Enjoy Thursday’s muted stock-market bounce, because Scott Minerd of Guggenheim Partners says it won’t last for very long.

The chief investment officer and one of the world’s premiere bond-fund managers, in a late-Wednesday interview, told MarketWatch that the equity market is likely to stage a mini-rebound in the coming sessions — but then, watch out.

Read: Stock-market bear who called selloff says S&P 500 near fair value, but beware ‘overshoots’

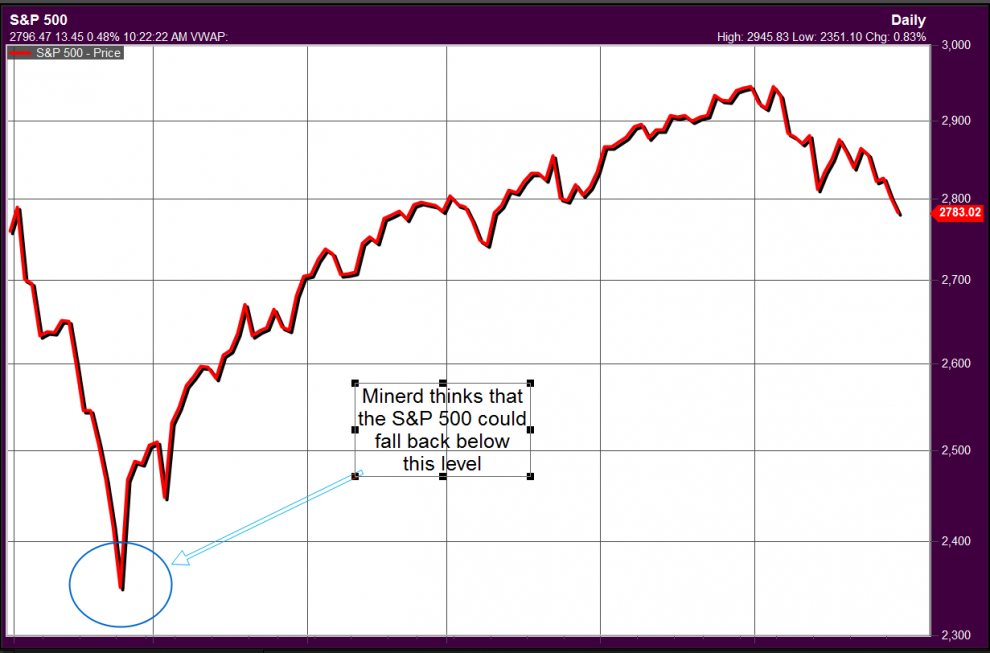

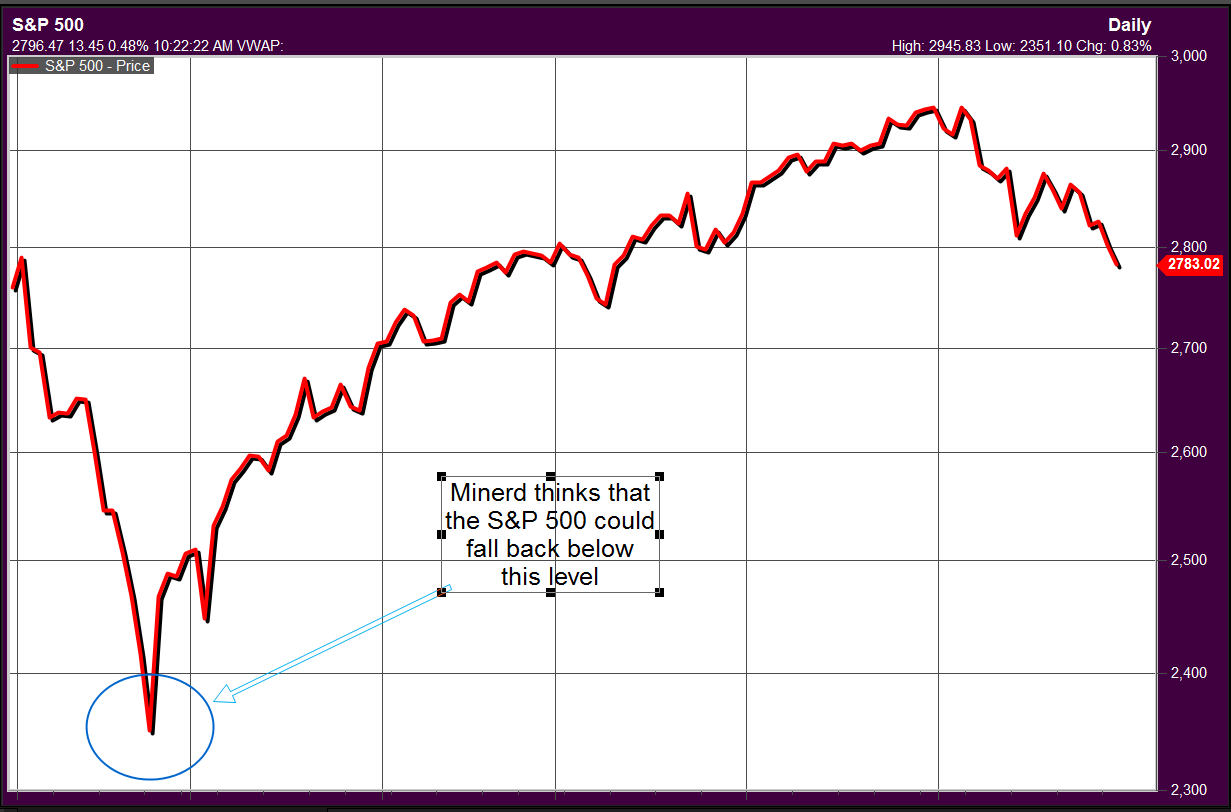

The investor said that by the end of the summer U.S. benchmarks could fall to lower lows than those produced during a withering fourth-quarter selloff that culminated in the ugliest Christmas Eve trading session in history.

“The trade tensions are likely to get a lot worse because we have never in modern times had a trade war like this,” Minerd said.

A fall to at least its December low for the S&P 500 SPX, +0.10% would represent a decline of roughly 16% from its current level, for the Dow Jones Industrial Average DJIA, +0.03% a drop to last year’s nadir would mark a more than 13% skid, and for the Nasdaq Composite Index COMP, +0.22% a more than 18% tumble based on Thursday’s trading levels.

Source: FactSet data

Source: FactSet data

Check out: MarketWatch’s snapshot of the market

Minerd said that by the end of next week, if not sooner, the market will find a near-term bottom but then his proprietary trading models indicate that a downturn is more likely than not. “Our models signal markets will make new lows in the summer,” he said. “A break below December lows would mark the end of the bull market that began in 2009, Something we expect,” he wrote in a recent research note.

Read: How stock-market bulls are adjusting to the reality of a messy U.S.-China trade war

The investor said that the same metrics prompted him to dump stocks on May 7, two days after President Donald Trump’s famous trade tweet helped to spark fresh doubts on the likelihood of a Sino-American tariff resolution occurring soon.

Relations between Beijing and Washington turned south after Trump charged that China was reneging on its promises during negotiations and announced that he would let tariffs on some $200 billion in China goods rise to 25% from 10%, reigniting a tit-for-tat squabble that market participants had bet was on the brink of being resolved.

The Guggenheim CIO says his decidedly bearish tilt is warranted because he sees signs that the trade war could last longer than previously anticipated — a point that investors are slowly coming to grips with — and that the implications are wide-ranging as the world’s two largest economies upgrade their tariff tussle to a full-blown war.

Recent comments by JPMorgan Chase & Co. Chief Executive Jamie Dimon may best exemplify Wall Street’s changing view on trade tensions.

Three weeks ago, Dimon placed the chances of a China-U.S. trade resolution at 80%, in an interview with Bloomberg News (paywall). Earlier this week, speaking at a conference in New York, the bank boss described trade as “a real issue” that had gone from “being a skirmish to being far more important than that.” Dimon said that a protracted can do direct harm to American corporations because an unresolved and intensify trade battle makes it difficult for CEOs to form investment strategies.

“You’re already starting to see businesses starting to think about moving their supply lines,” Dimon said. “That can obviously slow down business investment and cause uncertainty of all different types.”

There are some signs of that already. The latest reading of first-quarter gross domestic product, showed that adjusted corporate profits before taxes fell at an annual 2.8% pace, marking the sharpest decline since 2015.

Of course, Minerd’s forecasts haven’t all panned out precisely. In October, Minerd predicted stocks would fall 40% or 50% after a 20% surge, as he predicted that the Federal Reserve continued to lift interest rates until the end of 2019.

To be fair, the Fed’s December rate hike is widely viewed as a policy mistake that helped to briefly derail the bullish trend in markets in late 2018. However, stocks didn’t fall by the degree Minerd had anticipated, as monetary policy makers pivoted, adopting a wait-and-see stance.

Minerd still believes that because of that 180-degree turnaround by the Fed, it isn’t likely that they will cut rates (and that they may even consider raising rates) as markets are hoping.

Check out: The market is too pessimistic about prospects for a trade deal, says a longtime China watcher