Stock-market weakness in May has been attributed to fears over global growth and rising U.S.-China trade tensions, concerns that have helped to push trade-sensitive sectors like information technology, industrials and materials into a severe pullback.

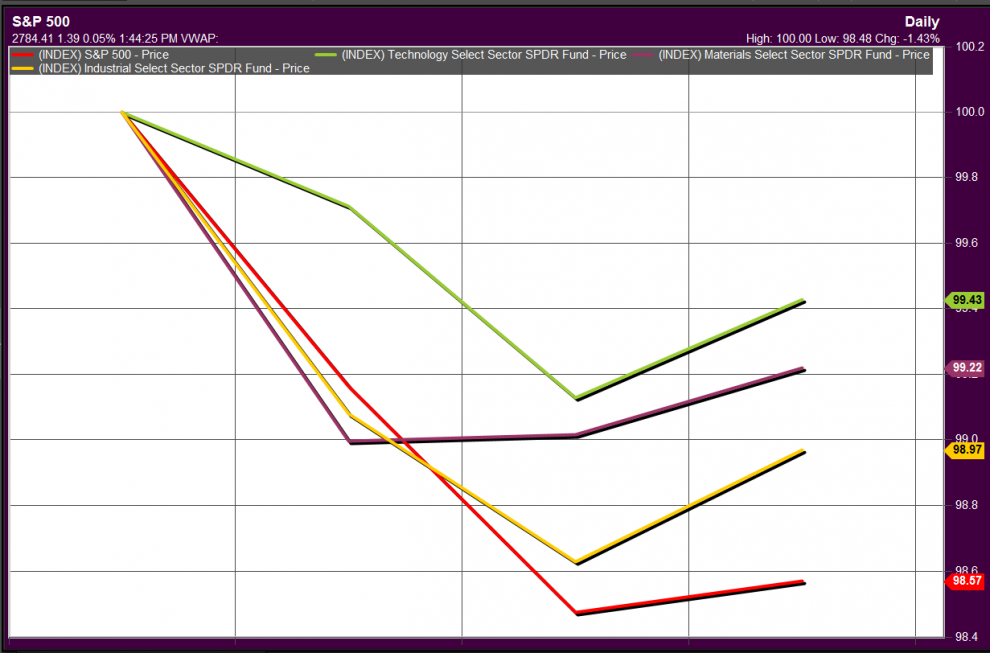

So far in May, the Information Technology sector XLK, +0.25% has lost 7.4%, as measured by the Technology Select Sector SPDR fund, while the materials sector, gauged by the Materials Select Sector SPDR ETF XLB, +0.13% has retreated 7.2% and industrial stocks, measured by the Industrial Select Sector SPDR ETF XLI, +0.23% have fallen 6.3%, compared with a 5.1% decline in the broader S&P 500 index SPX, +0.05%

As stock markets resumed its descent during the holiday-shortened week starting Tuesday, analysts continued to chalk up weakness to concerns over growth and trade, but a deeper look at recent moves have shown that the same trade-sensitive sectors that led the market on the way down have staged a rebound.

