Getty Images

Getty Images

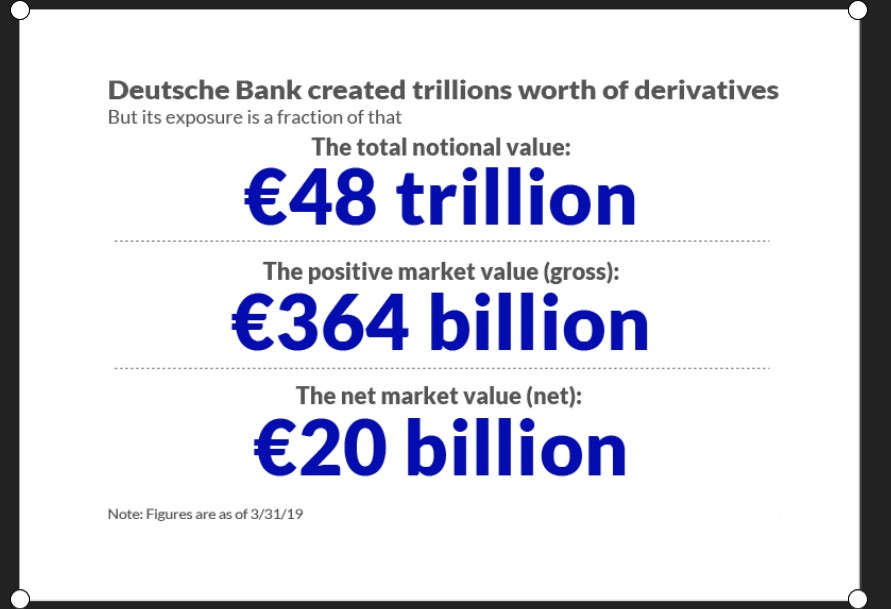

Deutsche Bank created over the years a whopping $53.5 trillion (€48 trillion) book of derivatives contracts that it now is seeking to unload, but experts say getting rid of those assets is no easy task.

The plan, as part of Deutsche Bank’s DBK, +0.17% biggest restructuring in decades, is to see its derivatives and other unwanted financial instruments that are now housed in its Capital Release Unit, or “bad bank,” be sold or wound down over time.

Earlier this week Deutsche reported a $3.5 billion loss for the second quarter, including restructuring charges that will see 18,000 of the bank’s 91,000 staff laid off.

However, putting a value on the complex derivative contracts that Deutsche wants to auction off is a moving target at best, say experts.

“People like to think the dealers have this black box and that it is very scientific,” Craig Wolson, an attorney and derivatives consultant, said in an interview with MarketWatch. “But it is actually an educated guess. And most try to hedge their risks, but even their hedges are a guess.”

If all goes as planned, Deutsche Bank pegs its own exposure to its derivatives book at around $22.3 billion (€20 billion), according to recent estimates viewed by MarketWatch.

But even a small miscalculation on derivatives contracts can pose big problems if the assumptions used to underwrite agreements get the risks wrong.

Parties to derivatives contracts often have multiple bets going simultaneously with a particular counterparty. In Wall Street parlance, the concept is called “netting,” and, in theory, downside on one trade could be canceled by a win on another.

Netting creates an ability to offset amounts owed between parties under a master agreement, explained James Lovely, a Florida-based consultant to hedge funds and counterparties to derivatives contracts. The resulting exposure is often further mitigated by collateral being held by the party owed the net amount.

“But that assumes that counterparties perform, that clearinghouses perform and the collateral you have is adequate,” Lovely said in an interview. “If you ever, God forbid, had a full blow-up by Deutsche Bank, it is like being in a boat that does fine in 10-foot seas — and there is a 100-foot tsunami.”

To be sure, a failure of Deutsche Bank is viewed as unlikely, particularly since it is considered central to Germany’s banking system.

Banking expert Karen Petrou told MarketWatch that she was unconcerned about systemic risks tied to Deutsche Bank’s derivatives portfolio. “I tend to not worry about derivatives exposure, because all counterparties have priced or protected themselves from adversity,” she said.

