CLO funds, the biggest buyers of U.S. leveraged loans, could see another sharp, fourth-quarter sell-off as investors look to avoid the sting of weak economic data and signs of financial stress at debt-laden companies, Bank of America Merrill Lynch analysts warned in a recent client note.

Problems that have plagued the nearly $600 billion collateralized loan obligations (CLO) market for months could intensify toward the end of 2019, according to a team of Bank of America Merrill Lynch analysts led by Chris Flanagan.

They pointed to “tightening financial conditions, tepid loan technicals, and cautionary rhetoric” from investors at a recent industry gathering in Miami, for their new underweight recommendation on mezzanine CLOs, or securities rated BBB to B, which become vulnerable to losses if a wave of corporate borrowers begin to default.

Yields on B-rated CLO classes currently are near their widest level of the year at 13.6%, according to BAML data.

In other words, it’s not just WeWork’s pulled initial public offering that has been met by tepid investor demand. August also saw five failed leveraged loan offerings, according to Bloomberg News, after a decade of easy credit.

Investors often view the leveraged loan market as a canary in the coal mine, because economic weakness is likely to show up first in companies with heavy debt burdens.

CLO funds sell bonds to finance the purchase of leveraged loans to a range of already highly indebted corporate borrowers. Investors have pointed to waning liquidity in lower-rated bonds as a potentially troublesome development in the sector.

See: Warning signs are flashing in funds that buy leveraged loans

Leveraged loans also are floating-rate instruments, which has made them less attractive to investors as the U.S. central bank has embarked on its current rate-cutting cycle to bolster the economy.

Bank of America analysts said rates likely have room to “go lower on the back of continuous market disruptions from trade negotiations, poor economic data, and political gridlock” and worsen the “relative value picture for floating rate assets,” while potentially “extending the capital flight from retail loan funds.”

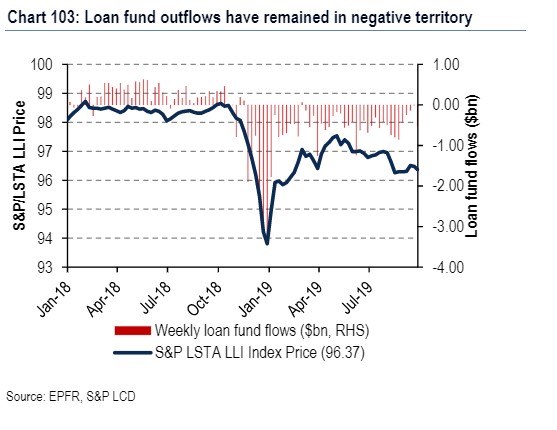

This chart shows the billions of dollars that have been pulled out of loan funds this year by investors:

Bank of America Merrill Lynch

Bank of America Merrill Lynch “A replay of the broad-market selloff seen in 4Q18 is not entirely out of the question, though lacking a clear catalyst for such a sharp spike in volatility, spread widening is expected to continue at a slow and orderly pace,” the BAML team wrote.

On Monday, the Chicago PMI business barometer, a key measure of business conditions in the region, dropped to 47.1 in September from 50.4 in the prior month. Any reading below 50 indicates worsening conditions.

What’s more, CLOs and leveraged loans lately have been again in the cross hairs of regulators and elected officials.

Sen. Elizabeth Warren, in a letter last week to Securities and Exchange Commission Chairman Jay Clayton, criticized the SEC for having “failed to use the regulatory tools” it was granted a decade ago to crack down on inflated bond ratings, a catalyst of the 2008 financial crisis.

Warren’s letter singled out the boom in CLO funds as source of worry.

“I am especially concerned about collateralized loan obligations (CLOs), given the rapid growth of CLOs and the lack of appropriate responses from federal agencies, including the SEC,” she wrote.

“These securitizations have helped enable increased leveraged loans that are generally poorly underwritten and include few protections for lenders and investors, which creates significant risk to the financial system and the American economy.”

Warren asked the SEC to respond to a list of her questions no later than Oct. 18, including any progress the regulator has made in shifting ratings agencies away from the current issuer-paid model, which allows issuers to pick only for the best possible ratings for their bond deals, while ignoring any lower grades it doesn’t like.