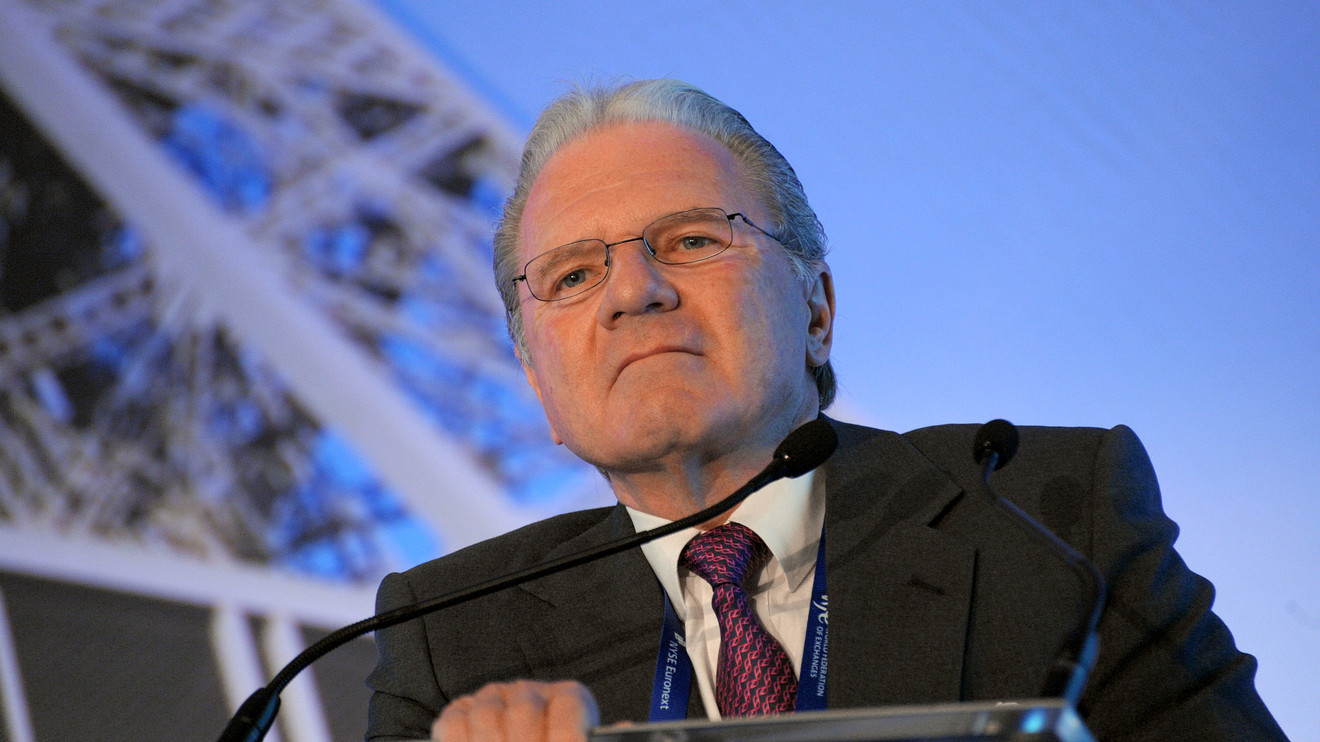

Interactive Brokers Group Inc. was in talks with E-Trade Financial about merging their brokerage operations but decided the deal didn’t make sense, according to Interactive’s founder, Thomas Peterffy.

Peterffy, a digital-trading pioneer who founded the online platform in 1978, told MarketWatch in a phone interview on Thursday that Interactive Brokers IBKR, +2.02% had been in talks with E-Trade ETFC, +21.81% before E-Trade agreed to a deal with Morgan Stanley MS, -4.55% MS, -4.55%.

