The Johnson & Johnson logo is displayed outside the company’s headquarters in New Brunswick, N.J.

Bloomberg News

Johnson & Johnson leveraged its top AAA credit ratings on Thursday to borrow $7.5 billion worth of cheap funding for its buyout of Momenta Pharmaceuticals, Inc.

J&J, which makes drugs, consumer goods and medical devices, stands as the only other major U.S. corporation, aside from Microsoft Corp MSFT, +2.32%, still carrying top AAA credit ratings, which NPR’s Planet Money explains are akin to the highest possible score in consumer credit.

In theory, that means J&J should have access to cheaper funding than companies with lower credit ratings that are considered a higher default or downgrade risk, although the pandemic-fueled boom in corporate borrowing has blurred the lines of what might be considered “low” or “high” yields.

Read: A binge? Bulge? Or just the new normal for debt in America as Fed helps spur string of records

Demand for J&J’s JNJ, +0.68% six-part corporate bond deal helped the 130-year-old-plus conglomerate lock in some of the lowest-cost funding available in years.

Final pricing details pegged the yield on the shortest five-year slug of bonds at 0.57% and at 2.49% for the longest 40-year class of debt.

With the Federal Reserve’s pandemic support, U.S. investment-grade companies have gone on a record $1.4 trillion bond-borrowing spree this year at record-low yields, issuing about 74% more debt than the same period of last year, according to BofA data.

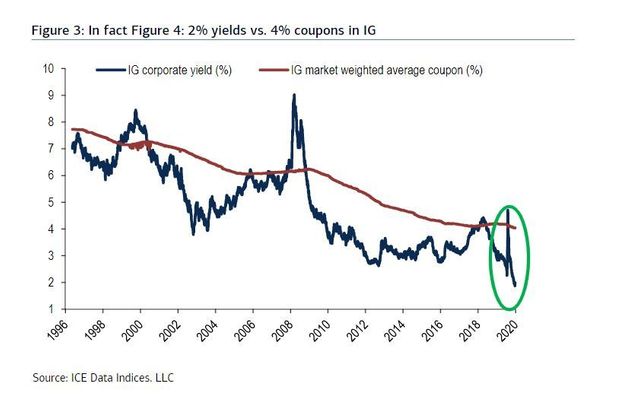

BofA Global created this chart to show investment-grade bonds hitting a fresh 24-year low this summer on a yield basis. Bond prices move in the opposite direction of yields.

The new financing mostly will be used by J&J to purchase Momenta MNTA, -0.01% in a cash, tender offer valued at $6.7 billion, which was announced Wednesday and sent shares of Cambridge, Mass.-based biotechnology company 69% higher to close at $52.12 per share.

Under terms of the agreement, J&J will pay $52.50 for each outstanding Momenta share. The deal is expected to close in the second half of 2020.

The remainder of the debt financing was pegged for general corporate purposes.

Moody’s Investors Service gave the debt financing a AAA rating, but with a negative outlook. While the credit-rating firm expects J&J’s pharmaceutical business to generate “mid-to-high single-digit growth” over the next few years, that contrasts with lower growth forecasts for its other business areas, which also face risks tied to “unresolved litigation involving opioids and talc,” that could constrain free cash flow “over multiple years.”

Johnson & Johnson, Moderna Inc. MRNA, -0.27%, Pfizer Inc. PFE, +1.20% and AstraZeneca PLC AZN, +0.46%, have been racing to get trials under way to help accelerate the development of a COVID-19 vaccine, with J&J planning to start a 60,000 person worldwide trial by late next month to test if it can protect people against the virus.

Vaccine hopes have been one catalyst helping to lift major U.S. stock indexes back to, or beyond, their prior all-time highs before the pandemic, with the S&P 500 index SPX, +0.31% this week marking its quickest recovery in history.

Related: Don’t look now, but here comes the vaccine news tidal wave