The U.S. dollar has jumped 1.3% over the past two weeks, making it more expensive than at any point since mid-2017, and U.S. stock investors are taking notice.

That’s especially true among investors in big U.S. multinational companies whose sales abroad greatly feel the pinch of a strong dollar.

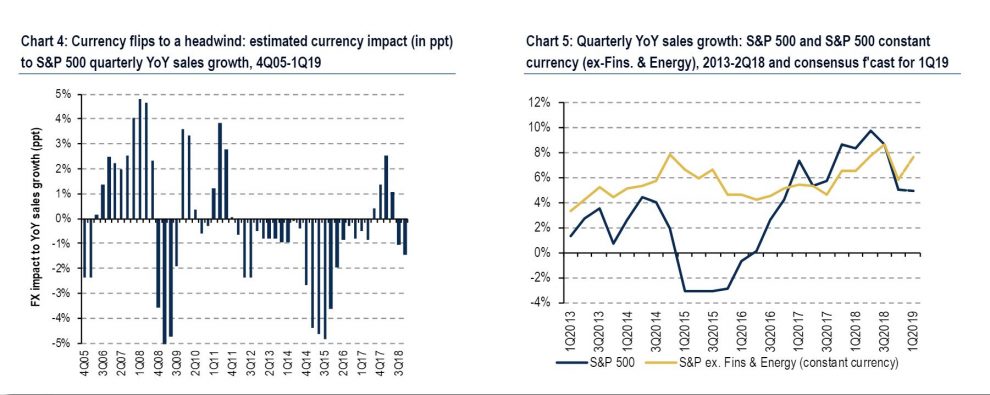

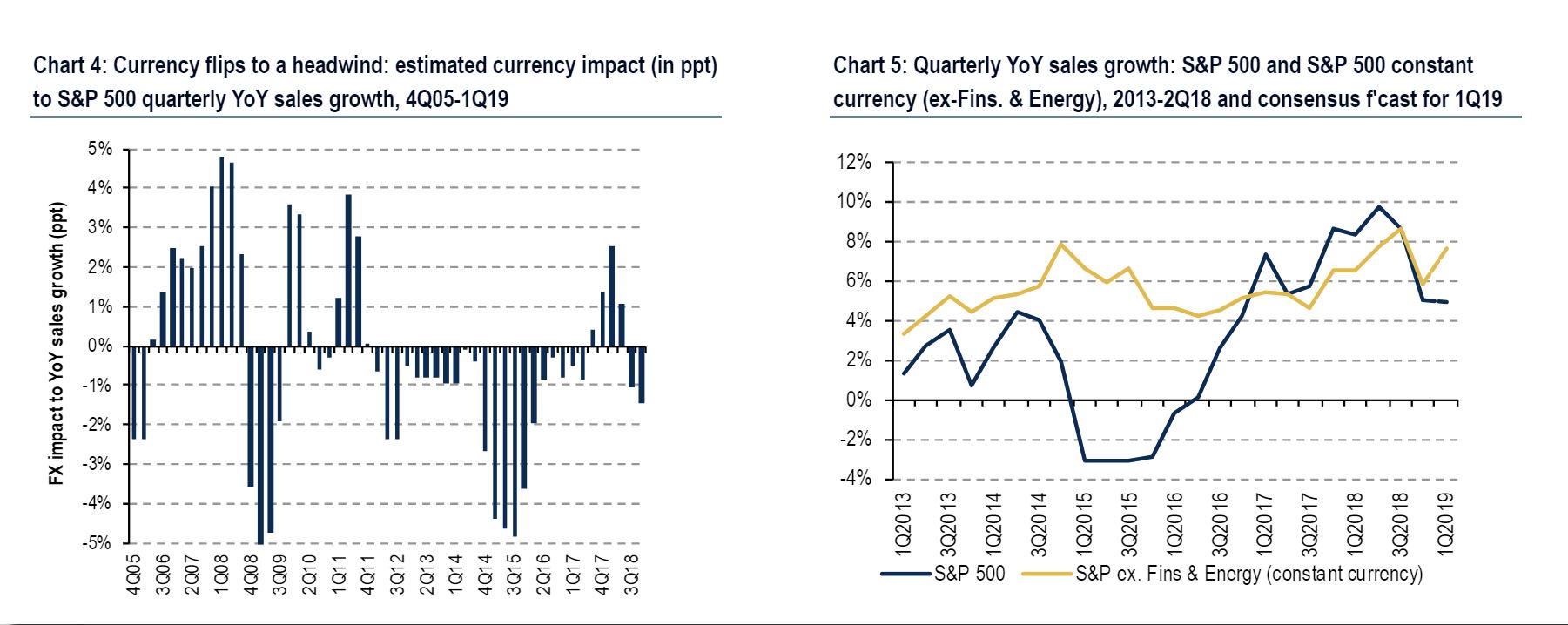

Savita Subramanian, equity and quant strategist with Bank of America Merrill Lynch, estimated in a Monday research note that U.S. dollar DXY, -0.26% strength will ultimately shave 2.1 percentage points from sales growth for the S&P 500 index SPX, +0.11% the largest such drag since the fourth quarter of 2015.

She also estimated that absent these currency headwinds, sales growth for U.S. large caps in the first quarter would have grown 8% year-over-year, versus a 6% rise in the fourth quarter.

“The strong dollar is definitely a headwind,” Alec Young, managing director of global markets research at FTSE Russell told MarketWatch. He said that a strong dollar hurts U.S. multinational companies in two ways: by making U.S. goods more expensive for foreigners to buy, relative to producers from countries with weaker currencies, and because when foreign sales are made, they get converted back into dollars at an unfavorable exchange rate, squeezing profits.

Several U.S. multinational companies have so far referenced the strong dollar as an obstacle to better performance in the first quarter of 2019, including Dow Jones Industrial Average DJIA, +0.04% components Procter & Gamble Co. PG, -1.02% , United Technologies Corp. UTX, +0.95% and Coca-Cola Co. KO, +0.33%

Coke in particular flagged the strength of the U.S. dollar as a major hurdle for the company’s performance in the first quarter, noting that earnings-per-share growth would have been 11 percentage points higher were it not for the “currency headwind,” in a call with analysts last week. “Comparable margins contracted in the quarter due to the impact of acquisitions and currency,” Coke CFO John Murphy said on the call.

