for loans has cooled, U.S. companies have shifted their borrowing needs into the so-called “junk-bond” market.

Funds that buy junk bonds, or debt issued by companies with sub-investment grade ratings, also saw a significant $3.8 billion of outflows this week, their biggest loss since the fourth quarter of last year, according to the Goldman report.

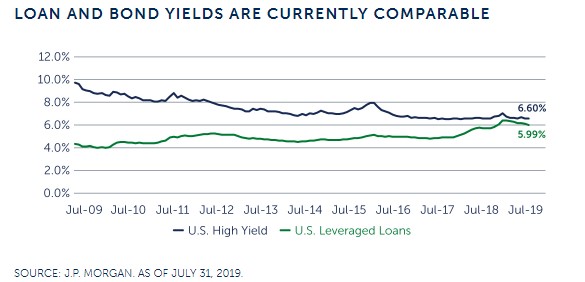

Yields have compressed sharply for corporate leveraged loans, but also climbed higher for the sector’s bonds, meaning both asset classes are now seeing yields around 6%, a signal that investors are willing to buy both types of debt at a similar, albeit low, return on investment.

This chart shows the near convergence of yields on U.S. junk-bonds and leveraged loans over the past decade.

J.P. Morgan data

J.P. Morgan data

Barings’ McDonnell argues that loans are still a solid bet, even as yields have dwindled and U.S. corporate debt levels have reached new all-time highs, mainly because loans typically get paid back ahead of other creditors and are secured on at least some of a borrower’s assets in an event of default, which can lead to higher recoveries.

“As of February 2019, the long-term average recovery rate for senior secured loans was just over 80%,” McDonnell wrote, pointing to a Moody’s research.

But Moody’s in January also said that leveraged loans were in uncharted territory, due to the erosion of investor protections that could chip away at recoveries.

Check out: Leveraged loans are in uncharted territory and that’s a big risk, Moody’s says

In recent months, regulators, current and former, as well as analysts and investors have joined a growing chorus of voices sounding alarms about leveraged loans and the specialized funds, called collateralized loan obligations, which are the sector’s biggest buyer.

On Friday, Fitch Ratings said that risks could rise sharply for large global banks that provide credit facilities to CLO funds and other market participants, should stress hit the $1.2 trillion leveraged loan sector.

“We estimate that the banks most active in the leveraged loan market have direct loan and CLO exposures averaging 30%-40% of capital,” Fitch analysts wrote. “These exposures appear moderate at a sector level. However, some banks have significantly higher direct exposure and may have built concentrations or taken riskier positions.”

Still, Barings points out that volatility has been more muted in loans in the past eight years than in high-yield bonds or equities, and that overall default rates for the sector are below 2% and expected to hold there in the near-term.