The gloomy talk that a recession is coming, driven President Trump’s international trade policies, belies the fact that economic data has been quietly beating expectations in recent weeks.

When investors come to realize forecasts for data to worsen are overdone, government bonds may sell off, according to some analysts. These bearish market participants say the relentless drop in U.S. Treasury yields this year did not reflect the economy’s resilience to the global economic growth slowdown.

“The U.S. economic foundation is still intact. Underlying fundamentals suggest the U.S. economy is still running at a 2% pace,” Lindsay Bernum, global macro analyst at Smith Capital Investors, told MarketWatch.

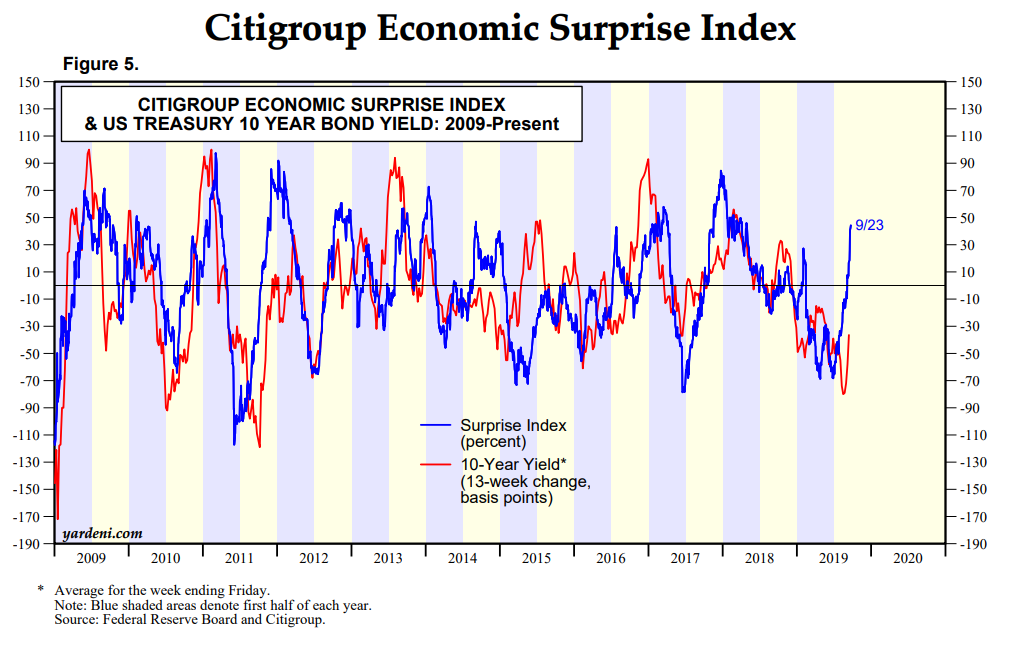

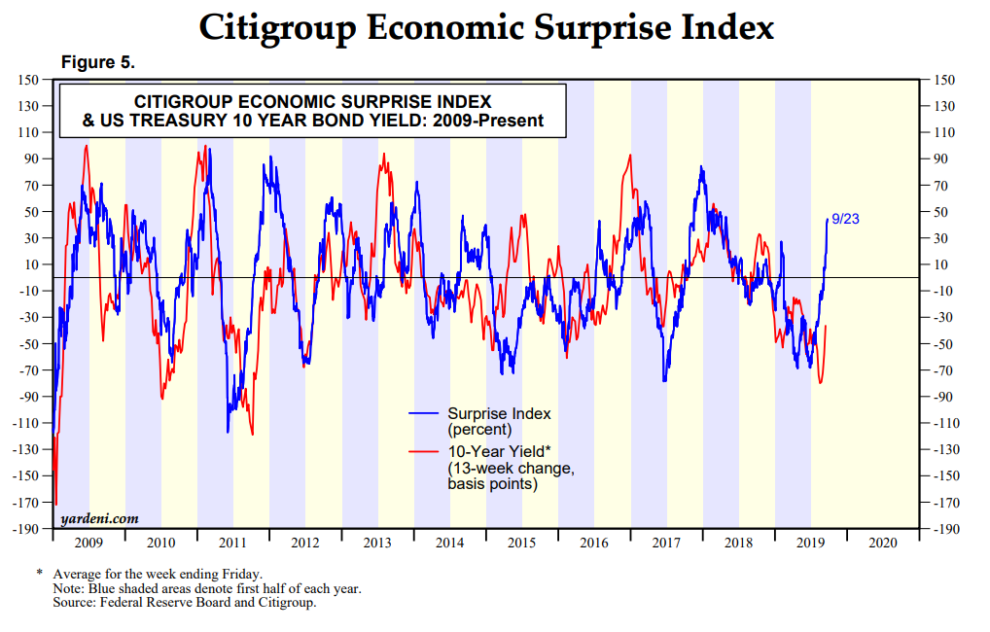

The U.S. Citi Economic Surprise Index stood at a positive reading of 44.7 as of Sept. 23, around its highest reading since April 2018, from a reading of negative 68.3 in late June, FactSet data shows. The economic surprise index calculates how much economic data has exceeded or fallen below analyst consensus estimates.

The chart below shows how the yield for the U.S. Treasury market’s benchmark maturity has closely followed the direction of the economic surprise indicators.

Until recently, both yields and the economic surprise index have moved steadily lower as bond investors reacted to the tide of global growth concerns that threatened to envelop the U.S. economy too. Yet in the last few weeks, the 10-year yield has continued its steady descent, even as the surprise index has reversed and turned higher.

Investors say this divergence should eventually resolve in the favor of the better-than-expected economic data as investors who had initially dived into Treasurys over recession fears rethink their decision to shift funds into haven assets, selling down their holdings of long-dated government paper.

The 10-year Treasury note yield TMUBMUSD10Y, -4.45% has shed 1.05 percentage points this year. The benchmark rate is trading at 1.632%, after falling another 7 basis points on Tuesday.

“Positive economic surprises are important,” wrote Eric Lascelles, chief economist at RBC Global Asset Management, in a Tuesday note. “Markets endeavor to price in all knowable information. By definition, a positive surprise represents something that wasn’t previously known and will thus deviate markets higher, much as a negative surprise will send them lower.”

Still Lascelles said investors shouldn’t confuse the uptick in the surprise indicator as an outright improvement in economic data. Rather, it may reflect pessimism among analysts, causing them to lowered their growth forecasts amid the inversion of the Treasury yield curve, a bond-market phenomenon that is often a prelude to a recession.

The spread between the 10-year note yield and the 3-month bill yield has been inverted for most of the time since May. The New York Fed’s recession indicator, which spits out recession probabilities based on this yield gap, estimates a 38% chance of an economic downturn in the next 12 months.

Still plenty of analysts expect the U.S. economy to grow at a steady clip, for now. Gross domestic product is expected to expand at 2.3% in 2019, versus 2.9% in 2018.

What then would bring the bond-market bulls back to their senses? Some say that once geopolitical jitters subside, allowing the U.S. economy’s performance to take center-stage, investors will turn away from the Treasurys market.

“The global growth fears and geopolitical problems have been like a glaring light that’s been in everybody’s face,” Peter Cramer, senior portfolio manager at SLC Management, told MarketWatch.

Add Comment