The number of U.S. companies whose bonds have a BBB credit rating is rising, and the risk of them being downgraded to “junk” is increasing, as they report pinched profits and lower revenue growth, Goldman Sachs analysts said in a weekly note to clients.

While Goldman analysts don’t expect a deluge of downgrades that strip U.S. companies of their coveted investment-grade ratings, they can point to “clear signs” of deterioration among BBB-rated companies in the first half of 2019.

“Key to this view is the notable deterioration in revenue growth and profit margins” among investment-grade borrowers in the first half of 2019, “which, in our view, raises the risk of passive re-leveraging – especially in sectors with weak pricing power,” warned a team of Goldman analysts led by Lotfi Karoui.

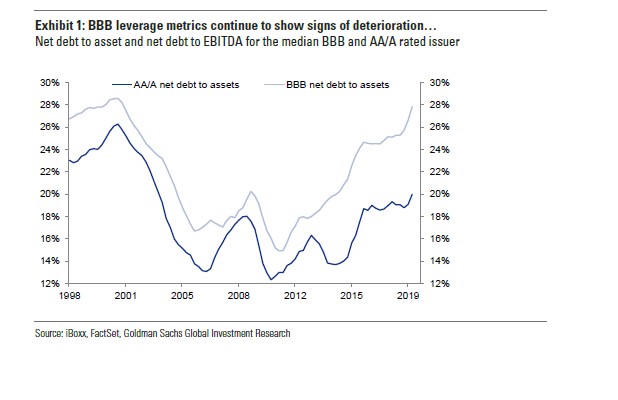

This chart shows net debt-to-asset ratios, a key leverage metric, climbing to almost 28% at BBB-rated companies this year, after it plunged below 16% in the wake of the global financial crisis.

Goldman Sachs

Goldman Sachs Companies with high debt-to-asset ratios can end up short of cash, or face problems meeting their debt obligations.

This week saw the collapse of Thomas Cook, a 178-year-old British travel company, under the weight of its debts and profitability challenges. It had been valued at £1.85 billion ($2.3 billion) a little more than a year ago.

For some time now investors, analysts and regulators have been bracing for fallout from the corporate debt boom which reached $9.4 trillion in the second quarter.

Federal Reserve Governor Lael Brainard this week added to the chorus of concerns with a warning that “excesses in corporate debt markets could amplify adverse shocks and contribute to job losses,” in testimony before the U.S. House Financial Services Subcommittee on Consumer Protections and Financial Institutions in Washington, D.C.

As of May, about $3.2 trillion of U.S. corporate bonds carried BBB-ratings, making it 2.5 times bigger than the speculative-grade corporate bond sector, according to a S&P Global Ratings.

Among investors, a chief concern is that the credit rating agencies, after showing leniency in recent years, could start cracking down on companies making slow progress on reducing their debts.

Their worry is that a cycle of downgrades, like the one seen in mortgage bonds at the onset of the global financial crisis a decade ago, could cause forced selling among investors that need to hold investment-grade assets, and a flood of paper hitting the much smaller junk-bond market.

To that end, investors have been keeping a close eye on developments at Ford Motor Co F, -0.66%, which was downgraded to Ba1, the first rung of “junk,” in September by Moody’s Investors Service. The rating agency pointed to Ford’s weak earnings and cash generation potential during its planned multi-year, $11 billion-plus restructuring, as part of its rationale for its ratings cut.

While the U.S. truck maker’s $35 billion of debt currently qualifies for investment-grade bond indexes, that would change if it receives a second downgrade from S&P or Fitch.

Meanwhile, corporate borrowers appear to taking note of market jitters, particularly in September, when a crush of bond issuers have seized on today’s ultra-low rates to repay older, often more expensive, debt.

See also: Here’s why corporate debt investors may want to eye Ford’s downgrade into ‘junk’

Add Comment