Murphy also predicted that there would be a seven-percentage-point hit to second-quarter operating income due to exchange rates, and this outlook has kept a lid on the stock price since it announced earnings on April 23. Since then, the stock has risen 0.7% versus a 1.3% advance for the S&P 500.

The performances of individual companies, however, shouldn’t lead investors to draw conclusions about the broader market. “The U.S. dollar can rally for two reasons,” Randy Frederick, vice president of trading and derivatives at Charles Schwab told MarketWatch. “The first is because the U.S. economy is performing well, and the other is because the Federal Reserve is raising interest rates.”

Frederick noted that the Fed has convinced markets that it will not raise rates again soon, and so the dollar strength today can be attributed to relatively strong economic news out of the U.S. — like better-than-expected GDP growth in the first quarter — versus evidence that economic growth is stalling out in Europeand Japan.

Because the dollar strength today is largely a story of healthy domestic growth, investors should not worry too much about it, Frederick said, as U.S. firms in general will benefit more from a backdrop of strong economic growth than they will be harmed by an expensive U.S. dollar.

Nevertheless, investors should be mindful that a strong dollar will be a headwind in the medium term for companies earn a significant share of revenue abroad. For the dollar to weaken, investors would have to see evidence of rebounding growth in Europe and Japan. “The U.S. has been outgrowing Japan and Europe for years, and will likely continue” to do so, FTSE Russel’s Young said. “Going forward it’s safe to assume a dollar strength world.”

Providing critical information for the U.S. trading day. Subscribe to MarketWatch’s free Need to Know newsletter. Sign up here.