Investors are worried about an economic slowdown, but the corporate credit market is not screaming recession.

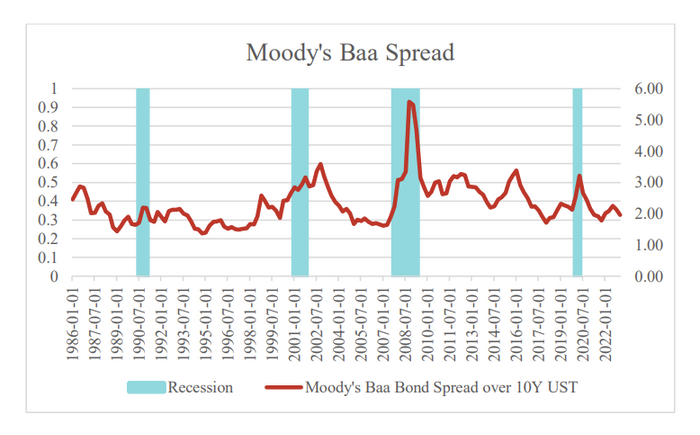

Spreads on corporate bonds with low investment-grade ratings have not widened in line with the rise seen ahead of past economic contractions in 2001-2002, 2007-2008 and 2020, said John Silvia, founder of Dynamic Economic Strategy, in a research note Wednesday. He was referencing spreads over 10-year U.S. Treasurys for bonds rated Baa by Moody’s Investors Service, the note shows.

Credit spreads are the level of compensation investors are paid above a risk-free rate, often Treasurys. They gap out when markets get volatile or concerns about potential defaults rise.

“On net, the credit spreads do not, as of now, signal recession,” said Silvia. “Moody’s Baa spread is the dog that didn’t bark.”

The current spread has not broken above to a higher level on a sustained basis, as seen just before or during the early phase of a recession in past periods, said Silvia, citing the fourth quarter of 1998, first quarter of 2008 and the fourth quarter of 2018 as examples.

But “the caution flag remains out” for investors, according to his note.

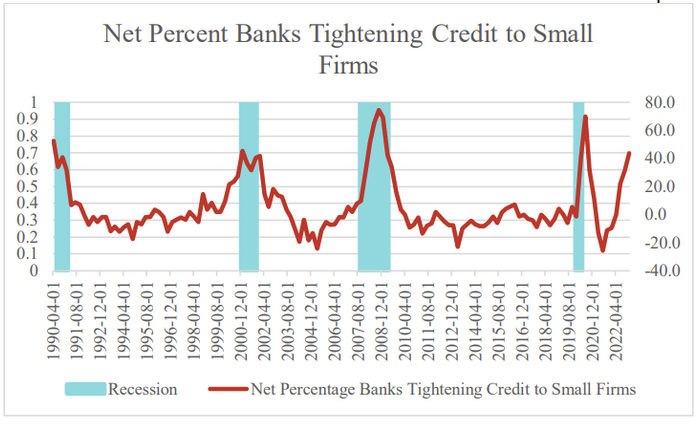

Investors are worried that bank lending standards will become tighter, prompting a recession in the next year, he said.

“As illustrated in the graph below, a sharp rise in the benchmark measurement of tighter standards does signal an oncoming recession,” said Silvia. “We saw this in 1999 and very sharp rises in 2007, and the 2020 period.”

The current measurement is already consistent with levels seen in the first quarter of 2001, the second quarter of 2008 and second quarter of 2020, the note shows.

“Therefore, we are already vulnerable to recession at current levels even before the release of the Fed updates in early May,” Silvia said, referring to the Federal Reserve’s senior loan officer opinion survey on bank lending practices.

Meanwhile, “the strength of the American household in jobs, real disposable income growth and consumer sentiment support the case for economic growth—although at a below trend pace that raises caution flags on the pace of profit growth, quality spreads and the upside for asset price appreciation,” according to Silvia.

Bond portfolios were hammered last year as the Federal Reserve dramatically raised rates, but are clawing back in 2023 with the help of higher yields.

Investment-grade bonds have produced gains so far in 2023. For example, the iShares iBoxx $ Investment Grade Corporate Bond ETF LQD, -0.50% has seen a total return of around 4.5% this year through Tuesday, according to FactSet data.

Junk bonds

Exchange-traded funds that invest in high yield debt, or so-called junk bonds, have also posted gains so far this year. The SPDR Bloomberg High Yield Bond ETF JNK, -0.37% has posted a 4.1% total return in 2023 through Tuesday, according to FactSet data.

In a note earlier this week, CreditSights analysts pointed to a recent tightening of spreads for both investment-grade and high-yield debt.

Spreads for an index of U.S. investment-grade corporate bonds last week tightened seven basis points to 139 basis points, while yields rose to 5.22%, the report shows.

Meanwhile, U.S. high-yield spreads over comparable Treasurys narrowed 41 basis points to 443 basis points as yields fell to 8.36%, according to the CreditSights note, dated April 17. Last week’s decline in high-yield spreads left them 38 basis points tighter than at the end of last year, the note says.

“Rate markets may be signaling a recession, but high yield credit spreads are signaling caution but not impending distress,” said Gautam Khanna, head of U.S. multi sector fixed income at Insight Investment, in emailed comments Wednesday.

At around 450 basis points, spreads are “only moderately above their historical averages,” he said, “albeit high yield now carries a higher credit quality composition than it has historically, so it is pricing in a bit more pain than may meet the eye at first.”