Individual investors might be putting too much faith in the ability of some mutual funds to return their money in a panic, according to Laura Kodres, a former division chief at the International Monetary Fund’s global financial stability unit.

Kodres, who left the IMF in late August after a more than 24-year stint, sees potential for trouble in the mutual-fund industry where investors are promised a quick way to sell their shares in funds that contain hard-to-sell assets.

“There is a sense in which retail investors should have some opportunity to take risks that were previously just the purview of high-net-worth individuals,” Kodres told MarketWatch in an interview. But that democratization, she said, also has resulted in financial products that may be unable to sell their underlying assets quickly, if shareholders get spooked and they rush to pull cash out.

“To be fair, probably somewhere in the fund documents it says there is liquidity risk and redemptions are not guaranteed within 24 hours,” she said. “But I’m not sure everyone has read that fine print as closely they should.”

Her concerns lies not with standard funds that buy stocks that frequently trade on regulated exchanges, but with the swell of mutual funds that now hold less liquid assets, namely corporate debt, emerging-market bonds, and real-estate exposure that can take days (or months) to unload in a jittery market.

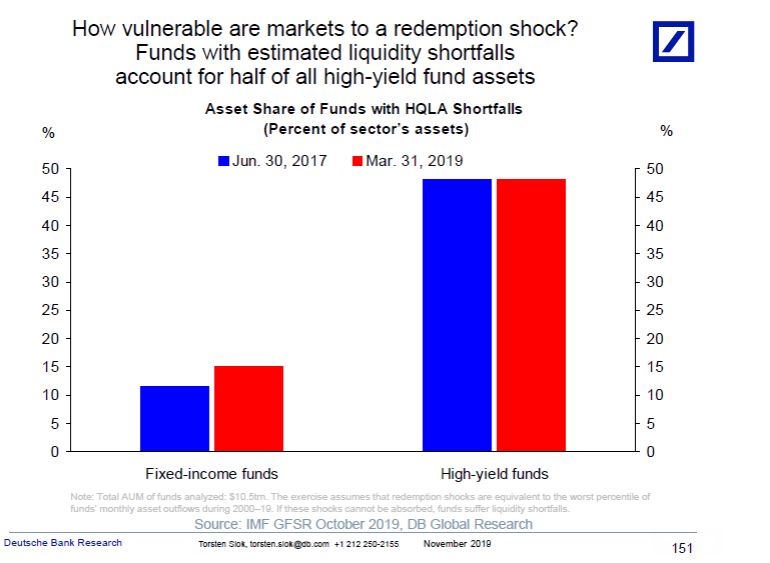

Deutsche Bank’s chief economist Torsten Sløk published a chart on Tuesday showing half of funds with high-yield assets would face liquidity shortfalls if mangers experience a repeat of the worst redemption shocks felt between 2000 to 2019.

Duetsche Bank

Duetsche Bank That compares with about 15% of fixed-income funds that are likely to run into liquidity problems under the same stress scenario.

“Holders may not realize their requests are straining the fund’s abilities to liquidate assets, especially if a lot of holders want to redeem simultaneously,” Kodres warned.

Check out: Bond mutual funds may hold riskier holdings than reported, NBER study finds

While at the IMF, Kodres cautioned about “reformers’ fatigue” in the wake of the 2008 subprime mortgage meltdown that sparked the worst financial crisis since the Great Depression. This fall she started teaching a class at the MIT Sloan School of Management with an aim of helping students think of ways in which post-crisis regulation has fallen short or gone too far.

She said the hope is to eventually offer the same course online for an expanded reach.

And while there has yet to be major hiccups in U.S.-based mutual funds, there have been scares abroad, including liquidity runs that hit a few high-profile funds. In response, the Bank of England Governor Mark Carney warned that investment funds that hold illiquid assets, but promise investors an easy exit, were “built on a lie” and said they could pose systemic risks.

