U.S. stocks are poised to experience large swings in the days and weeks ahead as heavy trading in equity option contracts continues to contribute to choppy price action, especially on days that feature the release of crucial economic data like Friday’s monthly jobs report, or Tuesday’s reading on the consumer-price index.

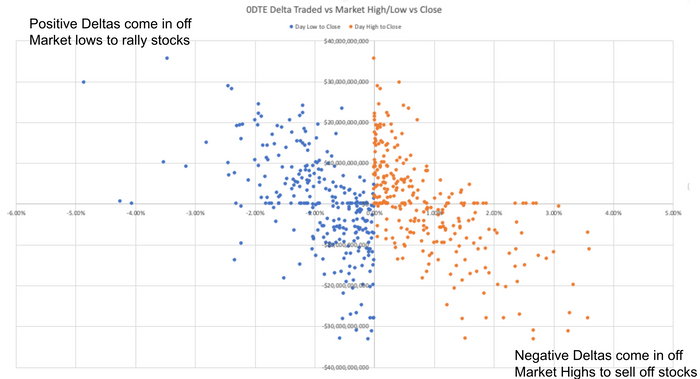

An analysis of options trading flows performed by SpotGamma, a provider of data and analytics tied to the market for U.S. equity option contracts, shows a correlation between trading in options on the verge of expiring, and large intraday market swings.

The historic reversal in U.S. stocks seen on Oct. 13, following the release of a monthly inflation report, offered one memorable example of this dynamic, according to SpotGamma founder Brent Kochuba, who shared some of his data with MarketWatch.

Something similar played out on Feb. 1, when the Federal Reserve announced its most recent 25 basis point interest-rate hike. The S&P 500 fluctuated within a range of almost 3 percentage points that day, according to FactSet data, buffeted by trading in option contracts on the verge of expiring.

Over the past year, trading in so-called “zero day to expiration” — or “0DTE” — contracts linked to the S&P 500 has surged, according to data from the Cboe Options Exchange, where many of these contracts are traded. They now account for more than 40% of total trading volume in S&P 500 options, according to data furnished by the exchange.

“What the data shows you is there’s this correlation between really big zero-day to expiration options flow acting as a tool for mean reversion,” Kochuba said.

What does that mean in plain English?

Kochuba explained it like this: When the market rallies sharply, option traders react by buying puts and selling calls. A put is an option contract that allows traders to profit when the price of a stock or index falls. A call offers the opposite: the opportunity to profit when the price of the underlying asset or currency rises.

Conversely, when stocks tumble, tactical traders buy calls and sell puts, helping to drive the market higher. Kochuba illustrated the dynamic in the chart below, which shows how large intraday swings in the S&P 500 often correspond to heavy option trading flows.

Heavy option flow forces dealers on the other side of those trades to engage in what’s known as “delta hedging” — that is, buying or selling stocks or index futures to protect against losses should the option contracts pay off.

Swings in stocks seemingly driven by little or no news are also becoming more common now that traders can place bets using 0DTEs Monday through Friday, according to Alon Rosin, head of equity derivatives at Oppenheimer.

As a result, trading in deeply liquid equity indexes like the S&P 500 is starting to look “like a game of ping pong,” he said.

“Every day is a battle,” Rosin added. “Short-term traders have a hold on the market.”

The data bears this out. Sizable swings in U.S. stocks on a daily and intraday basis have become more common over the past year as the Federal Reserve has hiked interest rates to combat inflation. The S&P 500 in 2022 suffered its biggest calendar-year selloff since 2008, according to FactSet data.

The S&P 500 recorded 122 daily moves of 1% or greater in either direction last year, the most since 2008 and nearly double the 20-year average of 65.6, according to Dow Jones Market Data.

This trend has continued into 2023, with intraday swings in stocks becoming more exaggerated as well.

The average intraday range for the S&P 500 rose sharply to 1.8 percentage points in 2022, according to Dow Jones Market Data. It has contracted a bit to 1.4 percentage points since the start of 2023, but remains large relative to recent history: Over the past decade, only 2020 and 2022 have seen larger intraday ranges.

To be sure, trading in short-dated options is only part of the story. Selloffs often inspire investors to dump shares, while rallies can inspire investors worried about missing out on potential upside to buy.

“When markets are more volatile it opens the possibility of inducing panic trading from non-option players,” said Michael Lebowitz, a portfolio manager RIA Advisors.

Another consequence of the surge in trading of 0DTEs is that Wall Street’s preferred gauge of implied volatility, the Cboe Volatility Index VIX, +1.42%, or Vix, has remained conspicuously subdued, causing some to underestimate just how rocky markets might become.

This is possible because of the way the VIX is designed, since it doesn’t incorporate trading in short-dated option contracts like 0DTEs. Because of this, some experts have blamed the increasing popularity of short-term option trading for “suppressing” volatility.

“Since option demand is transferred to ultrashort dated options, the VIX level will systematically decrease,” said Garrett DeSimone, head of quantitative research at OptionMetrics, in a recent blog post on the subject.

The end result is that the U.S. equity market could become more vulnerable to a selloff driven by options trading, an argument that has been embraced by Marko Kolanovic, a top derivatives strategist at JPMorgan Chase & Co.

Counterpoint: BofA claps back at JPMorgan’s ‘Volmageddon 2.0’ warning: ‘reality is more nuanced’

DeSimone also harbors concerns that, rather than suppressing volatility, trading in short-dated option contracts could exacerbate a selloff.

“It would be ill-advised to dismiss the impact of 0DTE as innocuous,” he said.

U.S. stocks logged another sharp intraday reversal on Thursday, when the Dow Jones Industrial Average DJIA, -1.66% swung from being up more than 100 points shortly after the open, before finishing down more than 500 point.

The S&P 500 SPX, -1.85% and Nasdaq Composite COMP, -2.05% also finished sharply lower, down 1.9% and 2.1%, respectively as a sharp selloff in shares of Silicon Valley Bank parent SVB Financial Group SIVB, -60.41% sent bank shares reeling, before spreading to the broader market.