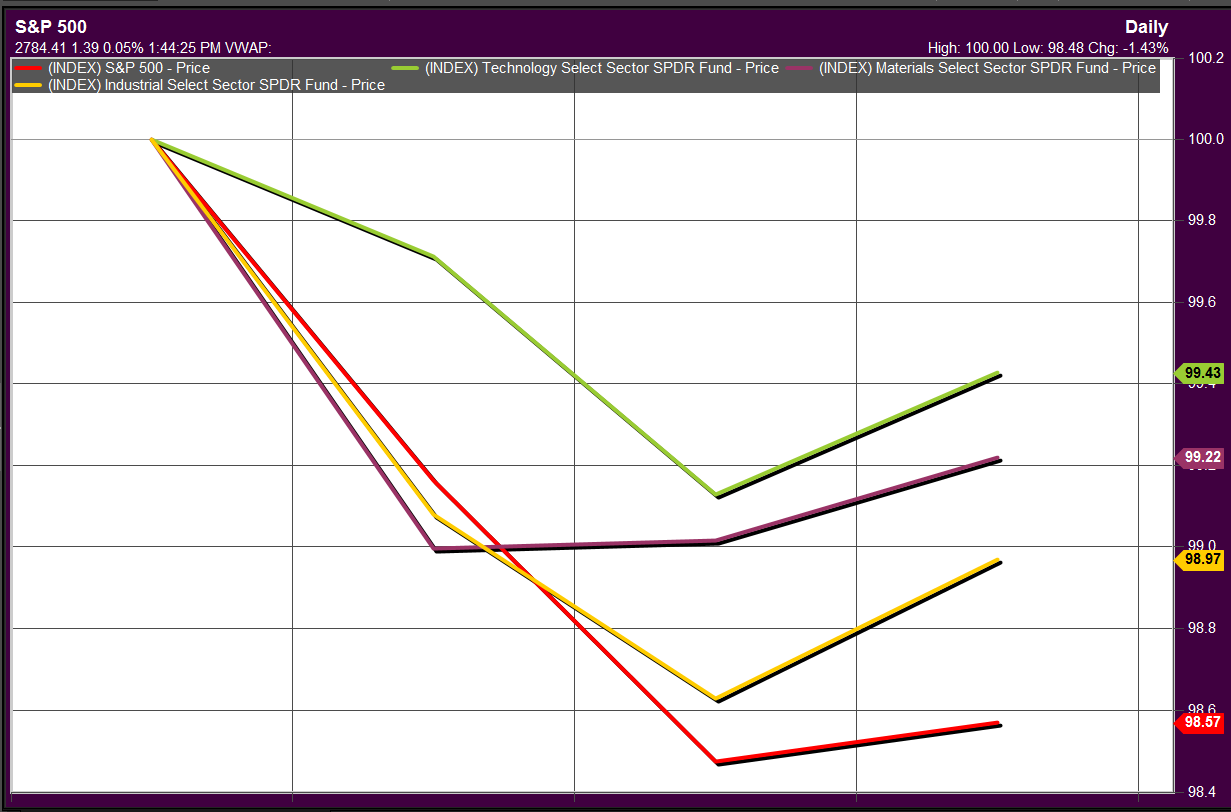

So far this week, information technology shares have decreased 0.5%, materials stocks have fallen 0.9% and industrial stocks have lost 1.2%, compared with the S&P 500’s 1.4% slide. Helping boost info tech shares has been the semiconductor industry, seen as a highly cyclical sector that is very sensitive to concerns over the proliferation of new trade barriers (see FactSet chart below with the S&P 500’s return in red, industrials in yellow, technology shares in green and materials in purple).