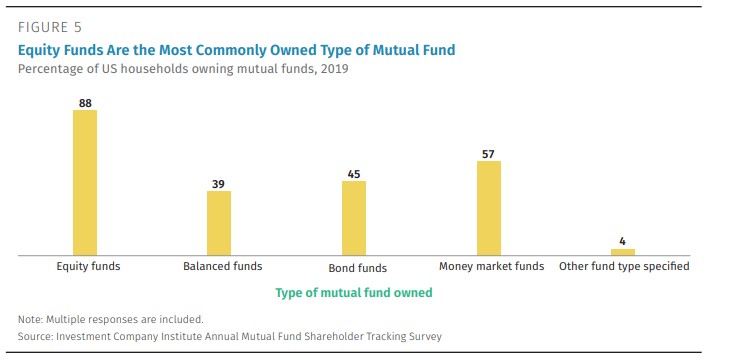

Meanwhile, mutual funds have become a popular way for many Americans to invest their money, with a majority gaining access initially through employer-sponsored programs designed to help workers fund retirement, according to this recent survey from the Investment Company Institute.

It found that almost 46% of U.S. households, or 58.5 million, owned mutual funds in 2019, with baby boomers, or those aged 40-54 years old, holding the biggest slice of those assets.

This ICI breakdown also shows most U.S. households are invested in equity funds, but with a strong preference for bond funds also.

Investment Company Institute data for 2019

Investment Company Institute data for 2019 Also read: Is Wall Street too ready to ‘pen the obituary’ of the 60-40 standard portfolio?

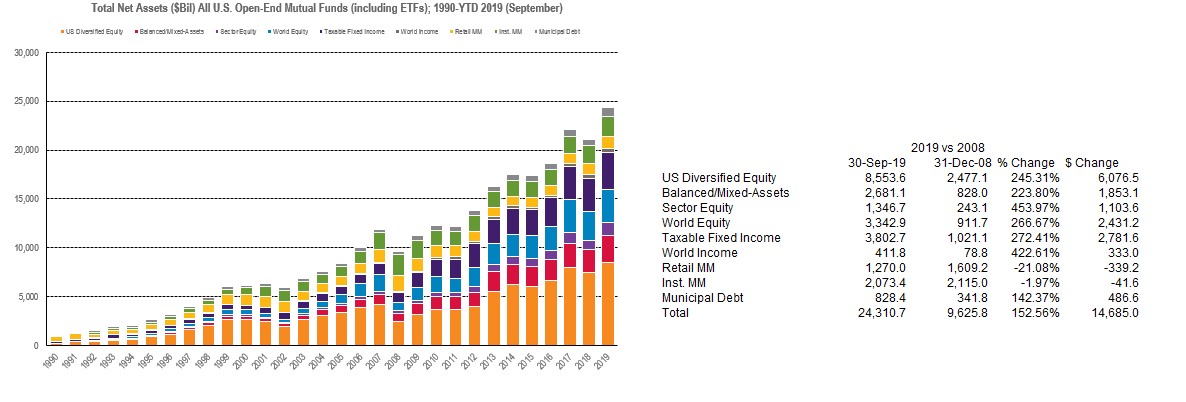

While regulations put in place in the wake of the 2008 global financial crisis have reduced the appetite of big banks for investing and trading in riskier types of assets, the asset management industry has stepped into that void. Its enlarged portfolios underpin an array of mutual fund offerings that allow investors a slice of the action.

To underscore the point, global mutual-funds have grown by more than 150% to $24 trillion in terms of their total net assets since the 2008 crisis, with U.S. equity funds making up the largest block of that at $8.5 trillion, according to Refinitiv data.

Refinitiv data through Sept.

Refinitiv data through Sept. But taxable fixed-income funds also have dramatically increased their footprint with total assets reaching $3.8 trillion from about $1 trillion in the same period.

While mutual fund performance has been mixed in the past five years, Refinitiv data has equity funds so far this year posting a 14.32% return through the end of September, nearly double the taxable fixed-income fund return of 7.63%.

Meanwhile, this year’s series of Federal Reserve interest rate cuts have sparked renewed hope that the U.S. can prolong its longest economic expansion in history.

The Dow Jones Industrial Average DJIA, -0.10% was up 18.5% on the year-to-date Tuesday, the S&P 500 index SPX, +0.02% advanced 23% and the Nasdaq Composite Index COMP, +0.10% gained 27%.

Add Comment