“It didn’t work for us because they kept their customer money in long-term government bonds and so that’s something we as owners cannot afford to do,” Peterffy said, referring to uninvested cash sitting in customer accounts. He said the discussions took place soon after TD Ameritrade Holdings Corp. AMTD, +2.41% announced in November that it would be bought by rival Charles Schwab Corp. SCHW, +2.40% in a $26 billion deal.

The billionaire founder said that Interactive puts customer money into short-term securities like Treasury bills rather than longer-term securities.

The interest from placing clients’ uninvested cash can be a profit center for brokers and affiliated banks, especially at a time when commissions at many brokerages have been driven to 0% and on the heels of a trio of cuts by the Federal Reserve to benchmark interest rates, which currently stand at a 1.50%-1.75% range. E-Trade didn’t immediately respond to a request for comment.

The Wall Street Journal, which broke the E-Trade-Morgan Stanley news, said Morgan Stanley expects to recoup the premium it’s paying for E-Trade through $400 million of cost cuts and $150 million in additional savings that will come from using E-Trade’s “low-cost” deposits to replace more expensive funding.

Peterffy said Interactive wanted to examine “what would happen [if the brokerages combine] and where we would come out.”

He said “as soon as we realized the differences in the yield we would be able to achieve on customers’ funds we realized that ETFC would not create a profit at all under our conservative models.”

Don’t miss: Charles Schwab on no-commission trading: ‘Wall Street would have never done this’

Also: Schwab to let investors buy and sell fractions of shares

In the deal announced Thursday, E-Trade shareholders will get 1.0432 Morgan Stanley shares in exchange for one E-Trade share, equal to $58.74 based on its closing price Feb. 19. The deal “will significantly increase the scale and breadth of Morgan Stanley’s Wealth Management franchise, and positions Morgan Stanley to be an industry leader in Wealth Management across all channels and wealth segments,” Morgan Stanley said in a statement on Thursday.

E-Trade has more than 5.2 million client accounts with over $360 billion of retail client assets, adding to Morgan’s existing 3 million client relationships and $2.7 trillion of client assets. The deal is expected to close in the fourth quarter.

Peterffy described the deal for E-Trade as fair and said his deal team had arrived at a value not far from what Morgan Stanley plans to pay. Interactive Brokers’ market value is more than $28 billion, as of Thursday’s close, with Interactive’s shares gaining more than 2% on the day, compared with the S&P 500 index SPX, -0.38%, Dow Jones Industrial Average DJIA, -0.44% and Nasdaq Composite COMP, -0.67%, which ended a whipsawing session lower, pulling back from records, amid persistent jitters due to COVID-19, the illness derived from the novel strain of coronavirus that was first reported in Wuhan, China, last year.

The E-Trade deal was hardly a surprise for Wall Street, particularly after the Charles Schwab-TD Ameritrade deal that was announced just weeks after Schwab shook up the sector with the news that it was cutting trading fees for its customers to 0%.

Other discount brokerages followed suit, and the deal prompted speculation that more mergers would follow as shrinking fees from commissions would eat into revenue.

Peterrfy recalled that Interactive Brokers were the first among the major discount brokers to cut commissions, offering clients the option of either being charged the firm’s standard commission or paying no commission.

Back in December Peterffy told Barron’s in an interview that the TD Ameritrade and Schwab merger would make his firm more of a buyer than a seller. “I’m always looking at opportunities, but more as a buyer than a seller,” he was quoted as saying.

Peterrfy told MarketWatch that he still feels that his brokerage is able to distinguish itself even better now that his shop is among the biggest discount brokers left standing.

He said that the Morgan Stanley/E-Trade deal “represents a very strong competitor to Schwab and Ameritrade,” but said that it still makes the distinctions between Interactive and other platforms sharper.

He pointed to Interactive’s roster of professional investors who trade on average 20 times a month versus an average of about once a month for his competitors. Last year, Interactive tapped Milan Galik as its chief executive, succeeding Peterffy, who remains as chairman.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment