Buying a pricey house, but have weak credit? Increasingly, that’s not a deal-breaker.

Next year the process of obtaining a new home loan could get easier for borrowers with spotty credit, according to Moody’s Investors Service. The credit-ratings firm sees more lenders willing to finance buyers in the months ahead with less-than-pristine credit by lowering their standards to offset a housing market drained of affordable options.

“Reduced home-purchase affordability will continue to drive lenders to loosen credit standards to maintain volumes,” wrote Moody’s analyst Donald Lee in the credit-ratings firm’s 2020 outlook. “With shrinking home affordability, the underwriting quality for non-prime mortgages will weaken as increased lender competition leads to lower standards.”

Moody’s isn’t anticipating a full-scale embrace of “liar loans,” which require little income verification and a decade ago helped ignited the worst U.S. foreclosure crisis since the Great Depression.

But the credit-rating firm does expect growth in mortgage volumes to non-prime borrowers that include “a high percentage” of loans with “limited or alternative documentation,” which ultimately will be packaged into bond deals without government backing.

The non-prime category is an offshoot of subprime, or the category of borrowers with credit scores in the 580 to 669 range. That group became synonymous with the fall of Bear Sterns and Lehman Brothers and the eventual loss of nearly 10 million U.S. homes to foreclosure during the crisis just over a decade ago.

The new classification includes home loans that fall outside of the government’s crisis-era “qualified mortgage standard,” which aims to make home loans safer and easier for borrowers to understand. That can mean non-prime borrowers have blemishes on their credit, are foreign nationals, are self-employed or even homeowners living in expensive coastal regions who need to finance large-balance mortgages.

Check out: Meet the little bank that’s helping immigrants achieve big American Dreams

Citigroup C, +0.60%, Credit Suisse CS, -0.46%, JPMorgan Chase & Co. JPM, +0.07% and Wells Fargo & Co. WFC, -0.43% only recently returned to financing borrowers outside of the prime credit category.

Check out: Credit Suisse and Citigroup join other major banks in mortgage bond revival, with a twist

The sector could see a record $32 billion of bond issuance next year, up from about $23 billion in 2019 and only $9 billion in 2018, per BofA Global Research analysts.

The swell of near-prime loans comes as mortgage standards remain tight by historical standards and most of the $11 trillion mortgage finance market still gets financed through government-sponsored enterprises Freddie Mac FMCC, +2.54%, Fannie Mae FNMA, +1.97% and Ginnie Mae, which offer bond guarantees, according to the Urban Institute.

Yet, Moody’s analysts expect non-prime mortgages will “remain an important funding source for an underserved market” in the year ahead, including through some nonstandard loan offerings that fell out of favor with borrowers in the aftermath of the housing crisis.

“New originators and issuers will enter this market,” Moody’s analysts wrote, and “transactions backed by Helocs, closed-end second liens and loans backed by manufactured homes are likely to return.”

Stanford Kurland, Pennymac Mortgage Investment Trust’s PMT, -0.31% founder and executive chairman, said during a third-quarter earnings calls that he expects the lender to “remain active” in debt tied to home-equity lines of credit “as the market evolves.”

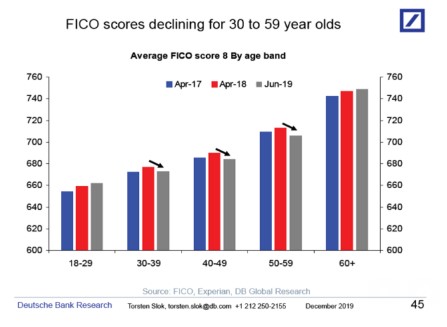

Meanwhile, more borrowers have been falling into the subprime category this year. Even with the U.S. unemployment rate at a 50-year low of 3.5% in November, this chart shows the recent decline in credit scores for borrowers who range from 30 to 59 years old.

Deutsche Bank

Deutsche Bank Deutsche Bank chief economist Torsten Sløk pointed to a spike in auto loan defaults as a likely catalyst, with the 90 days past due category now inching near a postcrisis peak of about 13% of outstanding auto-loan balances.

The credit decline comes as all eyes are on the health of the U.S. economy — and on the housing market — as the U.S. looks to consumers to help extend its record expansion.

Opinion: Americans keep gorging on debt, thanks to the Federal Reserve

Despite trade concerns that pulled stocks slightly lower Tuesday, the S&P 500 index SPX, -0.11% ended near its record close of 3,153.63, signaling a continuing appetite for risk-assets.

But unlike U.S. stocks, the housing market is showing signs of wear and tear.

“In many ways, the state of the housing market resembles that of a fixer upper. Some things are broken: foreign buyers are buying less, there is more supply and most importantly, affordability levels are stretched in some parts of the country,” wrote analysts at JPMorgan & Chase in a November note to clients.

But the analysts also said that if home price growth continues to cool and buyers see a period of higher income growth housing can find “a more sustainable long-term footing.”