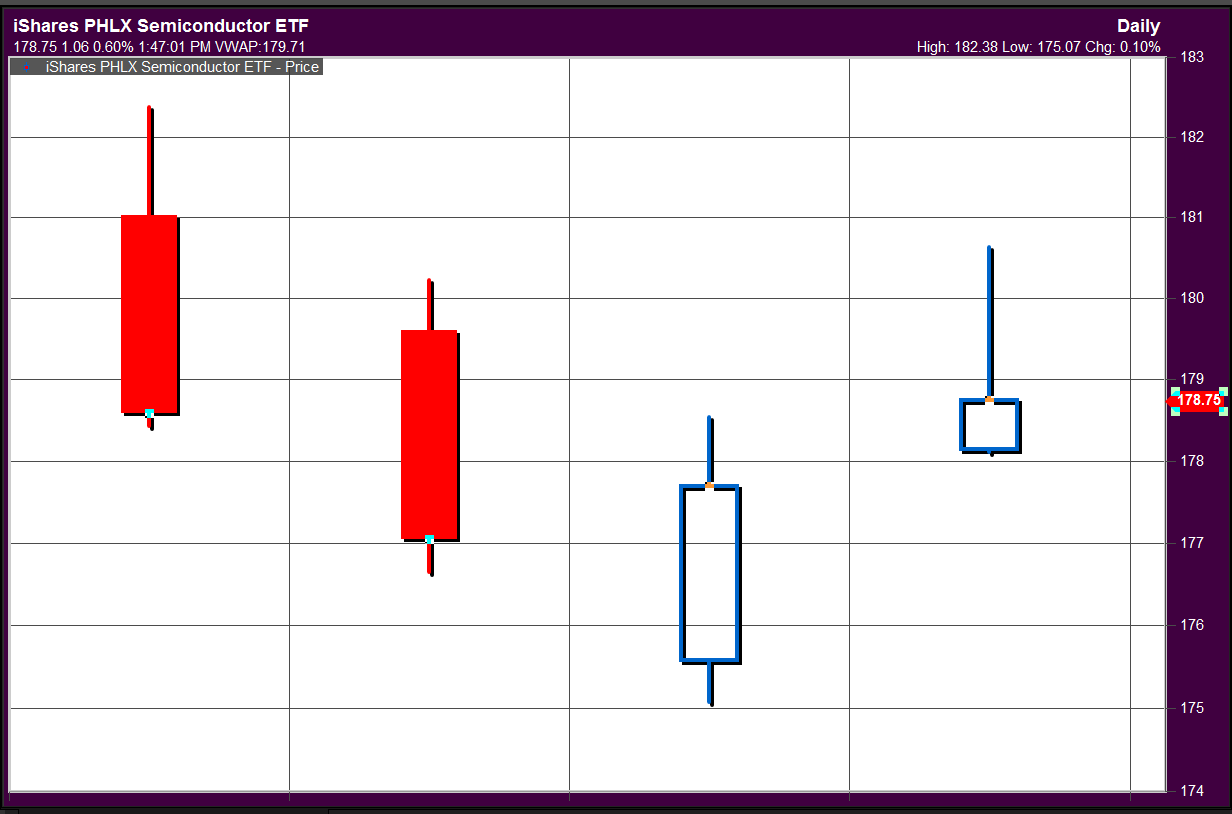

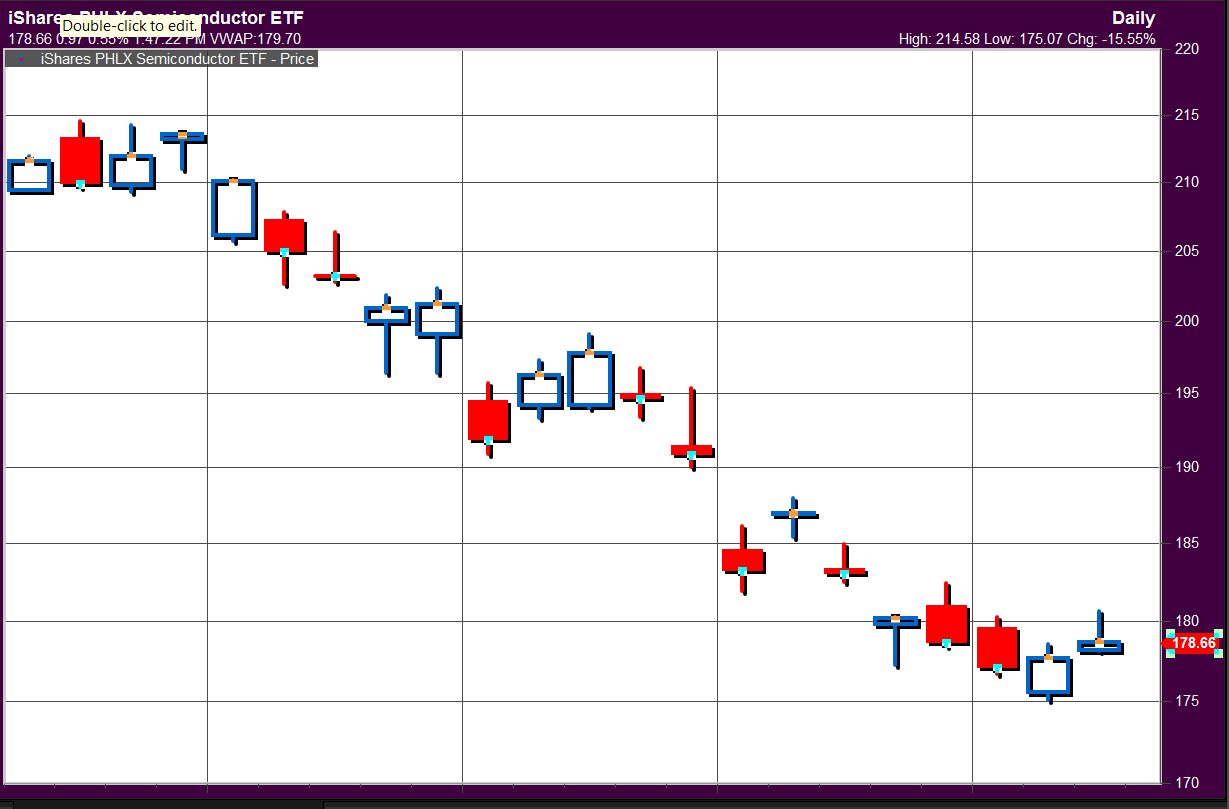

The Philadelphia Stock Exchange Semiconductor index SOX, +0.53% has risen 0.5% since the start of trade Tuesday, though it has fallen more than 15% during May.

The exchanged traded fund pegged to the index, the iShares PHLX Semiconductor ETF SOXX, +0.57% is up 0.2% in the week to date, but down 15.4% so far in May.

Tom Essaye, president of the Sevens Report, said in a Thursday note to clients that trade on Wednesday “somewhat shockingly saw outright gains by China ETFs and emerging market ETFs along with banks. That flies in the face of the “reasons” for the declines — specifically growth and trade worries.”

He said this turnaround has come as recent defensive outperformers, like the real estate, utilities and health-care sectors have seen this week’s worst declines.

“Part of this rotation is almost certainly end-of-month positioning, as funds rebalance out of what’s worked and cover shorts,” Essaye wrote. “Still, it’s notable that the groups that led markets lower are outperforming while the broad market is acting so heavy this week, and that’s silver lining for the bulls [that] hints this market is due for a bounce on any good news.”

Ryan Nauman, market strategist at Informa Financial Intelligence agreed in an interview with MarketWatch that this shift is notable, and provides evidence of confidence on the part of some investors that the U.S.-China trade standoff will ultimately be settled and that global growth concerns are overblown.

“We’re experiencing a slowing of economic growth, but especially in the U.S., the labor market remains strong, consumer confidence remains strong and there’s little evidence that a recession is coming any time soon,” he said, adding that these strong economic data can provide reason for investors to continue to stick with names they see as good bets over the long term.

“Investors just aren’t going to find the growth story that you find in info tech and semiconductors any where else,” he said. “These stocks have had a great 2019, but with price-to-earnings ratios coming down, investors are able to buy some of these dips that are driven by trade concerns.”