A monthlong bout of coronavirus has ravaged China, claiming hundreds of lives and sickening thousands but the Asian influenza also has infected the stock market and other assets, chilling bullish sentiment for the moment and stoking uncertainty at a period of lofty valuations.

Heightened anxieties around coronavirus comes as the number of people infected world-wide approaches 10,000 and as authorities from the Centers for Disease Control and Prevention reported the first quarantine in the U.S. in 50 years, as the U.K. and Russia each announced their first cases of the deadly illness that has drawn comparisons to SARS, severe acute respiratory syndrome.

Here are some of the assets and sectors that the novel Asian illness has impacted so far, since the infection was noticed Dec. 31.

Stocks get slammed Friday

Dow skids 0.7% in January and falls beneath its 50-day moving average at 28,443.30, a short-term line it hasn’t closed below since October, according to Dow Jones Market Data. Moving averages are used by market technicians to help determine bullish and bearish momentum in an asset.

Friday afternoon, the Dow Jones Industrial Average DJIA, -2.09% was down 587 points, or 2%, to 28,272. The S&P 500 SPX, -1.77% shed 57 points, or 1.7%, 3,226. The Nasdaq Composite Index COMP, -1.59% retreated 138 points, or 1.5%, to 9,161.

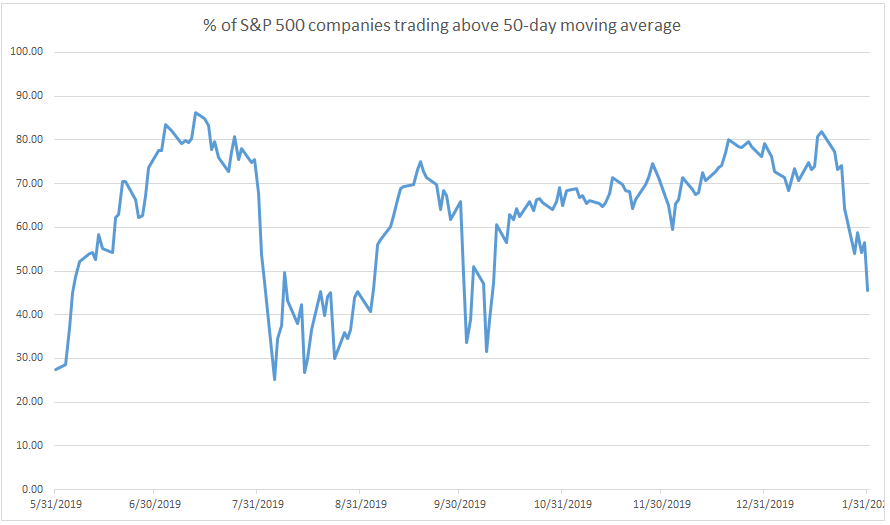

Stocks trading below trend lines

Source: Dow Jones Market Data

Source: Dow Jones Market Data The share of S&P 500 components trading above their 50-day MA has dropped below 50% for the first time since Oct. 10, according to Dow Jones Market Data.

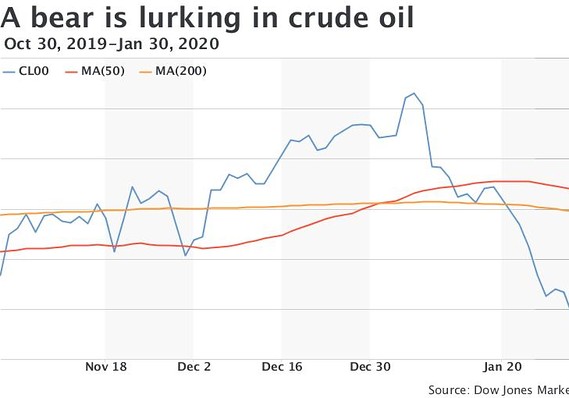

Oil is on the verge of a bear market

Dow Jones Market Data

Dow Jones Market Data Coronavirus could hurt demand for crude because China is among the biggest importers of the commodity, putting oil prices on the verge of a bear market. Entry into a bear market is defined by a price drop of at least 20% from a recent high.

West Texas Intermediate crude for March delivery CLH20, +0.14% was set for a 5.3% weekly skid and is off 18.9% off its recent peak of $63.27 hit on Jan. 6. A settlement below $50.62 would push it into a bear market, according to Dow Jones Market Data. WTI oil prices are down nearly 16% in January, according to FactSet data.

