U.S. stock benchmarks on Tuesday enjoyed a nearly unfettered run-up toward records on the back of hope that central banks here and abroad will ease monetary policy soon.

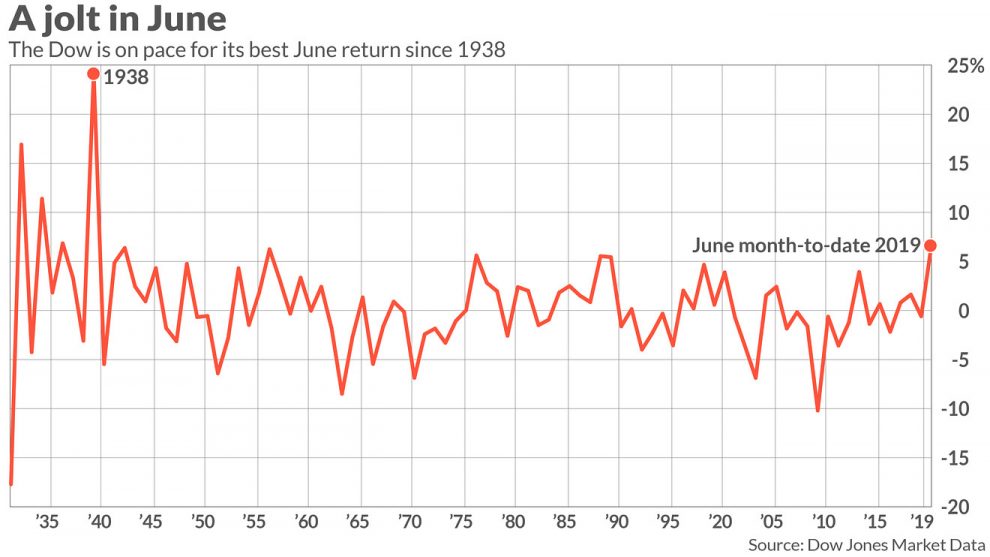

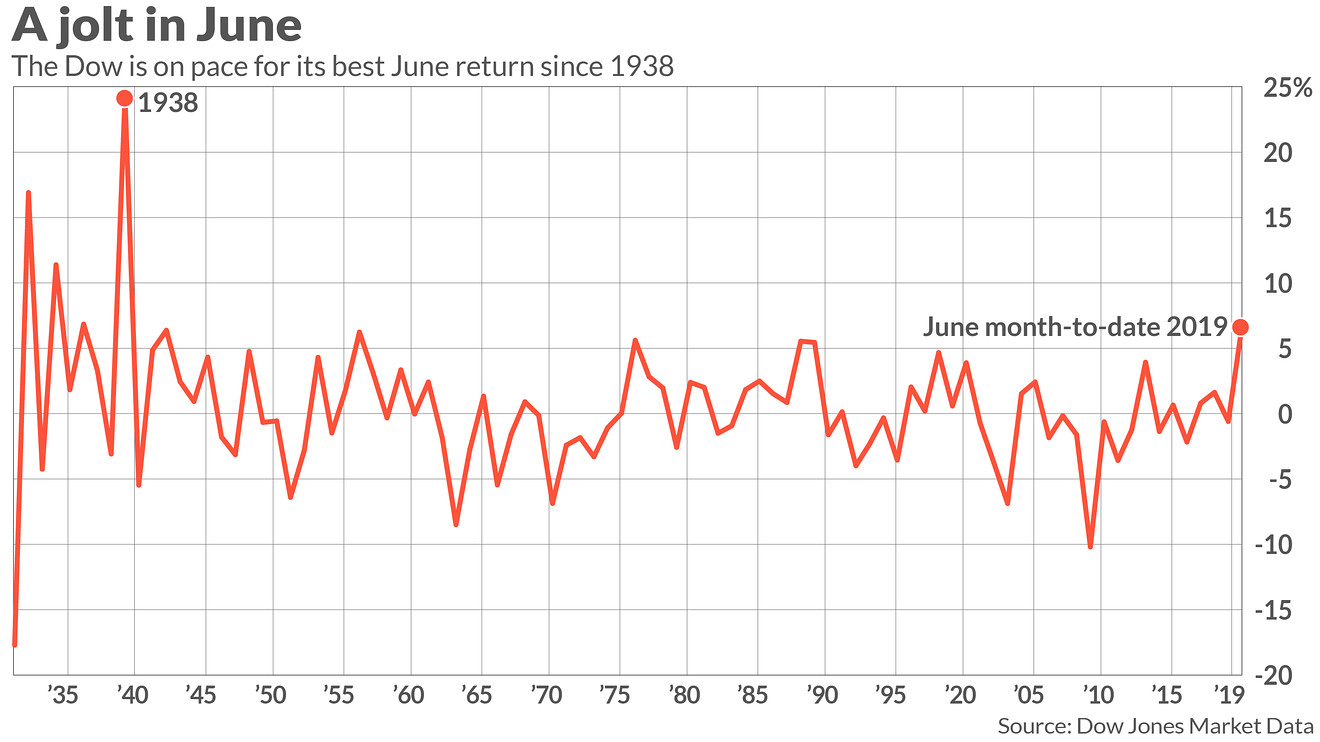

Gains on the day have put the Dow Jones Industrial Average DJIA, +1.35% in position to ring up its best June gain of nearly 7% since 1938, when the blue-chip benchmark surged an eye-popping 24.3% on the month, according to Dow Jones Market Data.

The S&P 500 index SPX, +0.97% is on track for its best June return, with a gain of about 6%, since 1955 when the broad-market benchmark rose 8.2%, while the Nasdaq Composite Index COMP, +1.39% was on track for a 6.8% return, which would represent its best June since a 16.6% gain back in 2000. The S&P 500 is within 1% of its April 30 closing record, while the Dow is less than 1.4% short of its all-time closing peak.

The rally for equities has been partly supported by the belief that the Federal Reserve at the conclusion of its Wednesday rate-setting meeting will indicate its intent to cut interest rates to curb the effects of tariff clashes between the U.S. and international trade partners, notably China, that have roiled global economies and threaten to disrupt global supply chains.

Wall Street is pricing in as many as three rate reductions in 2019, even if bets aren’t that high for a rate cut on Wednesday, according to CME Group data, tracking federal-funds futures. The market added to gains Tuesday after President Donald Trump tweeted that he plans to hold an “extended meeting” with China President Xi Jinping at the meeting of Group of 20 leaders in Japan later this month.

However, some strategists worry that the market has gotten ahead of itself and could be poised to be disappointed by the Fed, if not by Sino-American trade negotiations, which may not deem the economy sufficiently weakened to merit a rate reduction in the coming year or as many as Wall Street investors are hoping.