Read: Banking expert from 2008 crisis says low interest rates make banks vulnerable and Americans poorer

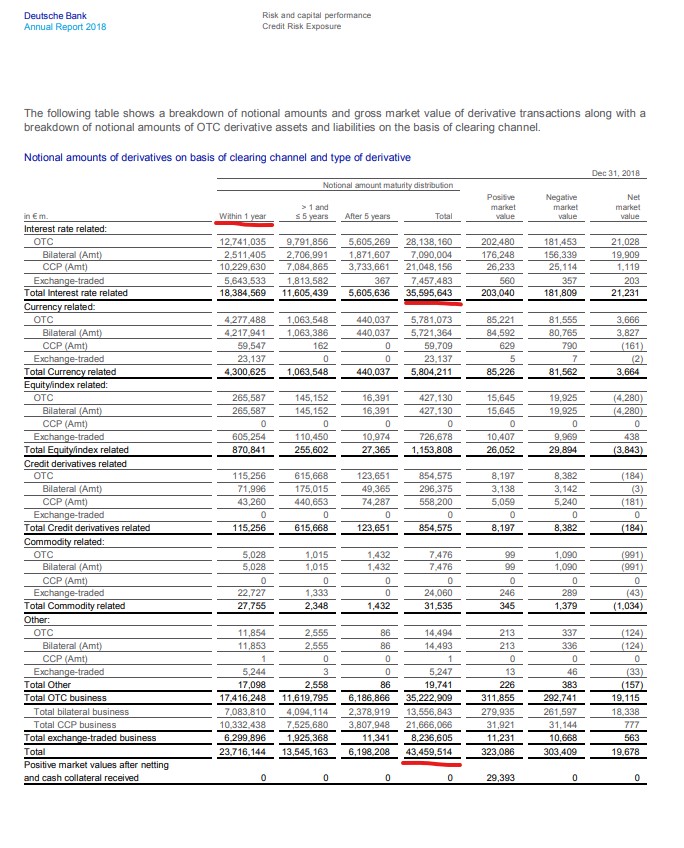

For its part, in March, Deutsche Bank reported that its derivatives book was mostly tied to interest rates and currencies, with equities and potentially worrisome credit exposure making up a much smaller portion.

Deutsche Bank’s 2018 annual report

Deutsche Bank’s 2018 annual report

American International Group AIG, +0.38% and others required bailouts a decade ago after incurring massive losses on a complex instrument called credit default swaps, or CDS, tied to subprime mortgages, rather than currencies or interest rates. And Lehman Brothers filed for bankruptcy in September 2008, stoking the flames of the financial crisis and Great Recession that brought global financial bankers to their knees.

Another mitigating factor for Deutsche Bank is that most of its derivatives contracts mature within a year, according to its annual report, which could lead to a sizable reduction of the portfolio in the near term. But, as Reuters reported on Tuesday, the bank’s longer-dated interest-rate and credit derivatives could be harder to unload.

Deutsche Bank declined to comment on its plans for its derivatives platform, beyond recent public statements and filings concerning its restructuring.

Since the restructuring announcement earlier this month, hedge funds have been withdrawing assets and, sometimes, entire books of business from Deutsche Bank. About $1 billion in assets per day had been pulled from the platform since its July 7 restructuring announcement, according to a person familiar with the matter.

Read: Deutsche Bank’s planned sale of prime brokerage unit to BNP still in ‘preliminary’ stage

Bloomberg first reported on the large transfers of assets by skittish hedge funds.

The U.K.-based bank Barclays recently won some $20 billion of hedge-fund balances from Deutsche Bank’s prime brokerage clients which could further complicate plans to unload the book to Paris-based BNP Paribas, according to a CNBC report Thursday. Switching prime brokerages often entails significant time and effort because it involves heaps of document preparation and systems integrations.

Read: Deutsche Bank reports $3.5 billion quarterly loss

Deutsche Bank expects to emerge from its restructuring — its most expansive in decades — in 2022 at a cost of about $8.2 billion (€7.4 billion).

Meanwhile, rules introduced since the 2008 crisis, designed to make financial markets fairer and more transparent could make it harder for Deutsche Bank to shed its prime brokerage.

Rules for higher margins or collateral for funds that use over-the-counter derivatives, rather than those cleared through a third-party exchange, are already being phased in. The final stage of the implementation of these rules, which impact smaller funds, has been extended by a year to September 2021, according to the industry publication the Trade.

Another complicating factor is that the scandal-plagued Libor, or London interbank offered rate, used as a benchmark for pricing interest-rate-pegged contracts, is being phased out, making valuation of existing derivatives contracts difficult in the future, experts have said.

An estimated $200 trillion in financial contracts and securities, which includes derivatives, continue to rely on Libor.

U.K. and U.S. regulators have warned market participants recently not to add to the Libor “hole” but to start adopting the alternative benchmarks already in use.

See: U.K. and U.S. regulators see promise in bond-market adoption of Libor alternatives

“Potential buyers may not be as eager to take that [derivatives book] down, as they know eventually there are higher margin fees attached, and that could potentially inhibit that sale,” said Audrey Blater, a senior analyst tracking fixed-income derivatives products at the Aite Group, speaking about Deutsche’s assets.

“Clients,” said Blater, “are having a hard time getting their heads around the Libor transition.”

Add Comment