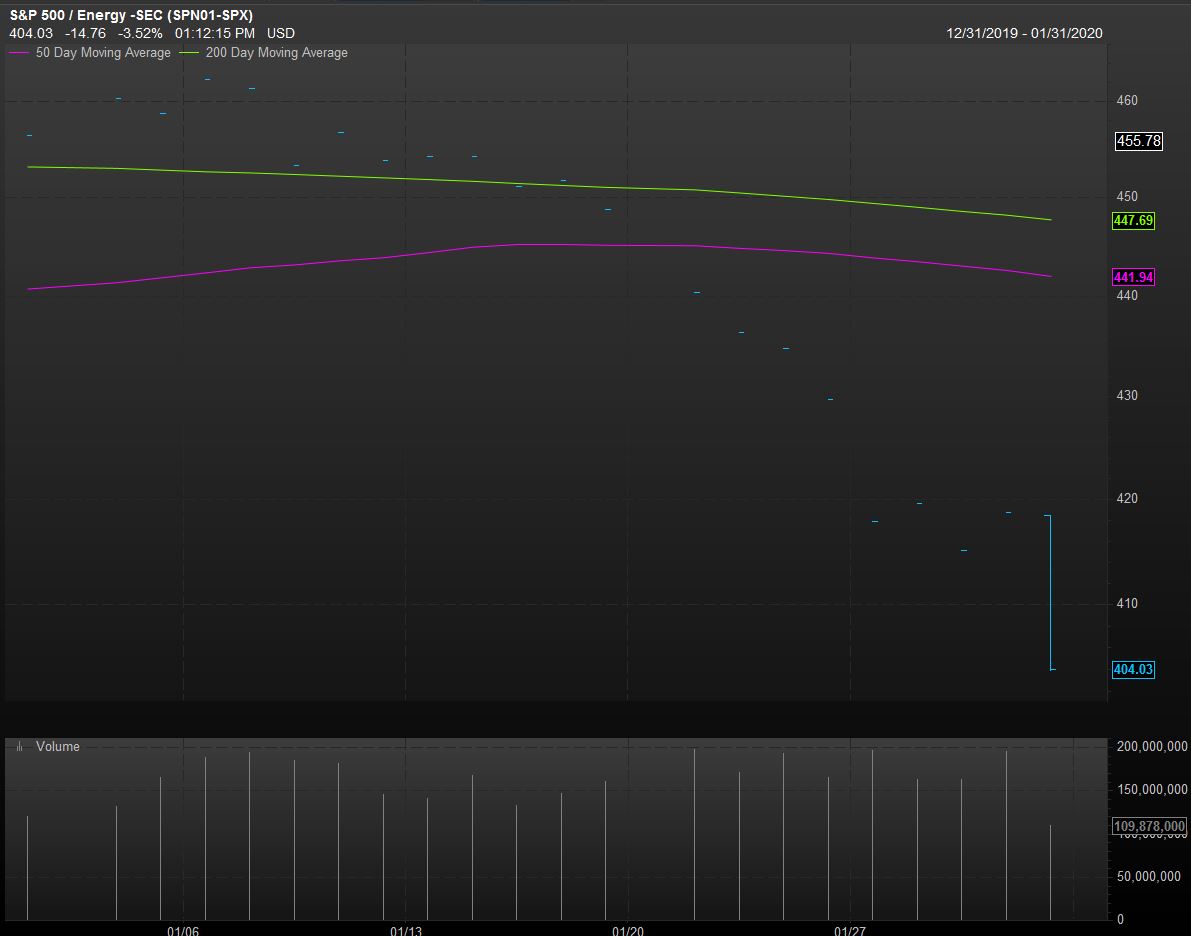

The S&P 500’s energy sector nears closing in a bear market

Source: FactSet data

Source: FactSet data The S&P 500 Energy sector XLE, -3.12% is on the brink of closing on Friday in bear-market territory. It would need to close at or below 405.8 and is currently at 404.1.

Airlines

Airline stocks have been flattened. Shares of United Airlines Holdings Inc. UAL, -3.79% slumped 14.9% so far in January. Delta Air Lines Inc.’s stock DAL, -2.38% slid 4.7% in the month to date and American Airlines Group Inc. AAL, -3.17% shares have fallen more than 6.6%, as both halted flights to China as the coronavirus fears spread.

Bonds take a beating, signal recession

The 10-year Treasury note yields TMUBMUSD10Y, +0.00% hit its lowest level since October after starting the month at 1.92%, it was most recently trading at 1.53% and the differential between the benchmark bond. Bond prices rise as yields fall. On top of that, the 3-month Treasury bill rate TMUBMUSD03M, +0.00% had briefly inverted, a condition that has tended to be viewed as an accurate predictor of coming recessions. Fixed-income investors, however, have pointed to the fears of coronavirus as the big driver of yields lately.

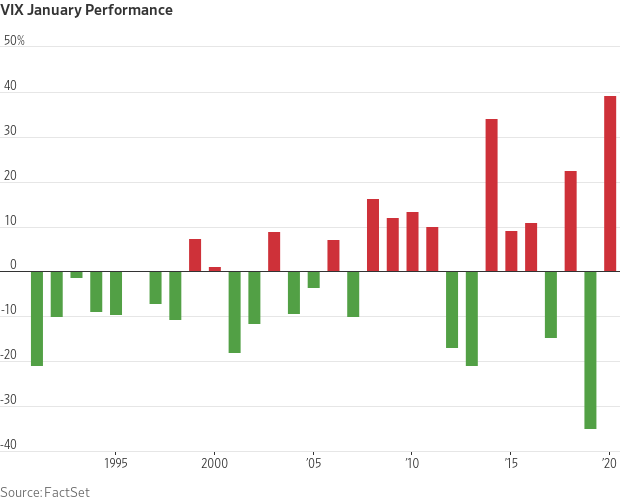

’Fear’ on Wall Street rises

Source: FactSet data

Source: FactSet data The Cboe Volatility Index VIX, +21.63%, or VIX, which uses S&P 500 options to measure trader expectations for volatility over the coming 30-day period, is on track for its largest monthly jump to start a year on record, based on available data going back to 1990, according to Dow Jones Market Data. The gauge often referred to as a guide to the level of investor fear, was up 39.3% in January and tends to rise as stocks fall.

Read: How the stock market has performed during past viral outbreaks, as coronavirus infects 9,500

Add Comment