“We think the Fed will not cut but will acknowledge the current slowdown in growth and risks around unknown trade outcomes. We think the Fed will lower inflation expectations,” wrote Jason Brady, CEO of Thornburg Investment Management, which manages $44 billion.

Stocks can rise in an environment of falling benchmark interest rates because it translates to comparatively cheaper borrowing costs for individuals and corporations. Still, a rate cut could also signal a more bearish turn in central bankers’ reading of the economic environment which could eventually hurt investor sentiment.

Gains for stocks also comes as bond yields across the globe were rallying, driving their yields which move in the opposite direction, solidly lower. Bond prices don’t usually rise while stocks are climbing because bonds are perceived as assets investors flee to during times of uncertainty while equities rise when appetite for risky assets rises.

The yield for the 10-year Treasury note TMUBMUSD10Y, +0.67% touched a 21-month low under 2.02% on Tuesday, while the comparable German bond TMBMKDE-10Y, -31.02% known as bunds, fell to a yield of negative 0.322%, marking a record low.

Back in 1938, the U.S. economy faced a slump as a recovery from the Great Depression stalled, until Franklin D. Roosevelt in his second term got a $3.75 billion spending program approved by Congress in the spring of that year to help stimulate sluggish expansion, increasing deficit spending.

The move, at least in part, helped to jolt blue chips as fiscal stimulus measures were used to combat unemployment which hit 19% in June of 1938 as manufacturing activity weakened.

This time around, however, U.S. unemployment stands at 3.6% even if the May report, with 75,000 jobs created, fell far short of expectations for a gain of 185,000 on the month.

—Ken Jimenez contributed to this article