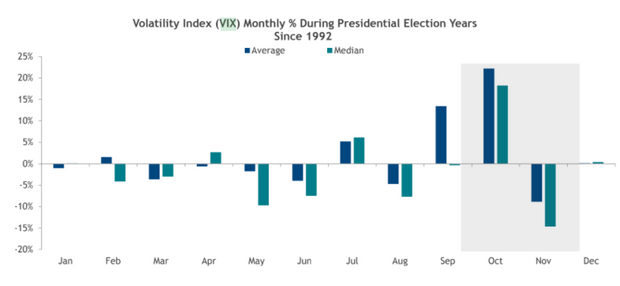

A closely watched gauge of expected stock-market volatility is on track to post its biggest weekly decline in about two years and the second-worst skid for the gauge in the week of a presidential election since 2016, according to Dow Jones Market Data.

The Cboe Volatility Index VIX, -7.50%, or VIX, is down nearly 32% so far this week to 26.02, after ending last week at 38.02. That move, if it holds, puts the VIX, often referred to as Wall Street’s fear gauge, on pace for its biggest weekly fall since Feb. 16, 2018 and puts it close to the 37.05% weekly decline seen by the volatility metric during the week that Donald Trump stunned Democratic challenger Hillary Clinton to win the 2016 presidential contest.

The VIX tracks options trading on the S&P 500 SPX, +0.03% to measure expectations for stock turbulence over the coming 30 days, and futures pegged to the VIX had suggested that volatility would spike on the lead-up to the contest between President Trump and former Vice President Joe Biden, who appeared to be closing in on winning the 2020 race for the White House.

Market participants had long declared a Biden win and divided Congress, which looks like the most probable outcome, as a near-term bearish scenario for markets.

However, investors seemed to re-evaluate the prospects of the split Congress, which is now seen as reducing the chances of a corporate-tax hike should Biden win the presidency. The former vice president has gained a lead over Trump in Georgia and Pennsylvania in recent counts, and he was leading in Arizona and Nevada, putting him within striking distance of the 270 electoral college votes needed to make a claim to the presidency.

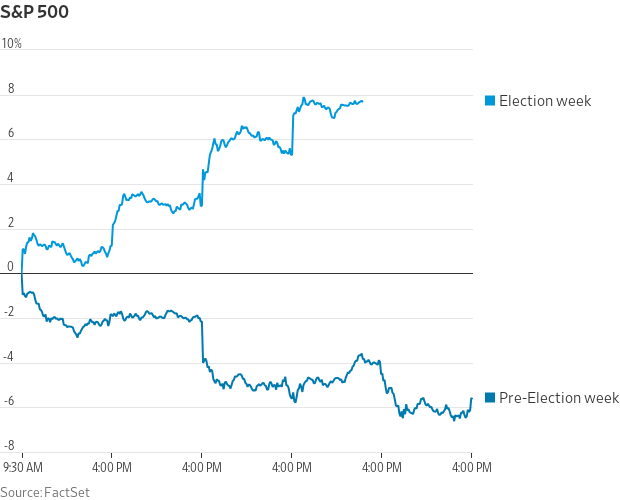

Equities, which typically move in the opposite direction of the VIX, as investors use it as a hedge against expected drop in stocks, have been on a tear this week.

The Dow Jones Industrial Average DJIA, -0.19% is up nearly 7% so far this week, the Nasdaq Composite Index COMP, +0.09% has surged by nearly 9%, while the S&P 500 index has gained 7.3%.

SunTrust Advisory chief market strategist Keith Lerner says that expectations for volatility tend to rise in October during an election year and recede thereafter, except in 2000, when the contest between former Vice President Al Gore and George W. Bush was still unclear.

In this case, although the outcome of the election hasn’t yet been declared, and may not be for days, investors have warmed to the possibility of Biden as the winner, and the composition of Congress, with hope that the COVID-19 pandemic will eventually abate and that some sort of fiscal relief package will come to fruition regardless of the election outcome.

Add Comment