Stocks and crypto aren’t the only things getting walloped.

Billions worth of bonds from Fortune 500 companies deemed nearly bulletproof from default also have been tagged in a yard sale for financial assets, as the Federal Reserve works to raise rates and cool inflation at the highest in four decades.

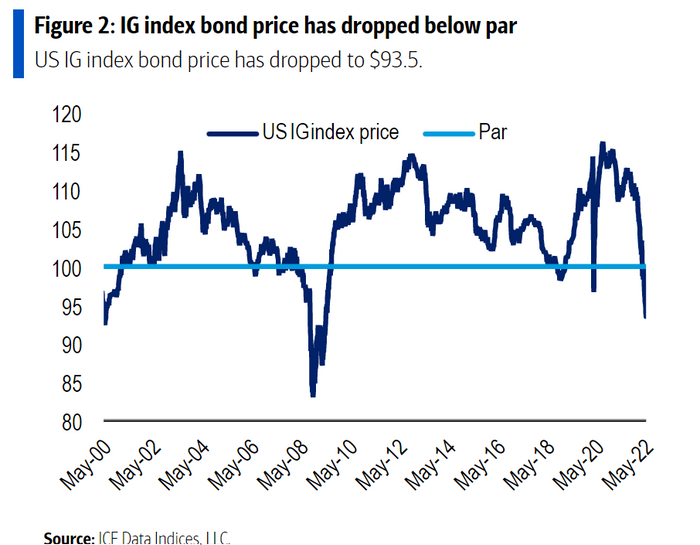

The dollar price of the U.S. investment grade corporate bond index recently fell to $93.5 (see chart), the lowest level since the global financial crisis, according to BofA Global data.

Investment grade bond prices fall to low prices since 2008

ICE Data, BofA Global

Prices on a host of highly rated corporate bonds in the index have tumbled even lower, during one of the worst stretches in history for total returns.

U.S. investment-grade corporate bonds were pegged at a minus-13.9% total return this year through Monday, compared with negative 9.3% for high-yield bonds, a slide that made it one of the worst performing sectors in fixed-income, according to Mizuho Securities.

“There are several high-quality bonds in the tech space, where the long bonds maturing in 30-years, are trading at 70 to 60 cents on the dollar,” Arvind Narayanan, co-head of investment-grade credit at The Vanguard Group, said by phone.

“These are names that are high AA rated, almost AAA, credits,” he said, noting the rare discounts on such bonds as global central banks pull pandemic support from markets.

“Companies and their debt have to stand on their own,” Narayanan said. “This is a great opportunity for active investors to really generate value for clients.”

Tech-wreck, in debt

The past two decades have been known for declining interest rates, translating to years in which investors flocked to the deep well of the U.S. investment-grade corporate bond market for yield.

High demand meant that much of the debt in the investment-graded corporate bond index typically traded at a premium to “par,” or above the $100 price many bonds fetch at issuance.

“Only on 15% of days since 2020 the average index price dropped below par,” strategists at BofA Global wrote, in a weekly client note. “Currently almost a third (32%) of index notional trades below $90 and 9% — below $80. Not surprisingly 92% of bonds with prices below $80 are 10yr and longer.”

A backdrop of climbing interest rate has led to slashed stock prices for many of the biggest U.S. technology companies, including Apple Inc., AAPL, -2.16% Netflix Inc. NFLX, -3.03% Amazon.com AMZN, -1.71% and Google GOOG, +0.40% parent Alphabet.

It also has spurred a sea of red for corporate bonds this year, particularly for debt maturing in a decade and beyond, according to Bondcliq data. For example, Apple’s AA+ rated 2.7% coupon bonds maturing August 2051 were trading at roughly $76 prices on Wednesday.

Interest rate mess

When pricing in the biggest part of the $10 trillion U.S. corporate bond market tumbled in the past it often could be attributed to concerns about “credit issues,” such as rising company defaults.

Bankruptcies clearly were a concern when banks were collapsing in 2008, but also initially in 2020 when much of the world adopted lockdowns to slow the spread of COVID 19. Many companies, however, used cheap debt in the past two years to bolster their balance sheets and push out financing needs further down the road.

“It’s an unusual situation,” said Nick Elfner, co-head of research at Breckinridge Capital Advisors, who said much of the move lower in corporate bond prices over the past six months was rates-driven.

Bonds are priced at a spread, or premium, above risk-free rates. The 10-year Treasury rate TMUBMUSD10Y, 2.951% was near 2.95% on Wednesday, up from the year’s low of about 1.63% on Jan. 3, 2022, according to Dow Jones Market Data. When bond yields move up, prices move down.

“In ’09, it was based on credit risks, downgrades and solvency risk in the banking sector,” Elfner said, by phone. “Right now, you are sort of seeing the opposite, with upgrades outpacing downgrades, companies having plenty of liquidity, and interest coverage is high.”

But he also called the sharp jump in interest rates a “double-edged sword,” dealing not only painful losses to bond investors over the shorter-run, but the chance at higher returns later as yields punch higher.

The yield in the ICE BofA US Corporate Index was pegged at 4.4% to start the week, edging closer to the 4.7% peak at the onset of the pandemic in 2020.

As bonds have sold off, some of the froth also has come out of other, more speculative parts of markets, with bitcoin BTCUSD, -1.33% down 36% on the year through Wednesday and the tech-heavy Nasdaq Composite Index COMP, -1.15% off 21%, according to FactSet.

The big question going forward will be if the Fed can tame inflation without sparking a recession, which would reawaken credit concerns for many corporate debt investors.

Against the uncertain backdrop, Vanguard’s Narayanan said investors have remained disciplined about how they have been deploying capital. Although, he also said it might mean prices for the yard sale still have further to drop.