A bout of volatility returned to financial markets with a vengeance last week, disrupting a nearly uninterrupted climb to records for U.S. stock indexes and raising questions about the path for Wall Street headed into a hornet’s nest of challenges for investors.

Perhaps, the overarching question is, “What the heck just happened to equity markets in the 48 hours after the S&P 500 index SPX, -0.81% and Nasdaq Composite Index COMP, -1.26% on Wednesday notched their 22nd and 43rd closing records of 2020 respectively, and the Dow scored its first finish above 29,000 since February, bringing it within 2% of its Feb. 12 all-time closing high?”

The bull perspective

From the bull’s perspective, not a lot has changed.

Bullish investors see the promise of lower interest rates for years to come and further injections of money by the Federal Reserve into various parts of the financial system, along with perhaps another fiscal stimulus from the government, as buttressing the market and offering a floor against future dramatic losses.

Optimists see the slump that the equity market experienced this week as a bump in the road to greater gains.

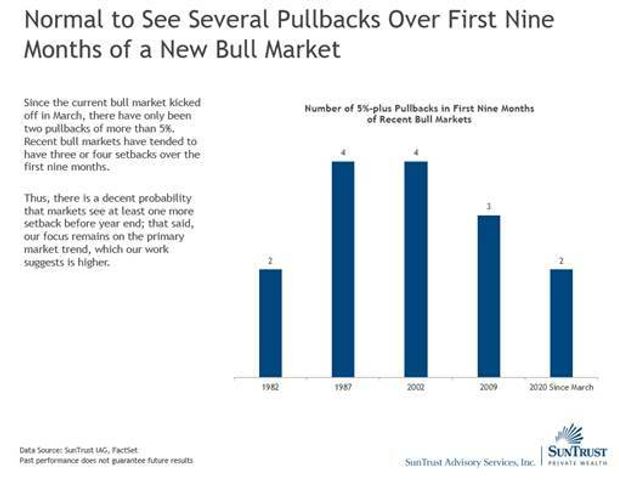

“Since the current bull market kicked off in March, there have only been two pullbacks of more than 5%. Recent bull markets have tended to have three or four setbacks over the first nine months,” wrote SunTrust Advisory chief market strategist Keith Lerner in a research note on Thursday — see chart:

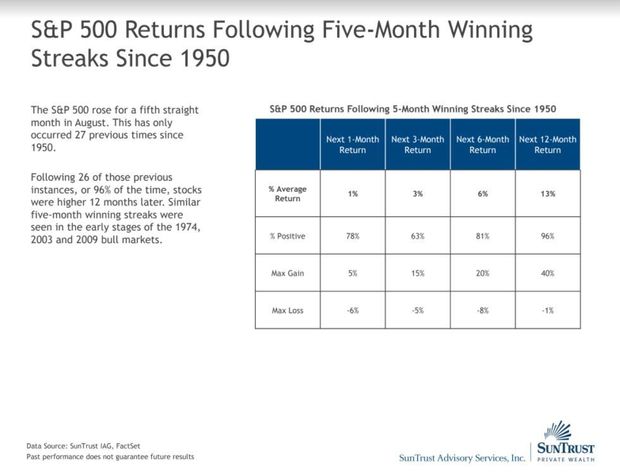

Lerner also notes that the five-month winning streak for the S&P 500 since August, which has only occurred 27 times since 1950, is a good sign because it tends to imply that further returns are ahead.

So, investors may view this retreat as a natural corrective phase that removes some of the euphoric froth from equity valuations that had far exceeded the metrics that pragmatic investors use to assess an asset’s value compared against its peers.

MarketWatch’s William Watts wrote last Thursday, citing Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors, that technology stocks — particularly, a cohort that includes Facebook FB, -2.88%, Amazon.com AMZN, -2.17%, Netflix NFLX, -1.84%, Microsoft MSFT, -1.40%, Apple AAPL, +0.06% and Google parent Alphabet GOOGL, -2.96% GOOG, -3.09% (or FANMAG) — had seen their valuations rise by dint of multiple expansion, or rapidly rising prices, while other segments of the market had seen earnings estimates fall out of whack with their prices, distorting the “P” portion of the commonly used priced-to-earnings metric, or P/E, used to gauge a stock’s worth.

“But these two groups of stocks have gotten more expensive for completely different reasons,” he noted. “FANMAG’s P/E has risen because their ‘P’ (prices) has gone up faster than their ‘E’ (earnings), while the P/E for the rest of the S&P 500 has expanded because ‘E’ has gone down much more than ‘P.’,” wrote Suzuki.

