The Strait of Hormuz, the world’s most sensitive oil-transportation choke point, remains in focus after the U.S. called off a retaliatory strike against Iran late Thursday for its downing on Wednesday of an American military drone.

While President Donald Trump “will likely keep the pressure on the Iranians, it appears we will need another provocation from Tehran to warrant a swift retaliatory measure. Airstrikes from the U.S. would lead to a broader conflict that could see an immediate 10% spike in oil prices,” said Edward Moya, senior analyst at OANDA, in a Friday note.

The shooting down of the drone this week is the latest in a string of incidents near the waterway that have contributed to rising fears of a U.S.-Iran military conflict that could disrupt the flow of crude oil from the Middle East. It came less than a week after a pair of oil tankers were attacked near the coast of Iran which the U.S. blamed on Tehran.

Here’s a look at the Strait of Hormuz and why it is so important to the global crude-oil market.

Where is the Strait of Hormuz?

The Strait of Hormuz is a narrow waterway that links the Persian Gulf with the Gulf of Oman and the Arabian Sea.

At its narrowest point, the waterway is only 21 miles wide, and the width of the shipping lane in either direction is just 2 miles, separated by a two-mile buffer zone.

Why is it important?

Oil tankers carrying crude from ports on the Persian Gulf must pass through the strait. Around 21 million barrels of oil a day flowed through it in 2018, equivalent to roughly a third of global seaborne oil trade and about 21% of global petroleum liquids consumption, the U.S. Energy Information Administration said Thursday.

What’s the latest?

Trump on Friday morning tweeted that he called off a retaliatory strike at the last minute due to concerns the expected fatalities wouldn’t be proportionate to the downing of an unmanned drone. Trump said he was in “no hurry” to confront Iran but that the country “can NEVER” have nuclear weapons.

Iran’s Islamic Revolutionary Guard Corps, a paramilitary that reports solely to Supreme Leader Ayatollah Ali Khamenei on Thursday said it shot down the drone when it entered Iranian airspace near the Kouhmobarak district in southern Iran’s Hormozgan Province, the Associated Press reported. Kouhmobarak is around 1,200 kilometers southeast of Tehran and near the Strait of Hormuz. The U.S. military confirmed an unmanned drone was shot down by an Iranian surface-to-air missile in what it said was an unprovoked attack in international airspace, The Wall Street Journal reported (paywall).

Trump on Thursday had tweeted that Iran had made a “very big mistake” and, when asked if the U.S. planned a strike, told reporters, “You will soon find out.” But he also said he had a feeling that the downing was an accident and suggested it might have been the work of rogue personnel.

The downing of the drone and last week’s tanker attacks follow a May incident that saw four tankers damaged in what Gulf authorities deemed “sabotage.” The incidents follow the U.S. decision to reimpose sanctions on Iran over its nuclear program, with Washington moving this spring to end waivers for several importers of Iranian crude. Military bases housing U.S. forces in Iraq have also come under rocket attack in the past week

Oil futures surged Thursday to set June highs and added to those gains on Friday. Brent crude BRNQ19, +0.23% the global benchmark, rose 1.2%, while the U.S. standard-bearer, West Texas Intermediate crude CLQ19, +0.30% ended 0.6% higher on Friday.

Read: Here’s what’s at stake for oil as fears of U.S.-Iran conflict mount

Stock-market investors largely shrugged off the incident, with the S&P 500 SPX, -0.13% rising to an all-time high Thursday in a rally attributed to the Fed’s dovish tilt on rates, while the Dow Jones Industrial Average DJIA, -0.13% DJIA, -0.13% advanced nearly 250 points, or 0.9%. Stocks ended flat to slighlty lower Friday in a choppy trading session.

Following the drone hit, airlines around the world said they would reroute flights to avoid airspace over the Persian Gulf, news reports said.

Can the strait be bypassed?

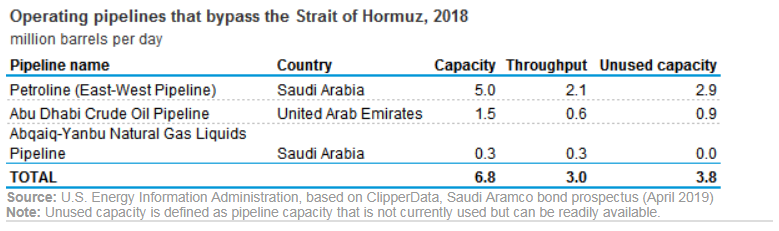

Not easily. Saudi Arabia and the United Arab Emirates operate the only pipelines capable of shipping crude outside the Persian Gulf and the additional pipeline capacity to circumvent the strait, the EIA said. At the end of 2018, the total available crude-oil pipeline capacity for both countries combined was estimated at 6.5 million barrels a day. With 2.7 million barrels a day moving through the pipelines that year, around 3.8 million barrels a day of unused capacity would have been available to bypass the strait, the EIA said (see table below).

Energy Information Administration

Energy Information Administration

Could Iran close the strait?

The presence of the U.S. Navy’s Bahrain-based Fifth Fleet has long cast doubt on Iran’s ability to close the waterway, analysts said. In addition, the U.S. in May announced it was sending an aircraft carrier group, bombers and a Patriot antimissile battery to counter what the Trump administration said were “clear indications” that Iran and its proxies were preparing to possibly attack U.S. forces in the region.

The U.S. military presence would make it extremely difficult for Iran to choke off traffic, but the country “has the strategic depth to stage one-off attacks on vessels, not just in the critical chokepoints but also in the region’s relatively open waters,” said Helima Croft, global head of commodity strategy at RBC Capital Markets said, in a May research note.

Is war likely?

Iran’s leadership appears comfortable taking large risks in its engagements, targeting U.S. forces directly rather than sticking to deniable, low-level attacks against third-party targets, said Henry Rome, analyst at Eurasia Group, in a Thursday note. The death of U.S. service members would be almost certain to force Trump’s hand, he said.

The analyst had predicted the U.S. would be unlikely to retaliate for the drone hit with a military strike, but reflected increased chances of a confrontation.

Thursday’s attack “underscores our decision to raise the probability of war between the U.S. and Iran to 40%, but war is still not base case,” said Henry Rome, analyst at Eurasia Group, in a note. The political-risk consulting firm earlier this week raised its estimate of the probability of a U.S.-Iran military confrontation over the next six months to 40% from 30%.