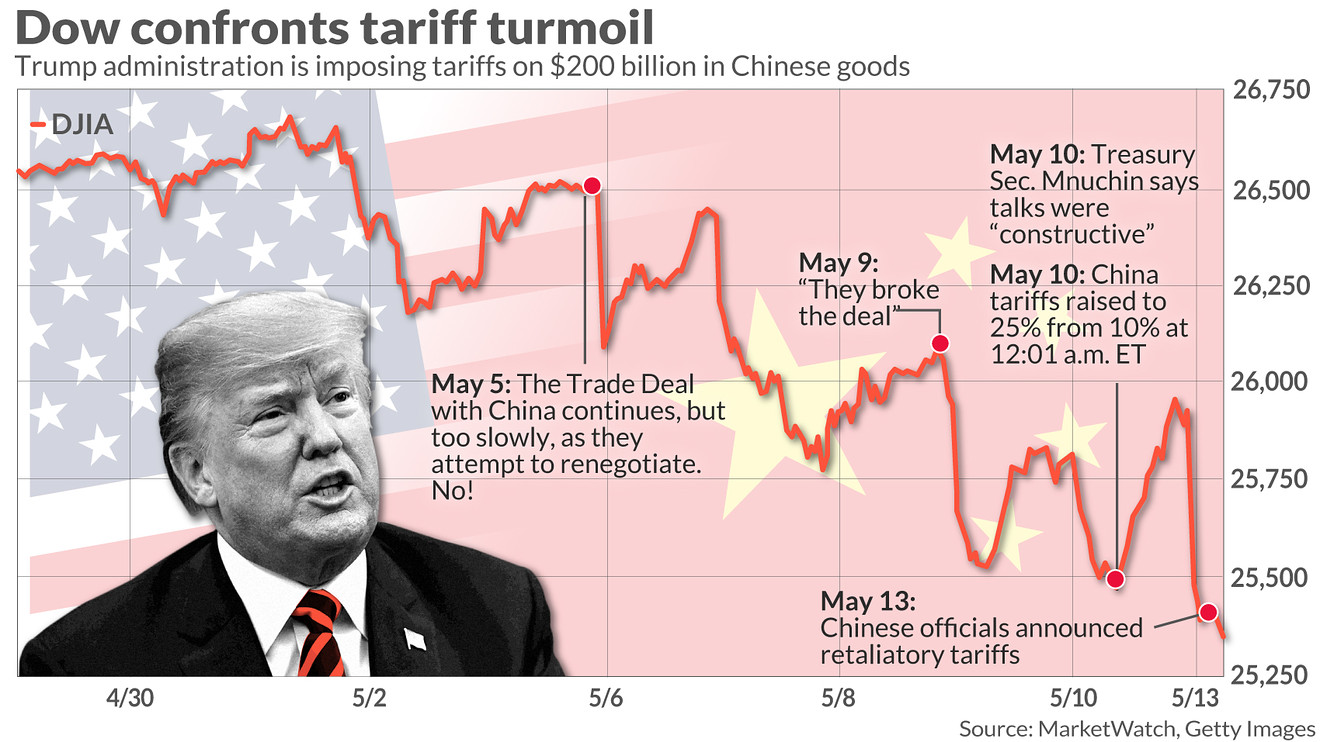

The intensifying Sino-American trade squabble is making for uniquely bad May trading for U.S. stocks, which continue to tumble after the S&P 500 suffered its worst week of 2019.

Stocks tumbled Monday, leaving the S&P 500 index SPX, -2.51% off 4.5% in the month to date, and the Dow Jones Industrial Average DJIA, -2.50% down 4.7%, with both on track for their worst start to the month through May 13 since 1970, according to Dow Jones Market Data. The Nasdaq Composite Index COMP, -3.27% off 5.3%, was set for its sharpest early May drop since 2000.

Read: Here are the stocks to buy if an all-out U.S.-China trade war erupts, says Goldman

All three benchmarks are looking at their worst monthly losses since December.

See: Why the tariff fight prompted a major wealth manager to change its U.S. portfolios

The retreat in the major U.S. indexes comes as Wall Street faces the prospect that a U.S.-China tariff deal could take longer than anticipated, if a pact occurs at all. Talks in Washington ended Friday without an agreement after the U.S. raised tariffs on $200 billion of Chinese imports to 25% from 10%.

Read: Why the U.S.-China trade deficit is so huge: Here’s all the stuff America imports

On Monday, Chinese officials announced retaliatory tariffs against the U.S., hitting $60 billion in annual exports to China with new or expanded duties that could reach 25%. Hu Xijin, editor in chief of China’s Global Times, a daily Chinese tabloid with ties to the Communist Party, reported on Twitter Monday morning that China may take further steps in the coming days and weeks.

President Donald Trump, via Twitter over the weekend and early Monday, vowed a hard line on China and said the U.S. held the upper hand in the battle, while Chinese media vowed Beijing would stand strong. The hard-line tone from both sides was seen adding to downside pressure, analysts said.

Trump Today: President warns China trade spat will worsen as Beijing retaliates

Also read: China media say ‘fierce U.S. offensive’ over trade won’t work

The S&P 500 is on pace for its worst daily drop since Dec. 4, as was the Nasdaq Composite COMP, -3.27% while the Dow was set for its largest daily skid since Jan. 3.

The turnabout for markets come just after those major indexes booked their sharpest April gains in about 10 years. However, the rich gains for stocks to start the year may have made them more vulnerable to a slump as international trade problems intensify, market participants said.

“For investors, uncertainty is heightened again, and weakness looks set to continue across global capital markets,” wrote Kim Catechis, portfolio manager at U.K. investment management company Martin Currie, a Legg Mason affiliate company.

Read: Sell the stock market in May and go away? Not so fast, say experts

Still, stock benchmarks are still holding on to strong year-to-date gains. The Dow is up 8.6% thus far in 2019, the S&P 500 is looking at a 12.2% return, while the Nasdaq is set for a 15.5% gain over the past five months, according to FactSet data.

Want news about Asia delivered to your inbox? Subscribe to MarketWatch’s free Asia Daily newsletter. Sign up here.