Indeed during the period between the market’s March lows and early last week, investors have maintained a voracious appetite for technology-related stocks, and a group known as “stay-at-home companies”, due to the belief that not only are they receiving a boost from the COVID-19 pandemic but also that they are best positioned to benefit when the economy eventually emerges from the recession.

A bounce off Friday’s lows, aided by moves into financials also was viewed as constructive for the broader market, heading into the three-day Labor Day weekend.

“The move higher was mostly led by financials, which came as a result of slightly higher rates rate on the long end of the curve, notably the 10 basis point move in the 10-year Treasury,” wrote Peter Essele, head of portfolio management for Commonwealth Financial Network, via email.

Yields in the 10-year Treasury TMUBMUSD10Y, 0.721% benchmark bond rose to 0.72%, marking the biggest single-day rise on Friday since May 18.

It’s unusual for yields to climb as stocks are falling as they did on Friday because investors usually turn to the perceived safety of government debt, driving prices higher and yields lower, in times of uncertainty. That didn’t occur on Friday and may be interpreted by some as signaling that at least fixed-income investors see the move in stocks as indicative of a temporary pullback rather than a more significant and lasting decline.

UBS Global Wealth Management’s chief Investment Officer Mark Haefele said that he viewed this week’s market drop as investors consolidating gains. “We view the latest selloff as a bout of profit-taking after a strong run,” he wrote.

“The S&P 500 enjoyed its strongest August in 34 years, gaining 7%, and added a further 2.3% in the first two days of September, to reach a fresh record high,” he wrote. “Stocks are still well-supported by a combination of Fed liquidity, attractive equity risk premiums, and a continuing recovery as economies reopen from the lockdowns.”

The bear’s perspective

From a bearish vantage point, the outlook for stocks looks more uncertain for investors. This uncertainty may have well laid the groundwork for substantial episodes of turbulence if not gut-wrenching drops in stocks, some experts say.

“The mini-tech selloff on Thursday has left a lot of scarring; it is not overly surprising that in New York equities trading, things were relatively muted into a long weekend,” wrote Stephen Innes, chief global markets strategist at AxiCorp, in a Friday research note.

September is a notoriously week month for investors, and even if that weakness is somewhat moderated in an election year, October also has the hallmarks of a rough patch for Wall Street, with the Nov. 3 presidential election looming.

Chris Senyek, chief investment strategist at Wolfe Research, said the possibility of a resurgence of COVID-19 headed into the fall and winter also is cause to lighten up on stocks.

“Our sense is that a similar resurgence in infection rates is likely to occur in the United States this fall as children and college students returns to school and flu season begins,” analysts at Wolfe Research wrote on Friday.

Michael Kramer, founder of Mott Capital Markets, in a blog on Friday described the recent swings in the market as “insane” and said that it is difficult to gauge what’s ahead for the market, but he notes that an explosion in volumes related to the selloff could signal a change in the uptrend for stocks.

He noted that for the first time since April 3, the S&P 500 closed below its uptrend. “This is typically not something we want to see; it would indicate that momentum is likely shifting,” he wrote (see attached chart).

Of Friday’s paring of losses into the close, Kramer said: “The rally into the close was impressive, but it could have just as easily been on the heels of short-covering as it was on real buying.”

Part of the downturn occurred as two popular companies saw their shares drop after stock splits: Apple AAPL, +0.06% and Tesla TSLA, +2.78%.

Tesla has been among the highest of highfliers in recent months and viewed by some as a gauge of sentiment in the overall market. Its recent retreat is something bearish investors have pointed to as a signal of weakness in the market.

On top of that, Tesla wasn’t announced as a new entrant into the S&P 500 index late Friday, which may cast a pall over the stock that has lost about 20% from its peak.

The road ahead

Looking ahead, investors turn next to the Federal Reserve’s Sept. 15-16 policy meeting, which could be important in clarifying the length of the time interest rates could be held lower but also what, if any, new quantitative easing the central bank will implement.

Fed Chairman Jerome Powell in an interview with National Public Radio conducted Friday afternoon said that the 1.4 million jobs added to the labor market in August and an unemployment rate falling to 8.4% from 10.2% as a good sign of progress in the economy.

But he did emphasize that progress is going to be slow: “We do think it will get harder from here,” Powell said.

Doubts that the government will soon provide a fresh round of fiscal stimulus for out-of-work Americans has put some pressure on the Fed to do more to dull the impact on the economy from disruptions caused by the pandemic.

The Fed’s role may be the most important feature of whether the stock market is able to continue to make progress higher. As it stands now, there are few alternatives to stocks, with long-dated government bonds yielding around 1% or less.