It’s the last day of October for stocks and the markets have enjoyed an anxiety-ridden climb toward all-time highs, but if this statistical trend for equity benchmarks holds up, there is much more room to run.

Dow Jones Data Group data going back to 1950 indicates that when the Dow Jones Industrial Average DJIA, -0.52% and the S&P 500 index SPX, -0.30% are up as sizably at the end of October as they are now, positive returns for the rest of the year are all but assured.

And those gains, historically, are remarkably stellar.

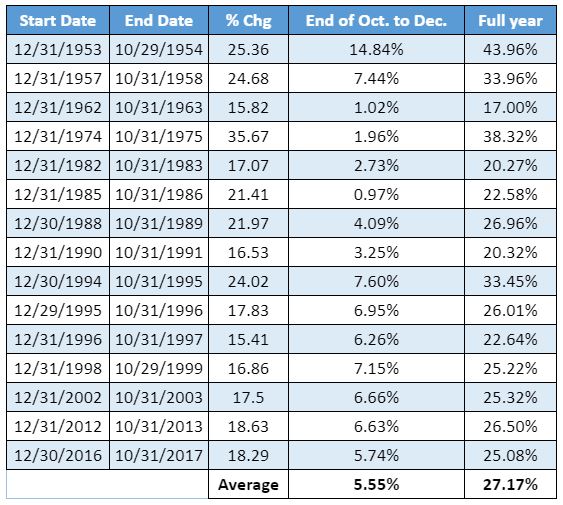

Specifically, when the Dow is up by at least 15% for the calendar year through the end of October, the index boasts an average return of 5.55% over the next two-month period, with an average year-to-date return of 27.17%. The Dow was up 15.94% thus far in 2019 as of Thursday’s close.

Source: Dow Jones Market Data

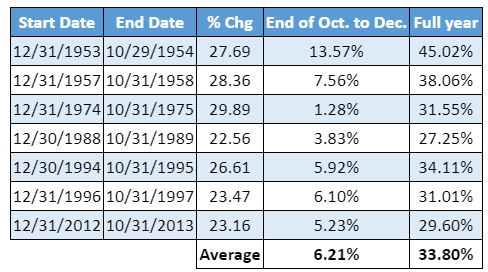

Source: Dow Jones Market Data Similarly, when the S&P 500 has gained at least 20% through Oct. 31 — it is up 21.17% thus far, as of Thursday — the benchmark’s return is 6.21% on average for the remaining period, with an average full-year gain of 33.8%.

Source: Dow Jones Market Data

Source: Dow Jones Market Data Although the Nasdaq doesn’t boast as impeccable a record, the index has gained 90% of the time when it is up by at least 20% at this point in the year (as of Thursday, it is up 24.97% so far in 2019), data show, with an average return of 7.48% for the remaining two months and a year-end gain of 42.81%.

To be sure, past results are absolutely no indication of future returns and U.S. stocks on Thursday fell amid growing worries about the likelihood that the U.S. will be able to carve out a genuine trade agreement with China soon and as an impeachment-inquiry vote tied to President Donald Trump was passed in the House.

That weakening comes a day after the S&P 500 index scored a record close in the wake of a Federal Reserve’s decision to cut interest rates for the third time this year, while also signaling that it would pause before making any further moves on monetary policy.

Having run a gantlet of political worries, including the U.S. trade dispute with China and Britain’s long-disputed plan to exit from the European Union, all three benchmarks are on pace to end a historically volatile period for stocks in positive territory. The Dow finished up 0.48% in October, the S&P 500 boasts a 2.04% month-to-date gain, and the Nasdaq jumped 3.66% in October.

Read: Sell the stock market in May and go away? Not so fast, say experts

October trading didn’t begin on a strong note, though, the Dow, S&P 500 and Nasdaq registered back-to-back losses of at least 1% before steadying at the start of the month.

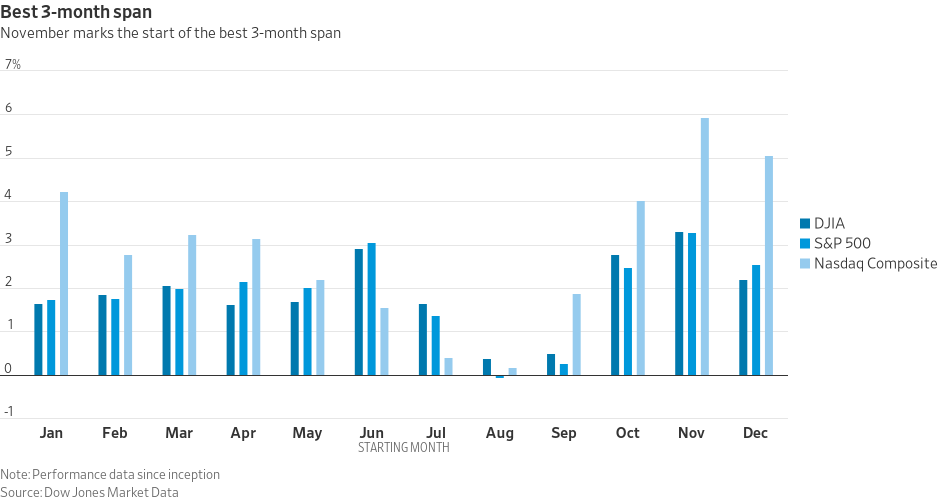

Now, stocks enter what’s historically been a strong period for equity markets. Data show that November through January is the strongest three-month span of the year, with average gains in November at 5.94% and, in December, 5.1%.

Source: Dow Jones Market Data

Source: Dow Jones Market Data Ken Jimenez contributed to this article.

Add Comment