Donald Trump holds a “narrow advantage” over any future rival in the 2020 election, according to economists at Goldman Sachs, but it has less to do with the stock market than the president’s Twitter account might indicate.

“In our view, the advantage of first-term incumbency and the relatively strong economic performance ahead of the presidential election suggest that President Trump is more likely to win a second term than the eventual Democratic candidate is to defeat him,” wrote economists Alec Phillips and Blake Taylor in a weekend note.

They noted that stands in contrast with prediction markets, which show a 56% probability of the eventual Democratic nominee defeating Trump next year. At the same time, surveys indicate Wall Street insiders expect a Trump re-election victory based on economic performance.

The relationship between economic performance and presidential elections is well-trod ground, with incumbents generally seen enjoying an electoral tailwind if the economy is perceived as doing well in the run-up to election day and challengers benefiting from economic weakness. Indeed, the phrase, “It’s the economy, stupid,” was made famous as Bill Clinton’s internal campaign mantra in 1992.

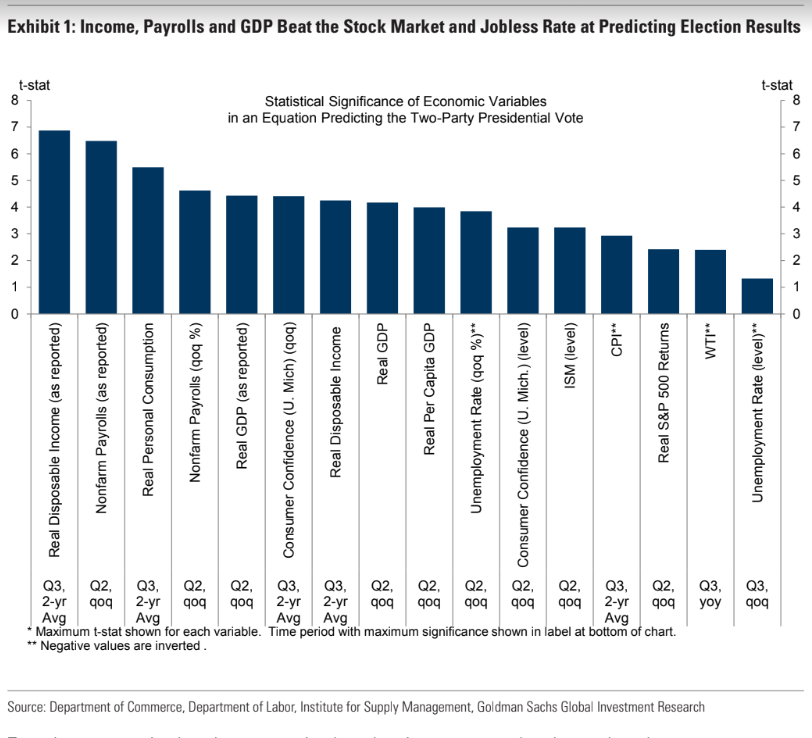

The Goldman analysis noted, however, that, in keeping with past findings, the performance of the stock market and other “market-based variables,” such as oil prices, are less important than other factors, including income, employment and consumption (see chart below).

Goldman Sachs

Goldman Sachs

Trump, since his election victory in November 2016, has unabashedly claimed credit for stock market gains, including a string of records through last fall, as equities built on a bull market that began in March 2009. Past presidents have been more reluctant to tie market performance directly to policy actions, commentators have noted, likely due to fears they would take the blame for any subsequent declines.

As the market stumbled in the fourth quarter of 2018, Trump repeatedly blasted the Federal Reserve and its chairman, Jerome Powell, via Twitter and in public remarks, for a series of interest-rate increases. On Sunday, Trump tweeted that the market would have been up “5000 to 10,000 additional points, and GDP would have been well over 4% instead of 3%” if the Fed “had done its job properly.”

Read: Frustrated investors say Trump administration overly sensitive to stock-market gyrations

Stocks have rebounded sharply from a fourth-quarter selloff, with the S&P 500 SPX, -0.07% up nearly 16% in the year to date and around 1.3% away from its all-time closing high set in September. The Dow Jones Industrial Average DJIA, -0.11% has rallied 13% since the end of last year and is off around 2.2% from its early October record close.

When it comes to the relationship between the economy and elections, the Goldman economists noted that change is generally more important than the level of most economic statistics, including headline-grabbing statistics like the unemployment rate.

The economists also affirmed that timing matters when it comes to economic performance. The relationship between some important factors, including real consumption and real disposable income, and the popular vote are best measured over a longer horizon. The strongest statistical relationship among other variables, however, often occurs in the second quarter of the election year.

Meanwhile, Trump’s net negative approval ratings are a drag, but the projected effect on the popular vote is still more than offset by the lift from economic performance, the economists said.

Turnout, however, remains a wild card after the 2018 midterms saw voter participation surge to its highest level since 1914.

There is no historic evidence indicating the Democrats’ strong midterm performance, which saw the party retake control of the House of Representatives, should lead to a win in the 2020 presidential election, but “the surge in turnout does suggest that something unusual has occurred among the American electorate and raises the uncertainty regarding turnout in 2020.”